CHICAGO – Fewer Illinois public school districts borrowed to manage through fiscal 2017, a trend state education officials cast as positive as districts digest an education funding overhaul that bolstered funding for some.

Long-term borrowing for operations was one factor reviewed in the 2018 financial profile of the state’s 852 public school districts. State Supt. Tony Smith and chief financial officer Robert Wolfe will present the report card to the Illinois State Board of Education

The board is expected to act on the financial watch list. The analysis marks the 15th year the state has issued a financial profile report card. More districts earned the top fiscal designation but more also sank to the weakest category of “financial watch” that can eventually lead to state intervention.

Increased funding and limited expense growth drove an increase in the top category of “financial recognition.” Overall, districts saw an increase in their property values which raised their levy and debt capacity while state aid increased by $380 million in fiscal 2017. Operational expenses were held in check increasing by just 1.6%.

“The 2018 Financial Profile reflects positive results due to increased EAVs [equalized assessed valuations), revenue, and maintaining expenditures. But it must be also be understood that these accomplishments were also realized through continued borrowing, though at a lesser amount than last year,” the report concluded.

The adoption last summer of the Evidence Based Funding law – bipartisan legislation that overhauled school funding formulas -- offers hope that the trend can be sustained into next year’s financial profile, the report suggested. The plan provides an additional $350 million to cover increases for some districts while holding wealthier districts harmless.

“The fact is that real estate valuation have gone up” in many regional pockets across the state although some areas have lagged, said Richard Ciccarone, president of Merritt Research Services LLC. “With state aid turning upward and real estate values also tweaking up I would expect to see improved revenue conditions for schools.”

The report lacked the same grim warnings of last year that “districts are now at a point where additional budget reductions are going to be very difficult” without damaging academics and late aid payments are forcing districts to “make difficult choices of decreasing expenditures, incurring debt and/or eroding fund balances.”

Last year’s report was released as the state was headed toward a third fiscal year without a budget. The Democratic-led General Assembly passed a fiscal 2018 budget last July with the help of some Republicans who broke with fellow Republican Gov. Bruce Rauner to override the governor’s vetoes.

Distribution of school aid however hinged on passage of a new funding formula and that was stalled over a feud between Rauner and Democrats. They finally agreed to a package in late August.

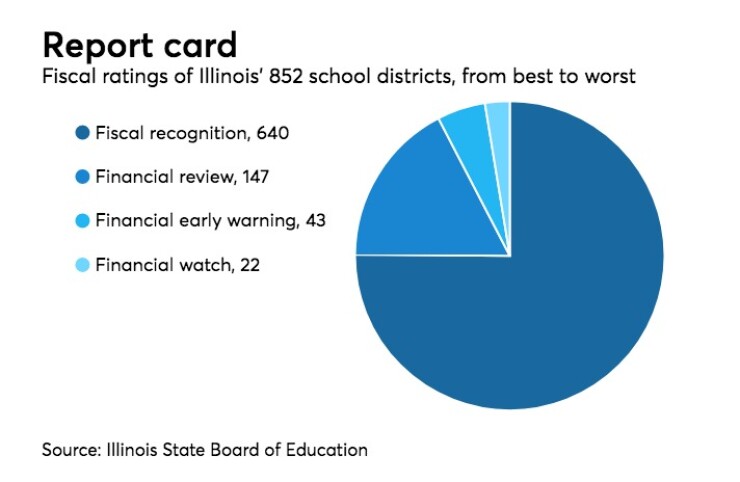

Districts fall into four categories based on a scoring system that evaluates five financial metrics including a district’s fund balance-to-revenue ratio, expenditure-to-revenue ratio, days cash on hand, and the percentage of remaining short-term and long-term borrowing ability.

A total of 640 districts achieved “financial recognition,” up from 632 the previous year. Another 147 districts fell into the second tier category of “financial review,” down from 154 the previous year while 43 districts landed in the “financial early warning” category, down from 47. The remaining 22 districts were designated in the “financial watch” category, up from 19.

The issuance of long-term debt for operations dropped by $83.5 million, or 18.4%, to $369 million. Districts were “less reliant on issuing debt to meet operational needs because of economic improvements and increased funding,” the report said.

