Wednesday’s economic data were not as bad as projected, but included just the beginning of the effects of the coronavirus on the economy.

Jobs in the private sector contracted in March, with 27,000 fewer jobs, according to the ADP employment report released Wednesday.

Economists polled by IFR Markets expected 154,000 lost jobs in the month.

The February read was revised down to a 179,000 gain from the initially reported 183,000 rise.

The report, and the monthly employment report, use payroll figures through the 12th of the month.

Therefore, this report, and Friday’s nonfarm payrolls do “not fully reflect the most recent impact of COVID-19 on the employment situation, including unemployment claims reported on March 26,” said Ahu Yildirmaz, co-head of the ADP Research Institute.

The decline was most pronounced in the small business segment (1-49 employees), with 90,000 jobs lost.

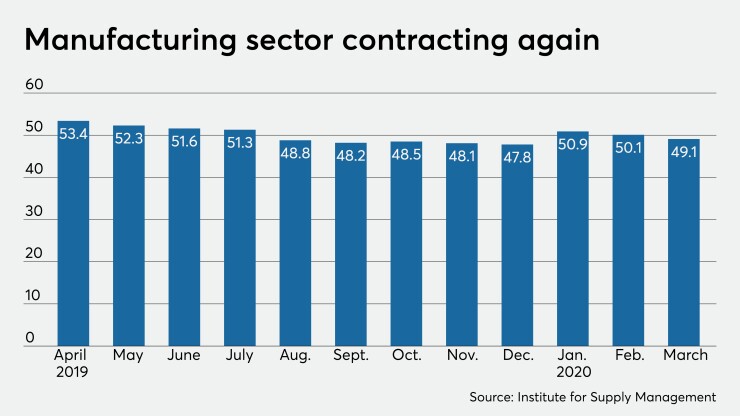

Meanwhile, the Institute for Supply Management’s report on Business showed the manufacturing sector contracting in March, as the PMI fell to 49.1 in the month from 50.1 in February. The new orders (at an 11-year low), production, backlog of orders, and employment indexes all fell in the month.

“Comments from the panel were negative regarding the near-term outlook, with sentiment clearly impacted by the coronavirus (COVID-19) pandemic and energy market volatility,” the report noted. “The coronavirus pandemic and shocks in global energy markets have impacted all manufacturing sectors.”

Economists expected a decrease to 45.0.

“Big declines were seen in new order, new export orders, employment and prices paid components,” said Scott Anderson, chief economist at Bank of the West. “The sharp declines in orders last month shows the spreading coronavirus is rapidly destroying demand across the globe.”

The main index suggested a rosier picture than expected due to “a sharp increase in the supplier deliveries” that resulted from “disruptions to global supply chains that have lengthened delivery times,” according to Berenberg Capital Markets U.S. Economist Roiana Reid. “The key details on current conditions were closer to 40 than 50. Seven of the survey’s 10 subindexes declined and nine were in contraction territory (below 50).”

In the Great Recession, the manufacturing index bottomed “at 34.5 and spent 11 consecutive months in contraction territory,” Reid said. “Over the next couple of months, we expect the ISM index to trough at an even lower level as more factories close and return above 50 when factories re-open. However, the level of manufacturing activity will remain depressed for some time.”

And the pain will continue even after the “economy re-opens,” she said. “Factories will be forced to reduce production due to the undesired inventory build from the sudden drop in demand. Households will face far higher unemployment, declines in disposable incomes, and cautious attitudes that lead them to reduce spending on discretionary goods. Supply chains will take a while to sort and the re-opening of economies across the world will not be synchronized. Global trade and production will remain soft for some time.”

And it wasn’t just the coronavirus: respondents mentioned the drop in oil prices as a negative. One respondent, in the food services area, said business was up because of COVID-19.

Separately, construction spending fell 1.3% in February, and is up 6.0% year-over-year, the Commerce Department reported.

In January, construction spending rose a revised 2.8%, initially reported as a 1.8% increase.

Economists expected spending to rise 0.6% in the month.