CHICAGO — The Metropolitan Water Reclamation District of Greater Chicago is conducting its first request for proposal process for underwriters as it prepares to sell $500 million of mostly Build America Bonds before the end of the year to help finance a long-term capital program of more than $2.5 billion.

“We again have capital needs and it would be malfeasance not to take advantage of the BAB program,” said Harold Downs, the triple-A rated district’s treasurer. The district also expects to issue some non-BAB taxable bonds and may include a piece of tax-exempt debt, depending on interest rates.

Proposals are due by Friday. Firms will be selected for a senior manager pool and a co-manager pool for a three-year term based on a scoring system with 30% of points awarded for experience and qualifications, 20% for key personnel, 25% for technical approach, 15% for cost, and 10% for underwriting capacity. The pools will be selected by a group of five district officials from the treasury, finance, law, and procurement departments and the team for the upcoming sale will be selected from the pools.

“We felt it was about time to get into the swing,” Downs said, especially given that the Government Finance Officers Association recommends the use of RFPs when issuers opt for negotiated transactions. Use of the RFP process also streamlines the process for board members, he added.

The district expects to soon pick a financial adviser and bond counsel for this year’s sale based on experience, but will conduct RFPs for those positions on future transactions.

The agency and its elected board are especially sensitive to the team selection process and pricing in light of the Securities and Exchange Commission inquiry into its $600 million BAB sale in August 2009. That deal was highlighted in a series of published reports by Bloomberg LP that raised questions about the accuracy of its pricing due to the level of investor profit-taking that immediately followed in secondary trading.

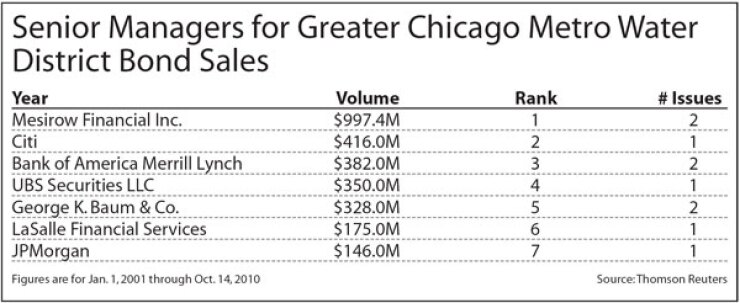

Mesirow Financial Inc. was senior manager of the deal and A.C. Advisory Inc. and Scott Balice Strategies were advisers. The bonds captured a true interest cost of 3.72 % once the direct-pay 35% BAB interest subsidy was applied. Loop Capital Markets LLC was co-senior manager and another 10 firms were co-managers.

Though the deal achieved savings over a traditional tax-exempt transaction, Bloomberg asserted in its analysis that the agency paid $8 million in unnecessary interest based on a comparison with similarly rated deals at the time and profiting in secondary market trading. About 23% of the bonds were initially purchased by hedge funds.

Profit-taking that impacts federal government costs because of the 35% interest rate subsidy has come under federal regulatory scrutiny. The district received the inquiry last April, responded by providing various pricing and other deal information in June, and has not heard back from the SEC, Downs said.

Some market participants have defended the 2009 transaction’s results, citing the novelty of BABs, which had debuted the previous spring, while others have suggested that Mesirow did not sufficiently market the deal to attract buy-and-hold investors.

Mesirow was financial adviser on the district’s 2007 sales and senior manager on one of two sales in 2006. Downs, a 41-year veteran of the district who has been treasurer for the last 28, is close to longtime Mesirow public finance banker Larry Morris.

Downs said ultimately he was pleased with the 3.72% final rate and all the firms involved in the 2009 sale that submit proposals will be in the running for the upcoming deal. “It was a new market,” he said. “To the best of my knowledge, everything was done in the best way it could have been and there was no subterfuge” on the previous sale.

However, the district will be on “full alert” with regard to both pricing and initial secondary trading on the upcoming sale. “We will be issuing instructions to our underwriters to watch every figure and who is buying the bonds,” Downs said.

Downs will return to the board to seek authority to sign off on a team next month for the $500 million issuance. Several local market participants said bankers have been approaching board members, sensitive to the past criticism, to make their case for a senior role on the underwriting team.

The district’s capital program includes plant expansions and improvements, sewer upgrades, bio-solids management projects, and deep tunnel-related projects. The district spans Chicago and 128 suburbs. It is responsible for maintaining the water quality of Lake Michigan and other waterways in the region.

In addition to its deep tunnel system, the district operates seven wastewater treatment facilities. The tunnel system includes 109 miles of interceptor tunnels and three reservoirs to hold runoff and sewage during storms, and prevent runoff into Lake Michigan, the region’s source for drinking water.

The agency recently completed the first phase of the deep tunnel project, but still has two permanent reservoirs to complete.

All three rating agencies last year affirmed the district’s top ratings on the deal and $1.4 billion of outstanding debt. The district won an upgrade in 2006 from Standard & Poor’s that placed it among the elite ranks of systems with three triple-A ratings. While the district faces some fiscal strains like most governmental agencies, it benefits from a reliance for 70% of its operating revenues on property taxes which provide some stability.

The district cut expenses to close a $25 million gap going into the 2010 budget and expects to have to cut another $20 million to $30 million to balance its 2011 budget, according to district superintendent Richard Lanyon.