Municipal bonds firmed as the primary helped direct secondary levels and U.S. Treasuries gained on weak consumer price index numbers, indicating lackluster inflation in the short term. Fed Chair Jerome Powell echoed the sentiment in dovish comments, saying the U.S. is "very far" from a strong labor market and he will wait to see inflation before adjusting monetary policy.

The municipal market did not blink and yields grinded lower with benchmark curves falling one to two basis points as investors tore through new issues.

The New York City Industrial Development Agency Queens Stadium bonds repriced as much as 17 basis points lower in yield from a preliminary pricing wire. The Lower Colorado River Authority also saw four to nine basis point bumps in repricing. The Florida Department of Transportation joined in the competitive slate with $121 million of Federal Highway Reimbursement Revenue Bonds (indirect GARVEEs) sold to Wells Fargo. Morgan Stanley & Co. won two other large competitive deals from Las Vegas Valley Water District and Colorado's Cherry Creek School District.

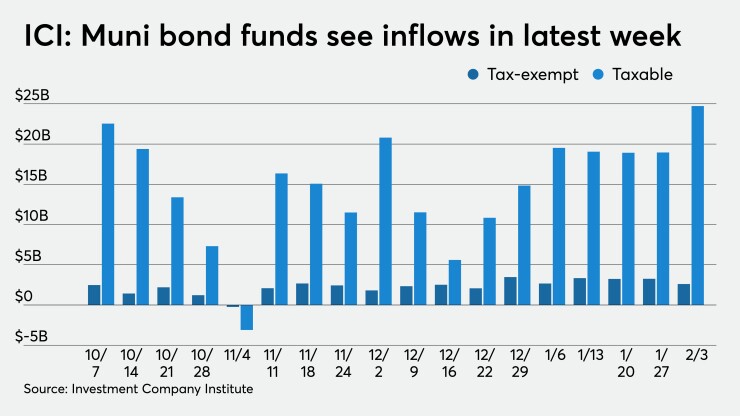

Flows continue to pour into municipal bond mutual funds. The Investment Company Institute reported long-term muni funds alone had an inflow of $2.607 billion in the latest reporting week, reaching a total of $15.5 billion year-to-date and 13 weeks in a row of inflows.

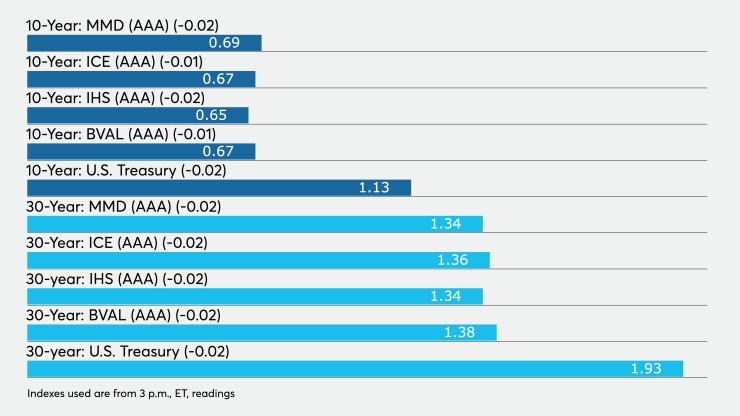

Municipal to U.S. Treasury ratios were at 61% in 10 years and 70% in 30 years, according to Refinitiv MMD. ICE Data Services showed ratios stayed at 59% in 10 years and fell a basis point to 71% in 30. BVAL showed 10-year ratios flat at 60% and down a basis point to 74% in 30 years.

Primary deals Wednesday

Goldman Sachs & Co. LLC repriced $507.8 million of Queens Baseball Stadium Project PILOT refunding bonds for the New York City Industrial Development Agency (A2/AA//) with large bumps. Assured Guaranty insured.

Bonds in 2024 with a 5% coupon yield 0.25%, 5s of 2026 at 0.43%, 5s of 2031 at 1.03%, 3s of 2036 at 1.94%, 3s of 2040 at 2.03% and 3s of 2046 at 2.26%.

BofA Securities repriced to lower yields $407.4 million of transmission services corporation project revenue bonds for the Lower Colorado River Authority, Texas, (/A//). Repricing moved yields four to nine basis points lower.

Bonds in 2022 with a 5% coupon yield 0.07%, 5s of 2026 at 0.32%, 5s of 2031 at 0.96%, 5s of 2036 at 1.28%, 5s of 2041 at 1.47%, 5s of 2046 at 1.48% and 5s of 2051 at 1.65%.

