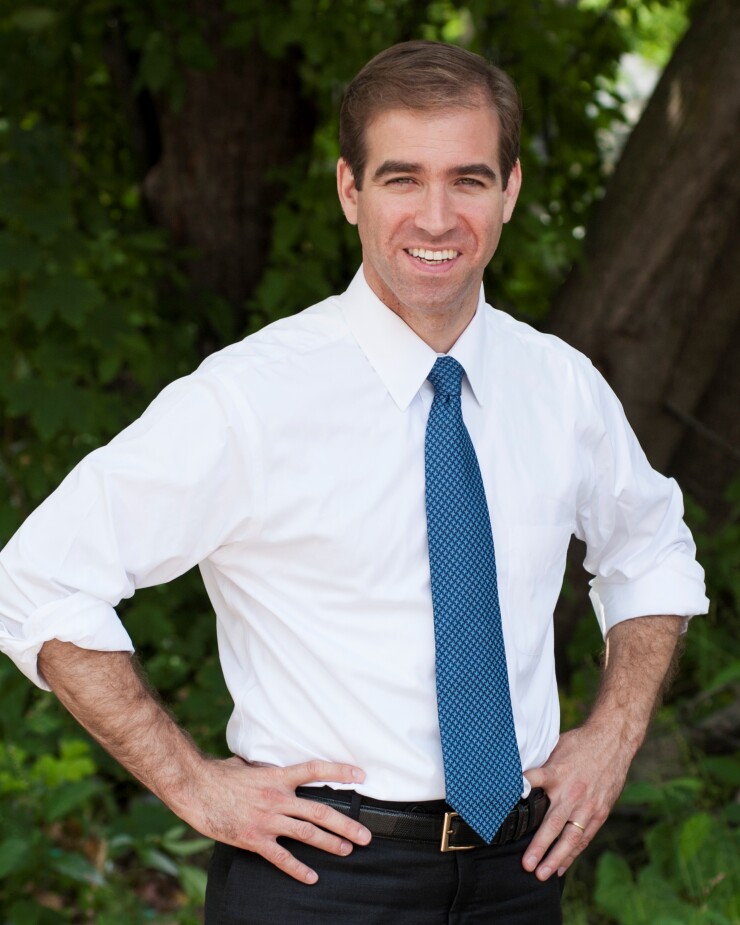

Hartford, Conn., Mayor Luke Bronin acknowledged a nearly $50 million gap as he submitted his $612.9 million budget request for fiscal 2018.

Bronin, whose distressed city received four-notch downgrades to its general obligation bonds last year from two rating agencies, cited rising debt-service payments, higher required pension contributions, health-care cost inflation, costly legal judgments from years past and unrealized concessions from most labor unions.

Moody’s Investors Service in 2016 lowered Hartford GOs to a junk-level Ba2. S&P Global Ratings knocked the city to BBB from A-plus, keeping it two notches above speculative grade.

Bronin, a former chief counsel to Gov. Dannel Malloy in his second year as mayor, repeated his call for help from the state – whose own budget situation is wobbly – and Hartford’s suburbs.

“You cannot run a city on the tax base of a suburb,” said Bronin. “The city of Hartford has less taxable property than our suburban neighbor, West Hartford. More than half of our property is non-taxable."

The new spending plan, which Bronin called an "essential services only" budget, represents an increase of about $60 million, or 11%, over last year’s approved budget. The Court of Common Council must approve the spending plan by May 31.

About $14 million, or 23%, of that increase is due to debt-service payments while $12 million is for union concessions that did not materialize, said Bronin.

Malloy’s proposed biennial budget, which state lawmakers are debating, calls for $35 million of aid to Hartford. The package, however, could be a tough sell to many suburban and downstate legislators.

While labor concessions are still a major loose end, Bronin said an agreement late last year with the Hartford Fire Fighters Association could set a pattern that might save the city $4 million next year. The agreement included changes to pension contributions and benefits, active and retiree health care, and salary schedules.

Last month, Hartford’s largest private-sector employers -- insurers Aetna Inc., Travelers Cos. and The Hartford -- agreed to donate $10 million per year to the city over five years.

Moody’s and S&P called out Hartford for limited operating flexibility, weak reserves, narrowing liquidity and rising costs of debt service and pension obligations.

Gurtin Municipal Bond Management, which called Hartford a "slow-motion train wreck," said that while the quadruple-notch downgrades had a headline shock effect, the city's fundamental credit deterioration had been slow and steady.

“The price impact of negative headlines and credit rating downgrades can be swift and severe, which begs the question: How should municipal bond investors and their registered investment advisors react?” Gurtin's Alex Etzkowitz said in a commentary.

“The only foolproof solution is to avoid credit distress in the first place by leveraging independent credit research and in-depth, ongoing surveillance of municipal obligors.”