The Massachusetts School Building Authority has scheduled the state's first municipal social bond issuance, a nearly $1.5 billion negotiated sale in two tranches.

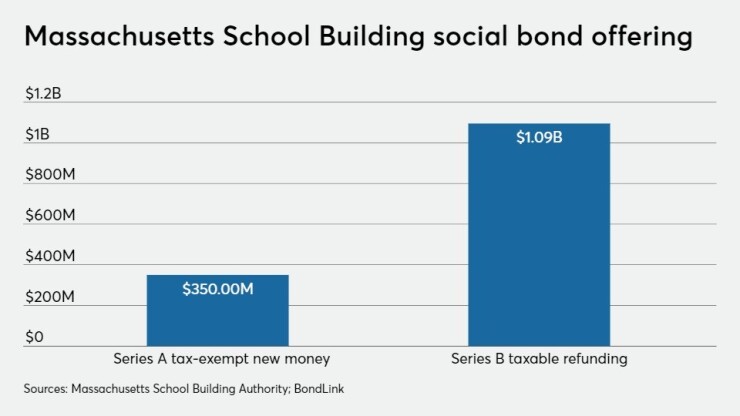

The authority will hold retail and institutional offerings Monday and Tuesday, respectively, for $350 million of Series A tax-exempt new-money bonds, and $1.095 billion of Series B taxable refunding bonds.

“I am very excited that our team at MSBA will be the first bond issuer in Massachusetts to use social bonds to fund public school projects throughout our state," said state Treasurer Deborah Goldberg, who chairs the authority's seven-member board.

The social bond labels stems from use of proceeds to finance and refinance public schools, based on the benefits of ensuring inclusive and equitable quality education.

“MSBA is a mission-driven organization committed to insuring that our kids have access to the 21st century learning environments that will help them succeed. These bonds will create opportunities and invest in positive social change.”

Social bonds fund projects that address or mitigate a specific social issue and/or seek to achieve positive social outcomes, according to International Capital Market Association

"The social bond market aims to enable and develop the key role that debt markets can play in funding projects that address global social challenges," the association said.

The social component is not independently verified. "'Social Projects' and 'Social Bonds' are entirely self-designating labels lacking any objective guidelines or criteria," the preliminary official statement says.

Bank of America Securities and UBS are the senior underwriters for the Series A bonds, with Citigroup for Series B. PFM is financial advisor for both.

“The market is strong,” said the authority's chief financial officer, Laura Guadagno. “This is a very attractive refunding for us.”

The 2020A bonds will fund new school capital projects, while the Series 2020B bonds will refund portions of Series 2012A, 2012B, and 2013A senior bonds outstanding.

Fitch Ratings and Moody’s Investors Service rate the bonds AAA and Aa2, respectively. S&P Global Ratings rates them AA-plus. All three assign stable outlooks.

"The stable outlook reflects our view of the magnitude and diversity of the statewide tax base supporting the bonds," S&P said. "We believe [debt service coverage] will remain strong even during the current recession, although revenues might dip in the near term."

Massachusetts in 2013 became the first state to sell

“We can’t be the first in the country to do social bonds, but we can be the first in Massachusetts. We sense that there are investors looking for that niche to complement their portfolio,” MSBA chief executive James MacDonald said.

Final maturities are Aug. 15, 2050, for Series A, and Aug. 15, 2035, for Series B.

The offering dovetails on the commonwealth’s

“It was very successful, and set the table, so to speak, for MSBA to come to market,” MacDonald said. “For those who weren’t able to get bonds on the commonwealth’s sale, this will provide another opportunity. From what we see and hear, this is a good opportunity to go to market.”

The state legislature created the quasi-independent authority in 2004 to overhaul what had been wayward process of funding capital improvement projects in public schools statewide. “We added some rigor to the process that wasn’t there before,” MacDonald said.

Key credit features include an unconditional gross pledge of a 1% dedicated statewide sales tax and a statutory non-impairment covenant. The authority solely controls the pace and scope of invitations into the capital pipeline. Additionally, MSBA has no exposure to operational costs of assets that receive grants.

Pay-as-you-go and debt defeasance are key components of the authority’s strategy to manage coverage.

It has $599 million of debt service reserve and sinking funds in advance of bond issuance.

Since 2016, MSBA has used roughly $594 million in unrestricted funds to make grant payments, thereby reducing the need to borrow. Since fiscal 2013, the authority has defeated $516.2 million in bonds.