CHICAGO — The Regional Transportation Authority of Illinois will take competitive bids Tuesday on $100 million of general obligation refunding bonds and in a separate transaction will further tap its commercial paper program as it awaits nearly $400 million in overdue state aid payments.

The agency, which provides oversight of the Chicago Transit Authority, Metra commuter rail, and Pace suburban bus service, will refund 2002 bonds for an estimated net present-value savings of about 6.5%, according to the RTA's chief financial officer, Grace Galluci. The bonds carry a final maturity of 2019.

Chapman and Cutler LLP is bond counsel and Public Financial Management Inc. is advising on the refunding sale.

The RTA's share of sales taxes and its state aid from Illinois are pledged to bondholders and sales tax revenues must meet a 2.5 times debt service coverage test before additional bonds can be sold.

Ahead of the sale, all three rating agencies affirmed the RTA's underlying ratings. Fitch Ratings assigns a AA-minus and a negative outlook. Moody's Investors Service rates the RTA Aa3 with a stable outlook. Standard & Poor's assigns a AA and a stable outlook. The RTA has $2.35 billion of GOs.

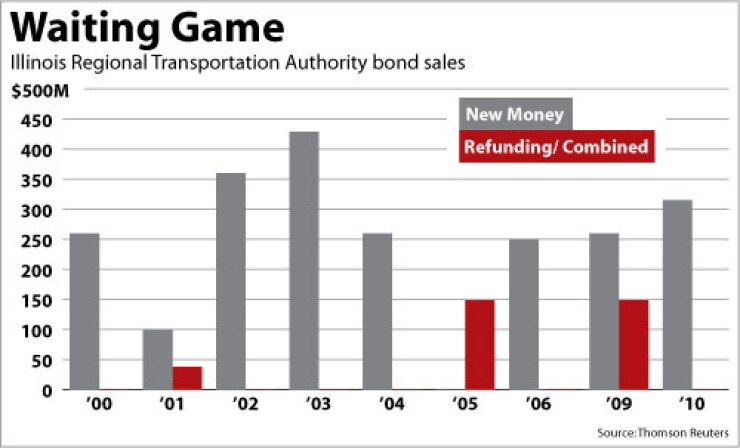

Assured Guaranty Municipal Corp., rated Aa3 with a negative outlook by Moody's and AA-plus and stable by Standard & Poor's, will insure the bonds. The agency has not used insurance since 2005 as its own issuance levels tapered off and the monoline insurers lost their top ratings.

On the upcoming transaction, Assured will a issue a surety policy so the RTA doesn't have to fund a reserve, making coverage the most economical choice as the reserve on the bonds being refunded also is supported by a surety policy. "It's a cash-flow issue," said RTA treasurer Allan Sharkey.

The state's delays are straining the RTA's coffers, said executive director Joseph Costello, who updated the board at its monthly meeting late last week.

The RTA has warned the state by letter that service cuts loom if it continues to remain so far behind on its obligations. "If we run out of money at some point, that will affect service," he said.

The authority has managed through the state delays with short-term borrowing. It may have up to $400 million of outstanding short-term debt under a working cash note program and a commercial paper program. The CP program has rolling maturity dates. The RTA will roll over about $65 million of outstanding CP next week and it expects to raise another $35 million for cash flow, according to Galluci and Sharkey. JPMorgan is the placement agent.

State budget spokeswoman Kelly Kraft responded to the RTA's concerns, saying: "We're working with the RTA — and other vendors who are owed money to come up with payment schedules to maintain operations, in this case transit operations."

Gov. Pat Quinn continues to press lawmakers to approve a borrowing plan to pay down overdue bills, to no avail.

The state currently owes $3.8 billion in bills and is on pace to close out fiscal 2011 owing $8.3 billion in obligations, according to Comptroller Judy Baar Topinka's office.

The $8.3 billion figure includes $4.5 billion in bills submitted by June 30 when the fiscal year ends and another $1 billion through the period during which vendors can submit bills for the previous fiscal year. Corporate tax refunds, employee health insurance, and the repayment of interfund borrowing are also counted in that number.

The RTA's fiscal woes drove a round of downgrades last year, but the three rating agencies affirmed current credit marks.

"The negative outlook reflects the continuing financial pressure both on operations and capital spending due to the delinquent state payments and the state's persistent financial challenges," Fitch wrote.

One bright spot for the agency is its sales tax collections. The economic recovery drove an increase of 5.8% in RTA sales taxes collections of $890 million last year. That marked a 4.2% improvement over the prior year, according to Moody's. Collections fell by 2.9% in 2009. Illinois provides a 30% match. The RTA has a $2.3 billion operating budget. The agency conservatively estimates nearly 3% growth in sales taxes this year.

"The rating reflects our view of the authority's good debt service coverage and participation in the large, strong, and diverse Chicago metropolitan-area economy," Standard & Poor's analyst Helen Samuelson said in the agency's review.

The authority's current five-year capital program totals $4.7 billion. The RTA has warned that $24 billion worth of infrastructure work is required over the next decade. It has exhausted its state-authorized capital bonding authority but was allocated $2.7 billion in the state's $31 billion capital budget.