Connecticut Gov. Dannel Malloy on Monday presented an updated $39.4 billion

Malloy's proposal, three days after Fitch Ratings

The Fitch downgrade means Connecticut joined Illinois and New Jersey as the only states with ratings below double-A. Moody's Investors Service chimed in Monday, dropping Connecticut GOs to A1 from Aa3.

“The state must live within its means. We cannot spend more than we take in," said Malloy.

Fitch's downgrade affected more than $20 billion of debt and several other credits.

It also prompted talk about possible future downgrades to the wobbly state, and even the specter of insolvency,

“I’m not predicting it, but I wouldn’t be surprised if there was another round of downgrades in the coming months,” said Alan Schankel, a managing director at Janney Capital Markets.

Schankel spoke in the morning, before Moody's took action.

State Sen. Scott Frantz, R-Greenwich, said Connecticut's outlook will worsen and even invoked Puerto Rico, whose U.S. oversight board two weeks ago filed for insolvency under Title III, the island territory's version of Chapter 9.

"We are another Illinois," said Frantz, co-chairman of the General Assembly's finance, revenue and bonding committee. "They call Puerto Rico a territory or whatever they call it, but it's essentially a state, and if they can invoke Title III, then states should be able to file for bankruptcy."

Connecticut received three GO downgrades last year. S&P Global Ratings assigns its AA-minus rating and negative outlook and Kroll Bond Rating Agency assigns its AA-minus with a stable outlook. Moody's changed its outlook to stable from negative after Monday's downgrade.

“The action by Fitch is disappointing, and should be taken extremely seriously as we chart a course on our next biennial budget,” Malloy said in a statement.

Malloy said his new plan finishes paying off the state’s economic recovery notes by the end of fiscal 2018 and puts the general fund nearly $30 million in surplus.

Fitch based its downgrade on “reduced expectations for economic and revenue performance over the medium term.” It assigned a stable outlook.

Malloy last week called for

“I don’t know if the depletion of the rainy-day fund was a driving factor,” Schankel said of the downgrade. “It consists of many things. They’re still duking it out over a budget.”

Senate Republican leader Len Fasano, R-North Haven, called the downgrade more devastating, but expected.

“Beating up on this downgrade won't solve the problem, but we also cannot ignore how serious this situation is,” he said. “We have to act boldly.”

Political gridlock has stymied progress at the State Capitol in Hartford. The Senate is split 18-18 between Democrats and Republicans. The Democrats hold a 79-72 advantage in the House of Representatives.

Frantz expects the impasse to continue.

"It'll get worse before it gets better," he said. "There are a lot of sore egos, people going at it for 11 hours the other day," he said.

Connecticut is staring at a roughly $5 billion deficit for fiscal 2018 and 2019. The state operates on a biennial budget.

In addition, capital city

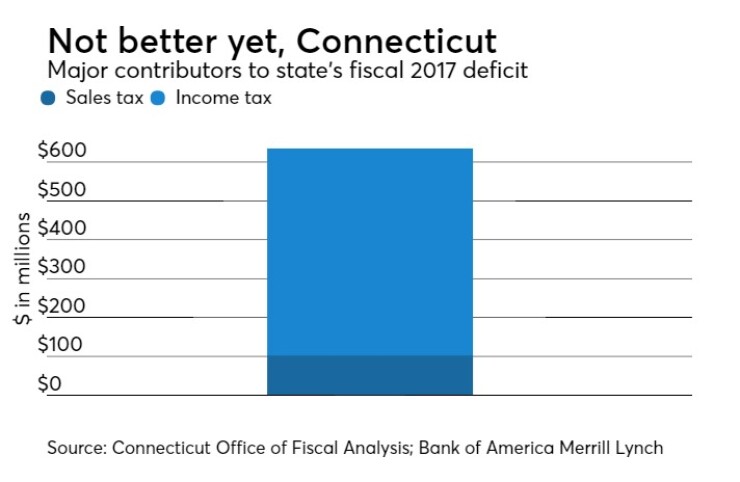

Malloy budget director Benjamin Barnes and the General Assembly’s nonpartisan Office of Fiscal Analysis have both cited a sharp drop in income tax collections. Connecticut’s post-recession recovery has lagged that of other states, despite per capita income that Janney pegged at 143% of national levels.

According to Bank of America Merrill Lynch, underperforming sales tax collections are also contributing to the deficit.

“The state is under very significant macroeconomic pressures, and the continued revenue weaknesses that have strained our budgets need to be addressed in a meaningful, sustainable way,” said state Treasurer Denise Nappier.

Nappier tried to put a positive spin on Friday’s news, noting that Moody’s, S&P and Fitch reaffirmed the triple-A ratings for Connecticut’s clean water fund revenue bonds. Connecticut plans to sell $250 million of new bonds and $120 million of refunding bonds for its clean water and drinking water fund programs on June 1.

Nappier repeated her call for

Other suggested remedies include restoring tolls on interstate highways, which Connecticut discontinued after a fiery crash at the Stratford toll plaza in 1983 killed seven people.

“Some proponents for the tolls have estimated that, by 2040, tolls on the state's highways could bring in over $18 billion to state coffers,” said BofA Merrill. “Still, many in the state are not sold on the idea.”

Fitch also downgraded to A-plus from AA-minus $5.3 billion of special tax obligation bonds, both senior and subordinate lien.

It lowered to A from A-plus the University of Connecticut state debt-service commitment bonds; Connecticut Higher Education Supplemental Loan Authority state-supported revenue bonds payable from special capital reserve funds; Capital City Economic Development Authority parking and energy fee revenue bonds, Series 2004B and 2008D; and Connecticut Development Authority and Connecticut Innovations general fund obligation bonds, Series 2004A, 2006A and 2014A.

In addition, Fitch downgraded to A-minus from A the Connecticut Development Authority GO bonds, Series 2004B and the Connecticut Health and Educational Facilities Authority revenue bonds child care facilities program, Series G.