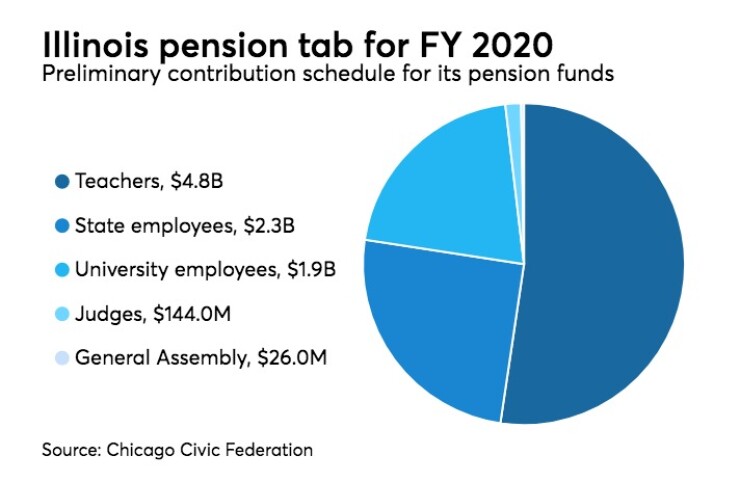

CHICAGO — Illinois pension funds would consume $9.1 billion of the state’s budget in fiscal 2020 under preliminary figures approved by the state funds, according to a report from the Chicago Civic Federation's Institute for Illinois' Sustainability.

The figure is up $680 million, or 8%, from this year’s scheduled contribution of $8.5 billion. The state is operating this year on a $38.5 billion general fund.

The numbers could change.

This year’s fiscal 2019 contribution isn't final, as the state is planning buyouts for some members of the state’s three largest funds. The state’s budget had anticipated $423 million in savings from those programs.

“There are also questions about whether changes will be required for some of the FY2020 contributions that, as currently proposed, do not reflect any impact from the buyouts,” according to the

The buyouts are to be funded with up to $1 billion of general obligation borrowing over the next several years. The administration of Gov. Bruce Rauner included a disclosure of the planned pension borrowing in its last general obligation offering statement, saying it would occur in the latter half of the fiscal year after the programs were implemented.

Rauner will not be around to issue that debt,

The current budget assumed that 22% or 25% of those eligible would choose the buyouts, but the savings estimates were not based on actuarial reviews of the plans. The three funds are not slated to receive their last monthly payments from the state for the fiscal year ending June 30 until they recalculate statutorily required contribution amounts to reflect the buyout savings.

The Teachers’ Retirement System, known as TRS and the state’s largest fund, included a 2020 estimate of savings due to the buyouts, while the State Employees’ Retirement System, SERS, and the State Universities Retirement System, SURS, did not. SERS said it couldn’t offer an estimate without any actual experience about members’ participation.

The first program would partially “buy out” inactive members who are eligible for an eventual pension, offering them a lump sum equal to 60% of their expected lifetime benefits.

The second program presents an option to retiring members of the system's Tier 1, employees in place before reduced benefits were approved in 2010 for new hires. They can trade in their 3% automatic annual pension increase for a 1.5% cost-of-living adjustment and a lump-sum check equal to 70% of the difference between what they would receive in retirement.

The fiscal 2020 requests certified by the boards of each fund are preliminary. The state actuary will review them. Final certified payment requests are due by mid-January in time for inclusion in the annual budget that is typically released by the governor in February.

TRS and SERS are expected to launch the programs in the coming months but SURS has said it may not be able to fully implement the plans until after the end of FY2019, according to the federation.

The most recent fiscal 2017 unfunded liabilities for all five of the state’s funds totaled $129 billion for a collective funded ratio of 39.9%. Actuarial reports from the funds for 2018 are expected before the end of the year.