While the number of districts in the weakest watch category rose, the report found some improvements between fiscal 2016 and 2017 with eight of the 19 that made the 2017 list moving out of the category. Six that remained saw some improvement in their overall fiscal scores although not enough to drop the designation. Districts with the weakest rating rely heavily on state aid.

The number of districts that relied on deficit spending to get through the school year showed improvement, dropping to 344 from 382 in last year’s profile. The number is projected to jump in the current fiscal year – which would be reflected in next year’s report – to 388 based on estimates submitted by districts.

The state is holding out hope that the number will shrink once the new funding from the overhaul is accounted for.

“It is hoped that the new EBF formula will have a positive impact on district finances and educational programs with more districts realizing improved finances than what the budgets are projecting,” the report said.

The profile falls short of representing the strains districts faced from delayed state grant payments during the budget impasse. The financial profile is statutorily required to be adjusted for delayed state payments, “thus, hardship that districts realize due to delayed state payments is not reflected” in scores.

“Some borrowing denoted in this report is due to districts needing to meet cash flow obligations,” the report read. The backlog of state payments to school districts was $454 million as of Feb. 28, compared to $1.1 billion at the same time last year.

The delayed grants prompted Chicago Public Schools last June to issue nearly $400 million of grant-backed notes to meet its fiscal 2017 year-end obligations.

Junk rated CPS – stuck in the financial watch category for a fourth consecutive year - was among the financial watch list districts that recorded a modest improvement in its score in fiscal 2017 and is expected to gain more ground in next year’s report.

The district is receiving $300 million in new state aid from the revised school funding formula and to help cover its pension contributions. The state also gave the district an additional $130 million in tax levy capacity and the city is providing $80 million to help cover public safety costs.

Days cash on hand improved due to operating increases of $230 million and operating cuts of $102 million, lowering deficit spending to $199 million from $531 million.

“For every dollar of revenue it receives, it spends $1.03,” the report said of CPS, which is formally known as District 299.

The district’s operational fund balance that provides a more sweeping picture of its fiscal status worsened to a negative $270 million from a negative $72 million. It’s the second year CPS incurred a negative operational fund balance which can trigger additional state intervention through a potential certification of financial difficulty.

CPS, however, is exempt from the most stringent oversight sanctions that a finding of “financial difficulty” can bring under the code, although it must submit information for review.

The state board concluded that CPS' fiscal improvements in fiscal 2017 and further strides expected this year preclude a financial difficulty certification.

The district lays out an updated picture of its fiscal progress in

The district’s short-term borrowing remains costly. It is paying 70% of the three-month London Interbank Offered Rate plus a spread of 330 basis points on the latest tranches. That’s up from tranches that sold earlier in fiscal 2018 at a rate of 70% of one-month LIBOR plus a spread of 275 basis points.

As of March 1, the district had $847 million of TANs outstanding including $247 million that mature April 2.

In a cash flow chart, the district projects ending fiscal 2018 on June 30 with a $250 million cash balance although $950 million of TANs will be outstanding. The district this fiscal year trimmed its reliance on short term borrowing to $1.1 billion from $1.55 billion. The district can legally borrow up to 80% of its 2017 levy of $2.4 billion.

The district was rewarded by investors with narrowing spreads in its general obligation and capital improvement tax-backed issues late last year. GO spreads were trimmed to about 220 to 250 basis points from about 480bp on a July sale before the funding overhaul.

Fitch Ratings last year raised its rating by one notch to BB-minus and assigned a stable outlook. S&P Global Ratings shifted its outlook to stable from negative on its B rating. Moody’s Investors Service rates the district at B3 and revised its outlook to stable from negative. Kroll Bond Rating Agency, the only rating agency that rates the district in investment-grade territory, revised its outlook to positive on its BBB and BBB-minus ratings.

Market participants say the credit remains distressed and the district faces expense and labor pressures with little additional room to further raise new revenue.

“While there has been some leveling off, they are still are in a highly vulnerable situation,” Ciccarone said.

“The change in school funding was definitely a positive credit” feature, said Fitch analyst Arlene Boehner. “Liquidity is improved but still narrow and they continue to be dependent on cash flow borrowing so the challenge going forward is whether there will be continued progress toward structural balance.”