Illinois would extend two pension buyout programs by two years funded by $1 billion in additional borrowing authority under legislation being advanced during the current session.

The existing buyout programs began in 2018 under the administration of former Gov. Bruce Rauner. Gov. J.B. Pritzker and the legislature in

It’s “a completely voluntary way” to remove the onerous 3% compounded cost-of-living adjustment (COLA) out of the equation for eligible pension fund participants “that would reduce our long-term unfunded liability and in turn reduce how much money every year we have to put into our pensions,” Morgan told the House Personnel and Pensions Committee.

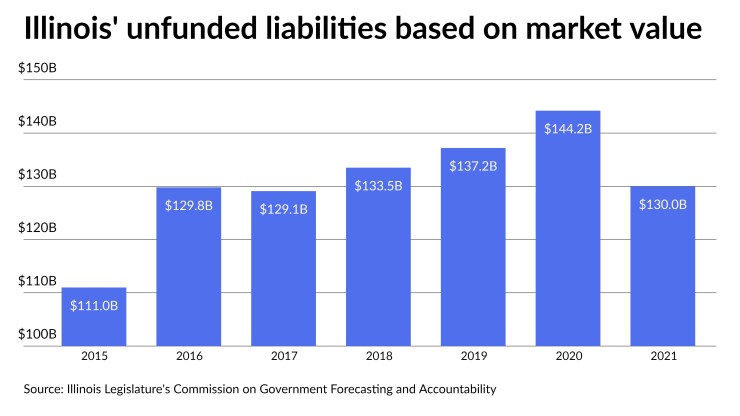

Illinois’ system, made up of five funds, carries a burdensome

The program is working and the state has nearly exhausted existing bonding capacity, Morgan said.

Tim Blair, executive director for the SERS, called the buyout program popular and endorsed its continuation as a means to offer its members options.

The legislation cleared the committee in a bipartisan vote and Morgan said he hopes to bring it up for a floor vote as soon as next month, although the timing could be influenced by the cancellation of spring session days due to the state’s surge in COVID-19 cases from the Omicron variant. If passed, it would then head to the Senate. Pritzker’s office did not immediately have a comment on whether he supports the measure.

The state had little data for the first few years of the program to gauge its impact and bond offering statements have said it’s unknown how much of an impact the programs would have on the liabilities.

More recently, the funds have begun to see an impact, albeit a modest one.

“As of the end of FY 2021, a $1 billion decrease in the liability came from all the Big 3 systems, TRS ($576.4 million), SERS ($404.7 million), and SURS ($24.8 million),” the Commission on Government Forecasting and Accountability’s annual pension review said in a

A TRS officials at the hearing last week said the buyout had resulted in a $90 million reduction in the state’s contribution levels.

The state is scheduled to contribute $10.78 billion in the coming fiscal year up from $10.6 billion this year. That is $4.1 billion short of an actuarially determined contribution.

The program offers members in the Tier 1 and Tier 2 group of beneficiaries — newer employees participate in a Tier 3 benefit structure — who no longer work for the state a lump sum payout equal to 60% of the present value of their vested pension benefit to leave the system.

The second offer goes to only Tier 1 members who are still employed by the state and have the option of receiving a lump sum benefit when they retire plus an ongoing annual payment but at a 1.5% non-compounded COLA instead of the compounded 3% COLA they are currently set to receive.

The state last borrowed to cover buyouts in December, tapping $175 million of remaining capacity.

Illinois has few options when it comes to tackling the pension quagmire, as several Illinois Supreme Court decisions in recent years have closed the door on any form of benefit cut to either pension or retiree healthcare benefits as a violation of the state’s constitution’s clause that bars the diminishment or impairment of promised benefits.

Pritzker has resisted pressure to put a question to voters to amend the state constitution to permit changes saying the state should honor its commitment and attempts to change the law should it pass would be mired in legal battles putting off any positive impact.

Under the funding schedule, the state has been required to make contributions as a level percent of payroll in fiscal years 2011 through 2045. The contributions are required to be sufficient, when added to employee contributions, investment income, and other income, to bring the total assets of the systems to 90% of the actuarial liabilities by fiscal year 2045.

S&P Global Ratings raised the state’s rating by one notch to BBB in June and more recently revised the outlook to positive from stable. Moody’s Investors Service raised it one notch in June to Baa2 with a stable outlook. Fitch Ratings raised the outlook on its BBB-minus rating to positive from negative in June.

"While pension-related fixed costs are likely to persist, if funding of the actuarially determined pension obligations does not continue to improve and the state's forecast budgetary out-year gaps do not meaningfully narrow, we could revise the outlook to stable," S&P said.