WASHINGTON – Government defaults have increased in frequency and size in recent years, heralding a "new normal" for the municipal market, according to a report from Moody’s Investors Service.

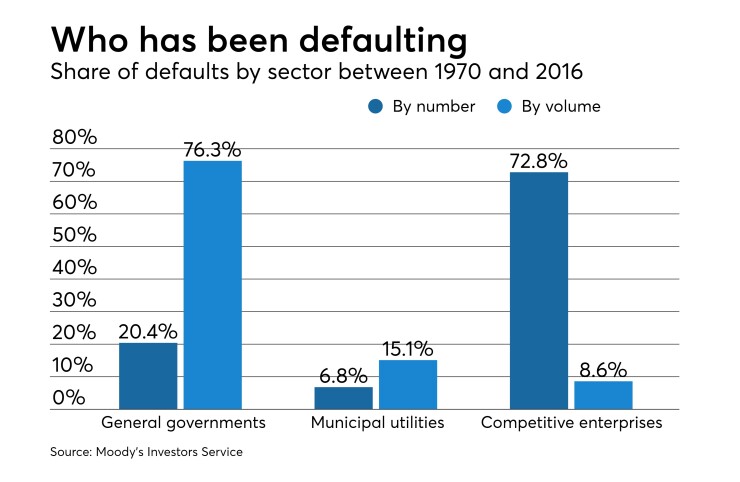

The rating agency released its discoveries Tuesday in a data report on defaults and recoveries in the municipal market during the period from 1970 through 2016. While the report is released annually, its authors chose to divide it into three different categories of issuers for the first time this year. The categories they chose were: general governments, including cities, counties, and public school districts; municipal utilities; and competitive enterprises like non-profits focused on housing, higher education, and healthcare.

Alfred Medioli, a senior vice president with Moody’s and an author of the report, said that the report’s breakdown by sector was intentionally done to try to show that the recent rise in government defaults that analysts believed they were seeing was actually occurring.

“What we did this year was take the data and re-cut it to separate the sectors between general governments and municipal utilities and others to show that in fact yes, what we expected was happening, here is the proof, there have been more general government defaults,” Medioli said. “When you have a big muni utility or general government that fails, there are a lot of dollars at stake.”

Of the 21 general government defaults since 1970, 16 have occurred since 2007, according to the report.

The report shows that while some years have many defaults from issuers that fall into the competitive enterprise sector, those defaults are generally small in terms of volume. The largest defaults by volume have come when governments like Detroit, Puerto Rico, and Jefferson County have faced fiscal trouble.

The report found that a large percentage of the recent government defaults have stemmed from Puerto Rico’s fiscal crisis. All four Moody’s-rated municipal defaults in 2016 were related to Puerto Rico and the total debt affected in those defaults was $22.6 billion, according to the report.

The number of defaults could more than double in 2017 if various Puerto Rico credits now entering court-ordered resolution under the Puerto Rico Oversight, Management, and Economic Stability Act (PROMESA) are restructured with bondholder losses or otherwise default, the report’s authors added. There could be $41.7 billion of rated debt caught up in those defaults, according to Moody’s.

“The US public finance sector is notable for infrequent defaults and extraordinary stability since 1970,” the report’s authors said. “However, rating volatility, rating transition rates, and cumulative default rates have all increased since 2007 and this trend will continue in 2017.”

They added that “the once-comfortable aphorism that ‘munis don’t default’ is no longer credible, although default rates remain low.”

Most municipal credits have stabilized since the Great Recession from 2007 to 2009, according to the report, as entities have “done the hard work to re-balance operations” and state and local governments have strong institutional frameworks.

“Nevertheless, a confluence of events has fostered a ‘new normal’ of more fragile budgetary balance,” the authors wrote.

“The growth of unfunded pension debt has really increased overall liability,” Medioli said, adding it has increased from almost nothing to currently being almost twice the amount of bonded debt in some instances. “It’s going to be a continued stress for a while.”

He added that there are other factors like demographic changes, underemployment, and still-recovering tax bases that are not new but remain a problem for some issuers.

The report also notes that pledges of revenues are less of a shield for bondholders than they were in the past.

“We have now seen several significant situations where municipal bonds, although secured by formal legal pledges of revenue, are displaced in bankruptcy, receivership or simple default in favor of pensions that have no such formal pledge or revenue claim,” the authors wrote. “The evidence of the few large municipal bankruptcies to date suggests that pledge still matters by providing bondholders a seat at the restructuring table.”

The authors also included their feelings that the cultural taboos to bankruptcy have weakened in the past decade because of factors like a growth in personal filings.

“The political incentives for municipal bankruptcy may also be shifting, particularly given the pattern of favorable outcomes for pensions,” the authors said. “One of the significant lessons of the recent large bankruptcies – and in particular Detroit’s relatively speedy resolution of its filing – is that market access may not suffer for long after bankruptcy.”

The report also explored general shifts in ratings over the last few years.

While the large majority of municipal ratings have stayed within the investment grade range since 2010, the number of top-rated credits have dwindled somewhat while the number of lower, but still investment-grade, credits have been on the rise, according to the report.

The five-year municipal default rate since 2007 is also on the rise, although at 0.15%, it is still a fraction of the 6.92% five-year global corporate default rate. That compares with the 0.07% default rate on munis since 1970.

Municipal credits remain highly rated and the gap between muni and corporate default rates continues to be driven by “the distinct strengths” of state and local governments like delinked revenue and spending as well as the ability to defer if not deter financial crises, the authors wrote.

The ratings assigned to various credits also remain strong indicators of risk, according to the report, as municipal defaulters in 2016 were rated on average below 99.9% of all the credits in the rated municipal universe at the start of 2016. The defaults for the period from Jan. 1, 2012 through the end of 2016 were on average below 96.8% of the rated municipal universe.