HARTFORD, Conn. – Connecticut’s special commission on pension funding is weighing how in-kind contributions of real-estate assets to an independently managed trust – novel among U.S. governments -- could help bolster the state’s pension and retiree health plans.

Calling pension underfunding the state’s biggest problem, Rep. Jonathan Steinberg, D-Westport, chairman of the Connecticut Pension Sustainability Commission, emphasized the importance of his 13-member panel to quelling fears among business leaders and in the capital markets.

“I see our role here, if we’re successful, to contributing to a restored sense of confidence in the state of Connecticut and its ability to have its house in order,” Steinberg said during Friday’s hearing at the legislative office building.

Connecticut last year received bond rating downgrades from all four rating agencies, which pointed to chronic budget imbalance and high legacy costs.

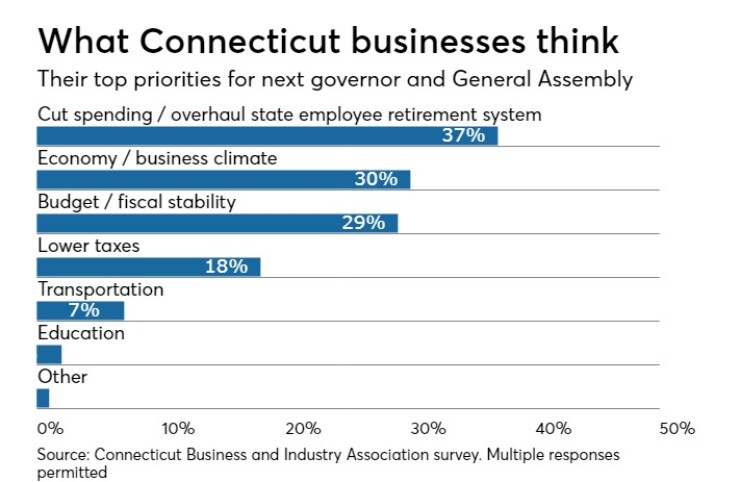

As the fall elections loom, a Connecticut Business and Industry Association

According to CBIA's polling of roughly 6,400 top executives throughout the state from mid-June to late July, a plurality of respondents, 37%, said cutting spending and overhauling the state employee retirement system should be the top priority when a new governor and legislature convene in January.

About 61% said the state’s business climate is declining.

The commission on Friday heard two speakers discuss how in-kind contributions could work.

Michael Bennon, managing director of the Global Projects Center at Stanford University, said Australia’s third-largest state,

Queensland received a credit equivalent to $2.3 billion in U.S. currency against its underfunded pension, Bennon said in his study. The pension fund, in turn, hired professional infrastructure managers who improved operations and expanded the toll road.

Valuing infrastructure assets can be challenging, according to Bennon. He cited the Chicago Skyway concession in which the top bid, a Cintra-Macquarie consortium, came in at $1.8 billion, far above the $700 million and $505 million offers from Vinci and Abertis Infrastructure, respectively.

“It’s difficult for these governments and very difficult, clearly, for the investors that are trying to value them,” said Bennon. "Clearly there is an inefficient-markets potential."

Another complexity is after-the-fact second guessing. Bennon referenced a follow-up study by infrastructure expert Dennis Enright that said Chicago lost $322 billion in gross revenue through the deal, based on best-case assumptions.

“There will always be ‘ex-post’ reports,” said Bennon. “It adds to the difficulty of valuing these assets.”

According to Frank Chin, managing director and co-founder of

“Our belief is there are huge values on many municipal governmental balance sheets and how to capture that in the appropriate matter is really the question,” Chin said.

The New Jersey Lottery concession last year and the Indianapolis water and sewer sale to Citizens Energy exemplify the benefits of asset in-kind transactions, said Chin. The New Jersey deal, he added, demonstrated stakeholder support for using the concept to reduce pension liabilities, while Indianapolis saved about $1 billion over 50 years, half of which it recycled into infrastructure investments.

“We believe by taking pressure off the pension-funding issue, it should help the [bond] ratings,” Chin said.

It’s no cure-all, he added.

“This is probably helpful in trying to, if you will, cut the bleeding but clearly is not the whole way to solve the problem,” said Chin. “It requires a lot of action and a lot of different levers, and this is a tool that at least municipal governments in the U.S., have actually not used or looked at seriously, and it is probably time to think about it.”

Commission member Michael Imber, a managing director at EisnerAmper LLP, has recommended establishing a

The trust, in turn, would issue certificates of trust, much like shares of stock, and divides them among various pension and other post-employment benefit funds the government unit sponsors.

Takeaways, according to Imber, include an immediate credit against its unfunded liability based on the fair-market valuation of the assets contributed to the trust; a boost in pension and OPEB funded ratios, which would placate rating agencies; positive budgetary cash flow; and an incentive for the independent manager to further increase funding ratios.

The committee has formed subgroups on actuarial, legal, capital asset selection and economic development matters. Steinberg said economic development will be the focus of its Sept. 21 meeting.