Morgan Stanley & Co. won $154 million of general obligation limited tax water refunding bonds (additionally secured by SNWA pledged revenues) from the Las Vegas Valley Water District, Nevada (Aa1/AA//). Bonds in 2022-2029, 2032-2033 and 2035-2038 were all away. Bonds in 2022 with a 5% coupon yield 0.07%, 5s of 2026 yield 0.26%, 5s of 2031 at 0.78%, 2s of 2036 at 1.57% and 2s of 2038 at 1.65%.

Cherry Creek SD #5, Colorado, (Aa2/AA+//) (Aa1/AA+// state aid withholding) sold $150 million of general obligation bonds to Morgan Stanley. Bonds in 2027-2033 and 2038-2040 were all away. Bonds in 2027 with a 5% coupon yield 0.35%, 5s of 2032 yield 0.79%, 5s of 2036 yield 0.96% and 2.25s of 2040 at 1.68%.

Powell: Labor market has 'very far' to go

Monetary policy alone will not be sufficient to achieve maximum employment, Federal Reserve Board Chair Jerome Powell told the Economic Club of New York in a webcast Wednesday.

“Given the number of people who have lost their jobs and the likelihood that some will struggle to find work in the post-pandemic economy, achieving and sustaining maximum employment will require more than supportive monetary policy,” he said. “It will require a society-wide commitment, with contributions from across government and the private sector.”

And although the economy has made significant strides, “we are still very far from a strong labor market,” with almost 10 million fewer people employed this January compared to February 2020, Powell said, noting it was “a greater shortfall than the worst of the Great Recession’s aftermath.”

The number of unemployed people may be even higher, since labor force participation rates have dropped the most in a year since 1948. “Fear of the virus and the disappearance of employment opportunities in the sectors most affected by it, such as restaurants, hotels, and entertainment venues, have led many to withdraw from the workforce,” he said. “At the same time, virtual schooling has forced many parents to leave the work force to provide all-day care for their children. All told, nearly 5 million people say the pandemic prevented them from looking for work in January.”

In a question-and-answer session, Powell said the Fed would wait to see real inflation rise before taking action, noting in the past decade although the Fed expected inflation to reach it’s 2% target, it never did on a sustained basis.

While he expects an increase in inflation during the spring months, he said, “it won’t mean very much” since it “won’t be very large or persistent."

Although “inflation dynamics will evolve over time,” Powell said, he doesn’t expect a sudden change, but the Fed will react if one occurs.

The national debt will not play a role in monetary policy, he added, noting the deficit will need to be addressed when the economy is healthy.

The latest round of infections led to another 500,000-plus job losses in leisure and hospitality in December and 61,000 more in January, Powell noted. “Extended periods of unemployment can inflict persistent damage on lives and livelihoods while also eroding the productive capacity of the economy. And we know from the previous expansion that it can take many years to reverse the damage.”

Those out of work will need support, Powell said. He hailed the Paycheck Protection Program and its extension.

The lower longer-run economy growth rate and a low neutral rate of interest mean monetary policy “will be constrained more often by the effective lower bound. That circumstance can lead to worse economic outcomes — particularly for the most economically vulnerable Americans.”

Economic indicators

The core consumer price index was lower than expected, despite the headline number being on target.

CPI rose 0.3% in January after a 0.2% gain in December, while the core rate was flat both months.

Economists polled by IFR Markets expected the headline number to increase 0.3% and the core to climb 0.2%.

Year-over-year CPI and core each grew 1.4%, on par with economists’ projections.

“While the headline figure catches the eye, the Federal Reserve will be far more concerned with what is causing any spike in inflation and how permanent it is,” noted Craig Erlam, senior market analyst, OANDA Europe. “It will be hesitant to react in a knee-jerk manner at a time when the economy needs all of the support it can get and the tweaks to its mandate will allow for that, as long as the desire to do so remains on the policy committee.”

Inflation may “test the Fed’s nerve this year,” he said, leading to concern about a taper tantrum.

Components of the report were termed “mixed” by Morgan Stanley researchers led by Ellen Zentner. “Closely watched rent and owners' equivalent rent measures both increased at a steady rate – rent +0.11%M, in line with its December increase, and OER +0.14%, also in line with its December increase,” they wrote in a note. “We have penciled in a roughly stable trajectory for rents and OER through most of the first half this year into our forecast, and the data continues to show, in our view, a bottoming of the trend in these components.”

While prices of goods have rebounded, “core services inflation remains depressed,” said Roiana Reid, U.S. economist at Berenberg Capital Markets. “Its flat reading for the second consecutive month in January lowered its year-over-year change to 1.3% from 1.6%, a 10-year low.”

