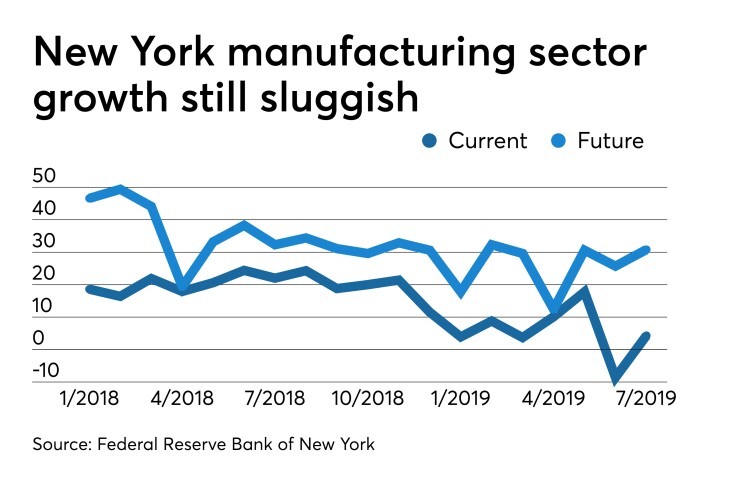

The Empire State Manufacturing Survey’s general business conditions showed some weakness in the sector after turning positive in July, the report still showed some softness in the sector.

After a contractionary negative 8.6 reading in June, its lowest level since October 2016, the general business conditions climbed to positive 4.3, still below the May 17.8 reading.

Economists polled by IFR Markets expected a 2.0 reading.

“Unfilled orders and inventories continued to move lower, while delivery times were longer,” according to the report from the Federal Reserve Bank of New York, released Monday. The number of employees index fell to negative 9.6, its lowest level in nearly three years, from negative 3.5.

The new orders gauge climbed to negative 1.5 from negative 12.0.

Future conditions indexes “were generally somewhat higher than” the previous month, the New York Fed said. The future business conditions index gained to 30.8 from 25.7.

Low inflation

With inflation remaining low across the globe, “the inevitable conclusion is that there are global forces putting downward pressure on inflation, and it is not just the result of better monetary policy,” researchers write in an

Despite appearances, “the Phillips curve could still be at work,” said authors Òscar Jordà, vice president in the Economic Research Department of the Federal Reserve Bank of San Francisco; Chitra Marti, a research associate in the department; Fernanda Nechio, deputy governor in International Affairs and Corporate Risk Management with the Central Bank of Brazil; and Eric Tallman, a research associate at the San Francisco Fed.

“Fluctuations in labor market conditions have been largely offset with appropriate interest rate changes by central banks,” they write. “Under such conditions, the influence of past inflation has faded, and expectations for future inflation have gravitated toward the central bank’s stated target.”

Another explanation for low inflation is central banks have “successfully offset fluctuations in slack to keep inflation at the target.” But that doesn’t explain the phenomenon in less developed economies, where central banks can’t provide “full monetary policy offsets.”

Since researchers found that inflation in developed and developing nations has been trending down for two decades, “the inevitable conclusion is that there are global forces putting downward pressure on inflation, and it is not just the result of better monetary policy.”

The authors suggest low inflation globally can be resulting from “common underlying factors,” that could be “related to increasing trade openness, global supply chains, and greater capital and investment flows across countries.” These factors cut “costs of production and investments” and put “downward pressure on prices around the globe even before the crisis.”

One and done?

With the labor market strong, expect just one rate cut from the Federal Reserve this year, according to Fitch Ratings.

While the Federal Open Market Committee will reduce the fed funds target by 25 basis points in either July or September, it “is unlikely to signal the start of a series of interest rate cuts, in contrast to the path currently priced into Fed funds futures markets,” Fitch says. “The three rate cuts currently priced into futures markets by end-2019 would entail the Fed undoing nearly all of the tightening enacted in 2018, which seems quite unlikely unless the US economy slows down much more sharply than we (and the Fed) currently anticipate.”