Chicago’s $1.3 billion deal Sales Tax Securitization Corp., tentatively scheduled to price Wednesday, was moved to the day-to-day calendar, according to deal participants. Bookrunner Loop Capital Markets cited “market conditions.”

Proceeds of the deal will go to refund higher interest cost general obligation bonds, so the city is seeking to meet its targeted savings levels – both for budgetary relief and net present value savings – making the deal’s value especially subject to prevailing rates.

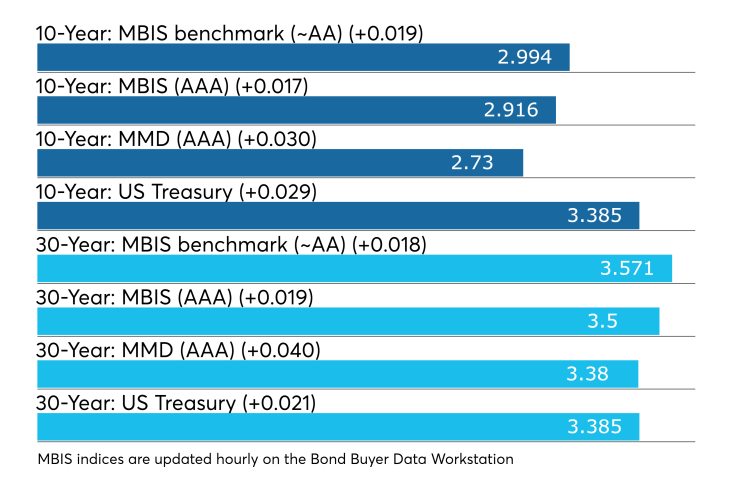

Municipal yields rose across the curve on Wednesday, with yields rising on Municipal Market Data triple-A scale by three basis points in the 10-year municipal maturity and increasing four basis points in the 30-year muni maturity.

Yields also moved higher on the MBIS benchmark and triple-A scales as Treasury bond yields rose while stock prices continued to climb.

"The recent market fluctuations resulted in the STSC’s decision to postpone the bond offering until the market normalizes,” said Chicago Finance Dept. spokeswoman Kristen Cabanban. “We will continue to monitor the market and will bring the offering when conditions are most favorable to achieving the greatest savings for taxpayers.”

Several market participants said other factors posed headwinds for the city. They included both a downgrade of the bonds last week and a downgrade of the state’s sales-tax backed Build Illinois bonds late Tuesday, both due to revised criteria published Oct. 22. The two credits are structurally very different, with the state’s falling under the category of traditional revenue bonds and the city’s representing a true sale of the pledged revenue to special bankruptcy-remote entity, but the fresh headline that the market was only beginning to digest was especially damaging.

One trader said a pre-pricing wire on Tuesday put one of the 2053 term bonds at a roughly 80 basis point spread with a 5% coupon to the MMD benchmark.

"It was a number of elements ... I don't think it was any one thing," a New York trader said Wednesday. "Overall, being priced into a weak market factored in, and I think people were spooked by the S&P downgrade," he said. "We heard some investors wanted cheaper levels, and I think when some people heard about S&P reassessing the sales tax bonds they found that scary."

The deal's size and its taxable portion were also concerns in today's market climate, the trader said.

With the taxable portion unfamiliar to cross over buyers, he said, "it was not something up their alley."

In addition, he said the track record of previous Chicago securitization deals may have given issuers pause, especially in a weaker market Wednesday."This was not a deal the market was licking its chops for," he said. "Prior deals have not been easy. To come with a large deal in a tough market makes it even more challenging."

Aside from the postponement of the Chicago deal, the trader said there are a lot of cross-currents in the market, including the anticipation of Friday's unemployment numbers and next week's midterm elections.

Chicago had been eyeing Halloween as the pricing date, chief financial officer Carole Brown earlier this month considered putting off the sale as rates fluctuated and supply grew. The finance team decided last week to move forward and on Thursday doubled the size to $1.3 billion from $665 million in an effort to wrap up the up to $3 billion of securitization borrowing authorized by the city council for refunding purposes before Mayor Rahm Emanuel leaves office in May. He announced in September he won’t seek a third term next year. The finance team did say the sale’s timing remained subject to market conditions.

