The municipal bond market will see a spate of new deals enter the market on Wednesday, led by issuers in Hawaii and Texas as well as California and New York.

Secondary market

U.S. Treasuries were stronger on Wednesday. The yield on the two-year Treasury fell to 1.33% from 1.35% on Tuesday, while the 10-year Treasury yield dropped to 2.37% from 2.40%, and the yield on the 30-year Treasury bond decreased to 3.01% from 3.04%.

Municipals finished weaker on Tuesday. The yield on the 10-year benchmark muni general obligation rose one basis point to 2.18% from 2.17% on Monday, while the 30-year GO yield increased one basis point to 3.04% from 3.03%, according to the final read of Municipal Market Data's triple-A scale.

On Tuesday, the 10-year muni to Treasury ratio was calculated at 90.6%, compared with 91.3% on Monday, while the 30-year muni to Treasury ratio stood at 100.1%, versus 100.5%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 41,698 trades on Tuesday on volume of $8.14 billion.

Primary market

The market is set to see several deals price for institutions on Wednesday after retail order periods were held the day before.

Ramirez & Co. is set to price the New York Metropolitan Transportation Authority’s Series 2017B dedicated tax fund green bonds for institutions on Wednesday after holding a retail order period on Tuesday.

The $306.94 million of Series 2017B-1 bonds were priced for retail to yield from 0.92% with a 4% coupon in 2018 to 3.58% with a 3.50% coupon in 2038. A 2042 maturity was priced as 5s to yield 3.28%, a 2047 maturity was priced as 5s to yield 3.33%, a 2052 maturity was priced as 5s to yield 3.45%. A 2057 maturity was not offered to retail investors.

The $142.6 million of Series 2017B-2 bonds were priced for retail as 5s to yield from 1.57% in 2022 to 2.57% in in 2028; a 2033 maturity was priced as 3 1/4s to yield 3.33%.

The deal is rated AA by S&P Global Ratings and Fitch Ratings.

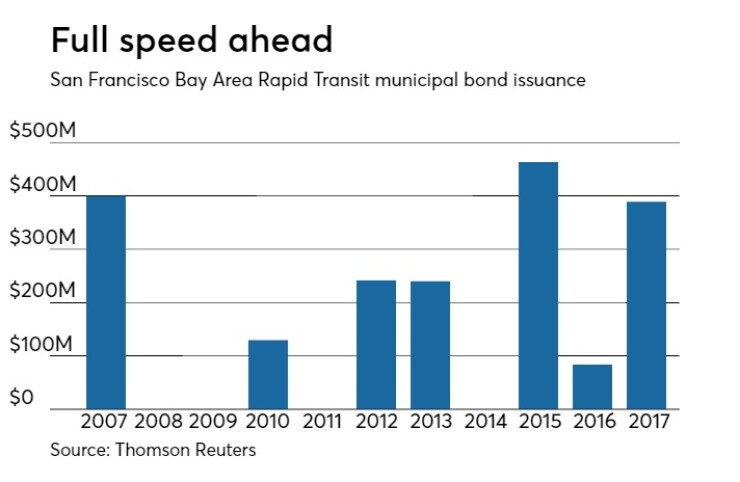

Barclays Capital is expected to price the San Francisco Bay Area Rapid Transit District’s $380.95 million of general obligation

The $270 million of Series 2017A-1 election of 2016 green bonds were priced for retail to yield from 0.88% with a 4% coupon in 2018 to 2.99% with a 5% coupon in 2037; a 2042 maturity was priced as 4s to yield 3.50%. No retail orders were taken in the 2033-2035 or 2047 maturities.

The $30 million of taxable Series 2017A-2 election of 2016 green bonds were offered as a sealed bid for the 2017 maturity.

The $80.95 million of Series 2017E election of 2004 refunding green bonds were priced for retail as 4s to yield 0.88% in 2018, as 5s to yield 0.98% in 2019 and as 5s to yield 1.10% in 2020. No retail orders were taken in the 2036 or 2037 maturities.

