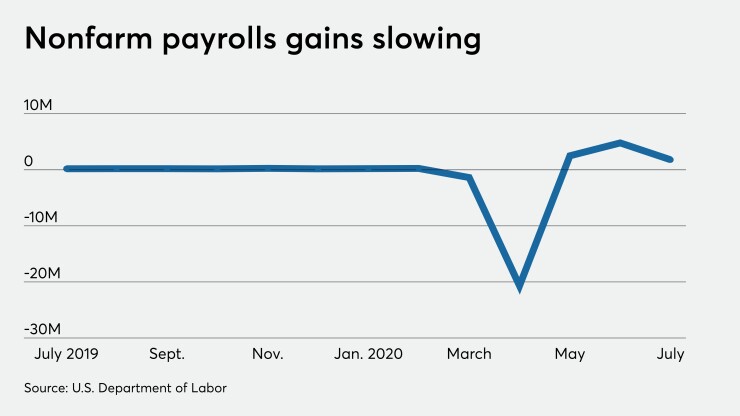

Although the July nonfarm payrolls data surpassed market expectations, the smaller gain than last month suggests rough times ahead for the economy and a slower recovery.

Nonfarm payrolls rose 1.763 million in July after increasing by 4.791 million the prior month. The unemployment rate declined to 10.2% in July from 11.1% in June, the Labor Department reported Friday.

Economists polled by IFR Markets projected 1.650 million jobs added and an unemployment rate of 10.5%.

Brian Coulton, chief economist at Fitch Ratings, said the numbers suggest the surge in coronavirus cases since late June has “so far not prevented” the continued re-opening of the economy at the national level.

“With 1.3 million workers on temporary lay-off going back to work in July, and 800,000 new jobs created in the hospitality and retail sectors combined, it looks like there was continued progress in getting back towards more normal levels of economic activity last month,” he said. “The health crisis still imparts key downside risks to the expected pace of recovery in the second half of the year, but right now it looks like we are still on track for decent expansion in Q3 GDP over Q2.“

“The non-farm payroll report confirmed economic data is plateauing and that the third quarter rebound everyone expected is not happening,” said Ed Moya, senior market analyst at

Jamie Sullivan, CFO of tru Independence, believes it’s going to be a long and slow return to "normal" jobs and unemployment rates. “All in, the slight increase is still good news as the gains were more than expected for July,” Sullivan said. “We have a long way to go as employment is still nearly 8% lower than pre-pandemic levels, but we are on the right track.”

Steven Skancke, chief economic adviser at Keel Point and former White House and Treasury Department staff member, noted job gains occurred principally in “leisure and hospitality, government, retail trade, professional and business services, other services, and health care.”

The report “is a reminder that the economic recovery and employment growth are much in need of another fiscal boost,” he said. “The better-than-expected 7.5 million in May and June new jobs reported are directly attributable to the positive impact of the CARES Act and Federal Reserve actions that catalyzed an economic turn-around at the end of April.”

The rise in positive cases brings into question the nation's ability to stem the pandemic near-term, said Gary Zimmerman, CEO of MaxMyInterest. “Employers — who previously might have been optimistic about the potential for a quick rebound — may be tempering those expectations and limiting new hiring activity,” he said. “Still, there are signs that as a ‘new normal’ emerges, consumers are developing new patterns to coping with COVID-19 and economic activity has begun to pick up somewhat, and with that, the return of some jobs.”

The data suggest the economy needs help, said Samuel Miller, senior investment strategist at Signature Estate & Investment Advisors. “The numbers continue to show that the U.S. economic bounce back stalled in July,” he said. “Gains in leisure and hospitality show that the economy is reopening, but the level of unemployment and low labor force participation remains a major issue. Income growth in 2020 continues to be dependent on fiscal stimulus; the economy does not yet appear healthy enough to stand on its own. Because of this, we expect another large stimulus bill to pass."

While current efforts are at "a stalemate," Miller said, "The market may eventually force policymakers’ hands, but it hasn’t done so yet.”

Despite beating expectations, Christian Scherrmann, U.S. economist at DWS Group believes, the employment report indicates a “major loss of momentum” as some states stopped or even reversed re-opening efforts.

“Quite a few of these reversals happened around or after the report’s cut-off date for data collection of July, 18, making it difficult to assess today’s release,” he said. “In June, 1.98 million jobs were added, July registered an increase of 0.59 million. The report implies that roughly 16 million people were still unemployed, compared to 5.78 million in February. This illustrates that the labor market is still in a very difficult position and a full recovery might well take some time. We hope that today’s numbers, despite being solid compared to expectations, have their effect and spur the decision making process in Washington on new fiscal stimulus efforts.”

While fewer jobs were added in July, August's report will be weaker, Diane Swonk. chief economist, Grant Thornton, predicted. s “The surge in employment at the state and local levels will no doubt reverse, given gridlock over a federal aid package including much-needed funding for the states,” she said. The fact that many school districts have decided to stay online in the fall semester will take a toll on hiring for education, come August. This is all against the backdrop of a lapse in unemployment benefits, which will curb spending in the months to come."

Macro trends suggest the bump back in the economy in May and June tapered in July, said Michael Rosenbaum, CEO and founder of Arena.

“The broader trend of jobs created and destroyed has been accelerating for decades, and so as the economy rebuilds the bigger opportunity is to rethink how we are assembling our economy and labor market medium term,” he said. “What does life look like on the other side of this? If it looks like what it looked like in January, then we missed a massive opportunity. Creation and destruction of jobs has been accelerating for decades. We need a restructuring of the economy, as the current pathway has failed us.”

“We need to come up with effective ways to move folks out of parts of the economy that are shrinking, into parts that are increasing,” he added. “If we do not do that, then GDP growth will continue to fail to live up to its potential."

Wholesale trade

Wholesale inventories fell 1.4% in June, after declining a revised 1.2% in May, first reported as a 2.0% drop, the Commerce Department said Friday.

Total inventories were 5.6% below the June 2019 level.

Sales of merchant wholesalers increased 8.8% in the month, after a 5.7% jump in May, but are down 8.5% year-over-year.

Economists expected inventories to fall 2.0%.