More retail orders will be taken on Monday for the big Hudson Yards deal while municipal bond traders will be watching yields.

The market will waiting on the new issue calendar, which is estimated at $7.02 billion.

Secondary market

U.S. Treasuries were little changed on Monday. The yield on the two-year Treasury was unchanged from 1.28% on Friday as the 10-year Treasury yield rose to 2.25% from 2.24% while the yield on the 30-year Treasury bond was steady from 2.91%.

Municipal bonds finished unchanged on Friday. The yield on the 10-year benchmark muni general obligation was steady from 2.01% on Thursday, while the 30-year GO yield was flat from 2.87%, according to the final read of Municipal Market Data's triple-A scale.

The 10-year muni to Treasury ratio was calculated at 89.6% on Friday, compared with 90.0% on Thursday, while the 30-year muni to Treasury ratio stood at 98.8%, versus 98.7%, according to MMD.

MSRB: Previous session's activity

The Municipal Securities Rulemaking Board reported 34,083 trades on Friday on volume of $8.23 billion.

Prior week's actively traded issues

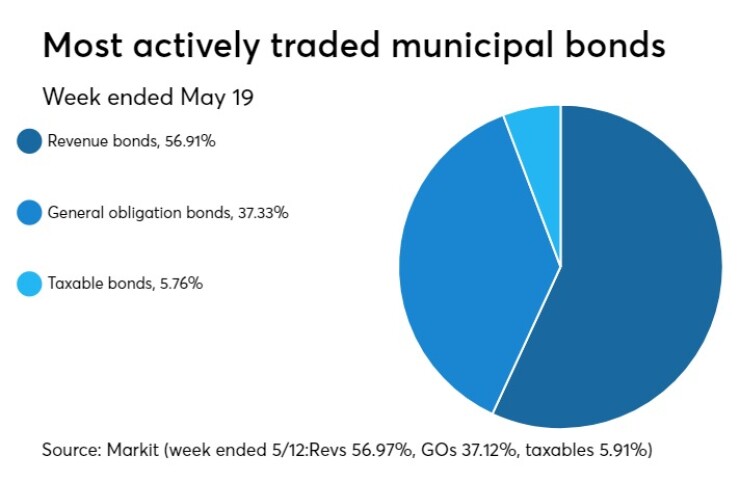

Revenue bonds comprised 56.91% of new issuance in the week ended May 19, down from 56.97% in the previous week, according to

Some of the most actively traded bonds by type were from California, Louisiana and New York issuers.

In the GO bond sector, the Los Angeles Unified School District, Calif., 5s of 2027 were traded 58 times. In the revenue bond sector, the New Orleans Aviation Board, La., 5s of 2048 were traded 68 times. And in the taxable bond sector, the New York State Dormitory Authority 3.998s of 2039 were traded 32 times.

Previous week's top underwriters

The top negotiated and competitive underwriters of last week included Morgan Stanley, Citigroup, Bank of America Merrill Lynch, JPMorgan Securities,and RBC Capital Markets, according to Thomson Reuters data.

In the week of May 14 to May 20, Morgam Stanley underwrote $1.29 billion, Citi $1.23 billion, BAML $1.14 billion, JPMorgan $1.05 billion and RBC $661.4 million.

Primary market

On Monday, Goldman Sachs is set to take retail orders for a second day on the Hudson Yards Infrastructure Corp., N.Y.’s $2.15 billion of tax-exempt Fiscal 2017 Series A second indenture revenue bonds. The deal will be priced for institutions on Tuesday.

The HYIC bonds were priced for retail on Friday to yield from 1.31% with 3% and 5% coupons in a split 2022 maturity to approximately 3.568% with a 3.5% coupon in 2038; a 2042 maturity was prices as 5s to yield 3.19% while a 2045 maturity was priced as 4s to yield 3.53%.

No retail orders were taken in the 2031, 2033-2035, 2039, 2041, 2044 or 2047 maturities.

On Tuesday, the HYIC’s $33.36 billion of taxable Fiscal 2017 Series B bonds will go out for competitive bid.

The deals are rated Aa3 by Moody’s Investors Service, A-plus by S&P Global Ratings and Fitch Ratings.

Also on Tuesday, Ziegler is set to price the Tarrant County Cultural Education Facilities Finance Corp., Texas’ $238.38 million of Series 2017A, B1-B3 and C retirement facilities revenue bonds for Buckner Senior Living’s Ventana project.

Bank of America Merrill Lynch is set to price the California Municipal Finance Authority’s $236.38 million of Series 2017A revenue refunding bonds for the Eisenhower Medical Center on Tuesday.

The deal is rated Baa2 by Moody’s and BBB by Fitch.

Raymond James is expected to price the Metropolitan Government of Nashville and Davidson County, Tenn.’s $174.51 million of electric system revenue and refunding bonds on Tuesday.

The deal is rated AA-plus by S&P and Fitch.

Wells Fargo Securities is set to price Clark County, Nev.’s $150 million of Series 2017 indexed fuel tax and subordinate motor vehicle fuel tax highway revenue bonds on Tuesday.

The deal is rated Aa3 by Moody’s and AA-minus by S&P.

In the competitive arena on Tuesday, Fort Worth, Texas, is selling $111.67 million of Series 2017 water and sewer system revenue refunding and improvement bonds.

The deal is rated Aa1 by Moody’s, AA-plus by S&P and AA by Fitch.

Bond Buyer 30-day visible supply

The Bond Buyer's 30-day visible supply calendar increased $125 million to $12.83 billion on Monday. The total is comprised of $4.56 billion of competitive sales and $8.27 billion of negotiated deals.