She added, “Headline inflation will not accelerate until services inflation does.”

Most economists expect a spike in inflation in the spring, and Berenberg says the headline number year-over-year could top 3% at times since prices fell in March, April and May last year, although gains in the second half could prove more sustained.

“As economic activity returns to normal, pent-up demand for services – particularly the leisure and hospitality, accommodation and recreational services sectors – will contribute to price pressures,” Reid said. “The persistent U.S. dollar weakness will continue to lift the prices of nonpetroleum imports and domestic goods. Inflation expectations will influence whether any acceleration in realized inflation is actually sustained.”

With the economy unable to fully reopen, inflation is “tepid,” said Diane Swonk, chief economist at Grant Thornton. “Sadly, the weakness in inflation tends to be in areas that most cannot benefit from, as they include airfares and hotels.”

Separately, wholesale inventories gained 0.3% in December after a flat November, while sales jumped 1.2%, following a 0.3% increase a month before. Year-over-year inventories are down 1.6% while sales are 1.7% higher than year-ago totals.

BlackRock expects heightened demand for munis

While new supply underwhelmed in January, as issuers took a wait-and-see approach on the new administration, in the tax-exempt space reinvestment of income from maturities, calls and coupons outstripped issuance by nearly $16 billion, "creating a powerful tailwind," according to a monthly report from Peter Hayes, head of BlackRock's Municipal Bonds Group, James Schwartz, head of its Municipal Credit Research and Sean Carney, head of its Municipal Strategy. They noted new issues were oversubscribed by 11 times on average.

Taxable issuance remained proportionally elevated at 29% of total supply, which depressed traditional tax-exempt issuance, they wrote.

The month of February has produced positive total returns in eight of the past 10 years, BlackRock said.

"While rich valuations will cause a drag, we expect strong demand to continue outpacing an elevated but manageable level of issuance," the authors wrote. "We believe fundamentals will likely benefit from additional fiscal aid, and vaccine distribution should support longer-term revenue normalization. As the new administration lays out its agenda and tax policy comes into focus, we anticipate heightened demand for tax-advantaged assets such as muni bonds."

Fiscal and credit stress is not deterring the voracious appetite or quest for yield in the municipal market, according to a February report from DWS Group.

Investors continue to devour low-quality bonds in the search for yield among new issues — many of which are oversubscribed, according to the report by the DWS municipal bond team, headed by Ashton Goodfield.

On the state level, challenges will be offset by opportunities.

“DWS anticipates financial stress to continue for states, but the promise of additional unrestricted aid makes the path forward much less challenging,” the report said.

States struggling before the pandemic, such as New Jersey, Illinois, Kentucky, Pennsylvania and Connecticut, are facing a lasting problem that will persist after the disease has receded, the analysts noted.

Credit concerns are present due to the delayed distribution of the COVID vaccine, the group added.

“DWS anticipates that the fiscal stress many municipal issuers are feeling will not abate and may actually worsen as the surge continues into the first quarter,” according to the report. “The degree and timing of additional federal aid will likely dictate whether the rating agencies continue to take negative rating actions.”

However there is optimism. “Opportunities still exist in purchasing municipal credit as the recovery will be meaningful and sustainable,” the team wrote.

A “powerful” factor in municipal credit fundamentals and supply going forward is restoring the ability to use tax-exempt bonds to advance refund high cost debt, the report said.

“Issuers would have the capacity to refinance debt at lower interest rates compared to the rates they currently pay with taxable advance refunding,” the report said.

ICI reports billions more inflows

Long-term municipal bond funds and exchange-traded funds saw combined inflows of $3.211 billion in the week ended Feb. 3, the Investment Company Institute reported Wednesday.

In the previous week, muni funds saw a revised inflow of $4.150 billion, ICI said.

Long-term muni funds alone had an inflow of $2.607 billion in the latest reporting week after an inflow of $3.266 billion in the prior week.

ETF muni funds alone saw an inflow of $604 million after an inflow of $884 million in the prior week.

Taxable bond funds saw combined inflows of $24.724 billion in the latest reporting week after an inflow of $18.966 billion in the prior week.

ICI said the total combined estimated inflows from all long-term bond funds and ETFs were $27.935 billion after an inflow of $23.116 billion in the previous week.