The deal is rated triple-A by Moody’s Investors Service and S&P.

Since 2007, BART has sold roughly $1.95 billion of securities, with the largest issuance occurring in 2015 when it sold $463 million. The Bay Area Rapid Transit did not come to market in 2008, 2009, 2011 and 2014.

Bank of America Merrill Lynch is set to price Hawaii’s $876.185 million of Series 2017 FK, FL, FM, FN, FO and FP refunding and taxable general obligation bonds for institutions on Wednesday.

The $594.915 million of Series FK bonds were priced for retail to yield from 1.19% with a 5% coupon and a 4% coupon in a split 2020 maturity to 3.64% with a 3.50% coupon in 2037. The 2030 through 2032 maturities, as well as the second half of split maturities in 2033, the 2034, the second half of a split 2035 maturity and the second half of a 2037 split maturity were not available to retail investors.

The $4.20 million of Series FL bonds was priced for retail as a bullet maturity in 2017 which will be sold by sealed bid. The $1.20 million of Series FM bonds were priced for retail as a bullet maturity in 2017 which will be sold by sealed bid.

The $230.87 million of Series FN bonds were priced for retail to yield from 1.36% with a 5% coupon in 2021 to 3.01% with a 4% coupon in 2031.

The $37.50 million of Series FO bonds were priced for retail at par to yield 1.95% in 2020 and also priced to yield 2.167% with a 2.30% coupon in 2021. The $7.50 million of Series FP bonds were priced for retail at par to yield from 1.95% in 2020 to 3.94% in 2037.

The deal is rated Aa1 by Moody’s, AA-plus by S&P and AA by Fitch.

Citigroup is expected to price the Houston Independent School District, Texas’ $838 million of Series 2017 limited tax schoolhouse and refunding bonds on Wednesday.

The deal, backed by the Permanent School Fund guarantee program, is rated triple-A by Moody’s, S&P and Fitch.

Citi is also set to price the Louisiana Public Facilities Authority’s $412 million of Series 2017 refunding revenue bonds for the Ochsner Clinic Foundation.

The deal is rated A3 by Moody’s and A-minus by Fitch.

In the competitive arena, the Metropolitan Water District of Southern California is selling $245.17 million of Series 2017A subordinate water revenue refunding bonds on Wednesday.

The deal is rated AA-plus by S&P and Fitch.

Bond Buyer visible supply

The Bond Buyer's 30-day visible supply calendar decreased $7.1 million to $16.30 billion on Wednesday. The total is comprised of $4.09 billion of competitive sales and $12.21 billion of negotiated deals.

BlackRock: Tax day doesn’t sway muni demand

Municipal bonds posted a fifth positive month, bucking the typical tax season trend, according to BlackRock’s May 2017 municipal market update from the team's muni group of Peter Hayes, head of the municipal bonds group, Sean Carney, head of municipal strategy and James Schwartz, head of municipal credit research said that

“Falling interest rates and a favorable supply/demand dynamic helped municipal bonds notch their fifth straight month of positive performance,” said the report. “Monthly issuance of $29 billion was down 18% year-over-year and 15% below the five year average but demand remained largely constructive and retail driven, resisting the seasonal tendency for outflows around tax day. April saw $2.4 billion enter muni bond funds, bringing year-to-date flows to $7.4 billion. Investors remain yield-focused, with flows directed primarily to long-term and high yield funds.”

The firm, which manages $118 billion in municipal assets, also said it views the initial tax reform framework as largely positive for municipals, given no explicit threats to the tax exemption.

“In fact, the elimination of deductions would likely increase retail demand for the asset class, leaving it one of few remaining tax safe-havens. Loss of the state and local tax deduction could have adverse effects on the credit quality of higher-tax states, while positive for the demand for muni bonds of high-tax states. The proposed 15% corporate tax rate poses the largest threat to municipals, as it could limit demand from banks and insurance companies.”