“We had identified targeted savings for the entire finance plan and we were able to achieve it," Brown said Friday. “Based on the interest we saw and the feedback and what we heard from investors, we saw there was the opportunity to complete the finance plan.” Prior deals sold late last year and earlier this year.

The bonds issued through a bankruptcy-remote special purpose entity that insulates the debt from city operations carry AAA marks from Fitch Ratings and Kroll Bond Rating Agency and AA-minus from S&P Global Ratings following a one-notch downgrade last week due to newly published revised criteria on “priority lien” credits. The city’s GOs are rated from a low of junk Ba1 to a high of A with two ratings in the triple-B category. Brown said the downgrades should not “surprise” the market since the rating agency’s review was long in the works, though she expected the buyside would use it in pricing negotiations.

The sale tentatively offers a tax-exempt series for $917.6 million with serial maturities from 2022 to 2038 and term bonds in 2043 for $57 million, 2048 for $72 million, and two in 2053 for $311 million and $250 million. A taxable series for $388.6 million is offered in a 2053 term bond. The bonds final maturity 10 years past the final maturity on the city’s GOs and 13 years past GOs being refunded with the proceeds had prompted some market participants to suggest it looked like another form of scoop-and-toss debt restructuring. Brown rejected the notion because unlike the city’s past restructuring practices that were phased out last year, the deal cuts overall interest costs and has net present value savings.

Loop, Ramirez & Co. and Stifel are the joint bookrunners. Ramirez was added after the city decided last Thursday to upsize the deal to finish the program. The city met with investors in Boston, Chicago and New York to promote the credit that’s supported by both healthy coverage of pledged revenues and legal protections that insulate it should the city’s fiscal foundation collapse.

The sales tax securitization bonds have a first lien on the state-collected portion of the city's home rule sales and use taxes, and the local share of the statewide sales and use taxes after a state administrative fee. The corporation is a bankruptcy-remote entity created after authorizing legislation was approved by the state last year and the revenues are lock-boxed and insulated from city operations.

Primary market

Several large bond deals did come to market on Wednesday.

Siebert Cisneros Shank & Co. priced the Wayne County Airport Authority, Mich.’s $231.93 million of airport revenue bonds for the Detroit Metropolitan Wayne County Airport. The deal consisted of Series 2018A-D, Series 2018A (non-AMT), Series 2018B (AMT), Series 2018C (Non-AMT) and Series 2018D (AMT) bonds.

The deal was rated A2 by Moody’s and A by S&P and Fitch.

RBC Capital Markets priced the Massachusetts Development Finance Agency’s $117.17 million of Series 2018 revenue bonds for Linden Ponds, Inc.

The deal is rated BB by Fitch.

Bond sales results

Michigan

Massachusetts

Bond Buyer 30-day visible supply at $6.18B

The Bond Buyer's 30-day visible supply calendar decreased $1.83 billion to $8.01 billion for Wednesday. The total is comprised of $1.87 billion of competitive sales and $4.21 billion of negotiated deals.

Secondary market

Municipal bonds were weaker on Wednesday, according to a late read of the MBIS benchmark scale. Benchmark muni yields rose as much as one basis point in the one- to 30-year maturities.

High-grade munis were also weaker, with yields calculated on MBIS' AAA scale rising as much as one basis points across the curve.

Municipals were weaker on Municipal Market Data’s AAA benchmark scale, which showed the yield on the 10-year muni general obligation rising three basis points while the yield on 30-year muni maturity gained four basis points.

Treasury bonds were stronger as stocks traded lower.

On Wednesday, the 10-year muni-to-Treasury ratio was calculated at 86.7% while the 30-year muni-to-Treasury ratio stood at 99.7%, according to MMD. The muni-to-Treasury ratio compares the yield of tax-exempt municipal bonds with the yield of taxable U.S. Treasury with comparable maturities. If the muni/Treasury ratio is above 100%, munis are yielding more than Treasury; if it is below 100%, munis are yielding less.

Previous session's activity

The Municipal Securities Rulemaking Board reported 42,443 trades on Tuesday on volume of $12.02 billion.

California, New York and Texas were the municipalities with the most trades, with the Golden State taking 15.514% of the of the market, the Empire State taking 13.278% and the Lone Star State taking 10.943%.

Data appearing in this article from Municipal Bond Information Services, including the MBIS municipal bond index, is available on The Bond Buyer Data Workstation.