Secondary

Trading showed high-grade prints in line with benchmark yields. Utah general obligation bond 5s of 2022 at 0.07%. Wisconsin 5s of 2024 at 0.14%. Ohio 5s of 2025 at 0.20%, Georgia GO 5s of 2026 at 0.28%-0.26%, Florida PECO 5s of 2026 at 0.26%, New York City TFA 5s of 2026 at 0.40%-0.37%. Maryland 5s of 2029 at 0.56%. Montgomery County, Maryland, 5s of 2029 at 0.63%. Minnesota GO 5s of 2032 at 0.75%-0.74%. Maryland GO 5s of 2033 at 0.84%.

Washington GO 5s of 2036 at 1.07%, two basis points lower than where the issuer priced new bonds Tuesday.

Out longer, Arlington Texas, ISD 4s of 2046 traded at 1.36% versus 1.43% original. Austin, Texas, electric 5s of 2045 at 1.41%-1.35%. Southern California water 5s of 2046 at 1.24% versus 1.39% original.

New York City TFAs 4s of 2046 at 1.85%-1.83% versus 1.91% original. TFAs 4s of 2049 at 1.88% versus 1.96% original.

High-grade municipals were stronger, according to final readings on Refinitiv MMD’s AAA benchmark scale. Short yields were unchanged at 0.06% in 2022 and 0.08% in 2023. The 10-year fell two basis points to 0.69% and the 30-year fell to 1.34%.

The ICE AAA municipal yield curve showed short maturities fall a basis point to 0.07% in 2022 and 0.09% in 2023. The 10-year fell one basis point to 0.67% while the 30-year yield fell two basis points to 1.36%.

The IHS Markit municipal analytics AAA curve showed yields at 0.06% in 2022 and 0.07% in 2023 while the 10-year fell two basis points to 0.62% and to 30-year at 1.34%.

The Bloomberg BVAL AAA curve showed yields at 0.07% in 2022 and 0.08% in 2023, while the 10-year fell one basis point to 0.67%, and the 30-year yield fell two bps to 1.38%.

The three-month Treasury note was yielding 0.09%, the 10-year Treasury was yielding 1.13% and the 30-year Treasury was yielding 1.93% near the close. Equities were mixed with the Dow up 35 points, the S&P 500 fell 0.15% and the Nasdaq fell 0.36%.

Details on Tuesday taxable pricings

The Tennessee State School Bond Authority (Aa1/AA+/AA+/NR) priced $716 million of taxable higher education facilities second program bonds. Bonds all priced at par, in 2022 yielded 0.167%, 2026 at 0.727%, 2031 at 1.512%, 2036 at 1.962%, 2041 at 2.561% and 2045 at 2.661%. Jefferies LLC was bookrunner.

RBC Capital Markets priced $175 million of taxable and tax-exempt refunding revenue bonds for the San Francisco Municipal Transportation Agency (Aa2/AA-//). Bonds priced at par: 2023 at 0.249%, 2026 at 0.824%, 2031 at 1.787%, 2036 at 2.287% and 2044 at 2.804%.

Wells Fargo Securities priced $149.3 million of Travis, Williamson and Hays Counties rental car special facility revenue refunding bonds for the City of Austin, Texas, (A3//A-/). Assured Gauranty insured. Bonds priced at par: 2024 at 0.639%, 2026 at 1.027%, 2031 at 1.96% and 2036 at 2.46%.

BofA Securities priced $113.7 million of taxable pension obligation bonds for the City of Downey, California (/AA//). Bonds priced at par: 2023 at 0.317%, 2026 at 0.972%, 2031 at 1.95%, 2035 at 2.35% and 2044 at 2.995%.

On the day-to-day calendar

The Tobacco Securitization Authority of Northern California is set to price $236.5 million of tobacco settlement asset-backed refunding bonds (Sacramento County Tobacco Securitization Corp.). $124.6 million Series 2021A, serials 2021-2040; term 2049. $33.1 million Series B1, terms 2030, 2049, $78.7 million Series B2, term, 2060. Jefferies leads the deal.

The Maryland Department of Transportation (A1/NR/A/) is set to price $211.9 million of Baltimore/Washington International Thurgood Marshall Airport special transportation project taxable refunding revenue bonds. The deal was moved to the day-to-day calendar. Serials 2023-2030. Citigroup Global Markets Inc. will run the books.

Wisconsin (Aa2//AA/) is set to price $118.5 million of taxable general fund annual appropriation refunding bonds on Thursday, serials 2022-2031. Barclays Capital Inc. is lead underwriter.

Competitive issue to come

On Thursday, the Maryland University System is set to sell $108 million of auxiliary facility and tuition taxable refunding revenue bonds at 10:45 a.m. and $230 million of auxiliary facility and tuition tax-exempt refunding revenue bonds at 10:30 a.m.

Christine Albano contributed to this report.