CHICAGO — Chicago will tap its high-rated sales tax credit this week to primarily refund general obligation bonds in a $238 million deal that marks the inaugural market outing by new Mayor Rahm Emanuel’s administration.

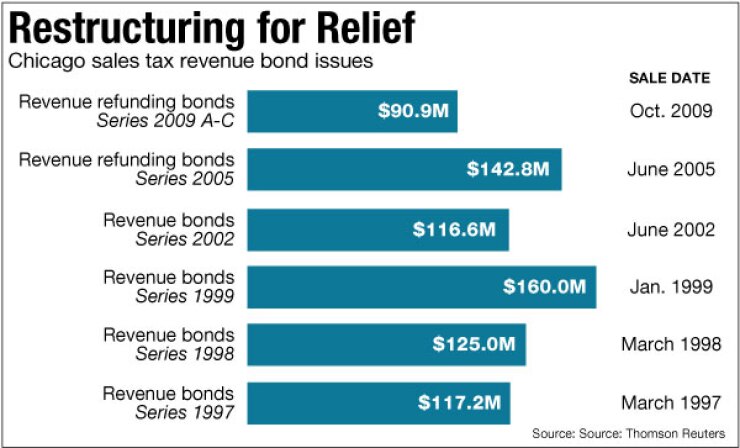

The restructuring — which will test the success of city efforts to bolster investor relationships — will achieve 2011 budget relief. It is the latest in a series of planned debt restructurings adopted by Emanuel’s predecessor, Richard Daley, to ease near-term debt service repayment beginning in 2008. Near-term maturities will be pushed out to between 2035 and 2041.

“It’s a higher-rated credit so there is a lower cost to our taxpayers,” Chicago’s chief financial officer, Lois Scott, said of the decision to use the sales tax credit.

The city’s sales tax bonds are rated AAA by Standard & Poor’s, which rates the city’s GOs A-plus. Moody’s Investors Service rates the sales tax bonds Aa2 and the GOs Aa3. Fitch Ratings assigns a AA-minus to both.

The city’s GO credit suffered a round of downgrades last year due to mounting fiscal challenges and a reliance on reserves and other non-recurring revenues to balance past budgets.

The bonds are being sold in two series, a tax-exempt one of $219 million and a taxable one of $19 million.

Loop Capital Markets LLC is senior manager. Bank of America Merrill Lynch and Cabrera Capital Markets LLC are co-seniors.

Austin Meade is financial advisor, Peck Shaffer & Williams LLP and Golden Holley James LLP are bond counsel. Ungaretti & Harris LLP and Sanchez Daniels & Hoffman LLP are underwriters’ counsel.

The city last month sold notes and has remarketed some series of bonds with new liquidity support, but this sale will mark the first long-term borrowing by the administration and will be followed by a new-money GO issue for up to $500 million later in the month.

With the deal, the city will debut a significantly beefed-up pension disclosure section adding about 30 pages of details on the funds’ financial condition, contribution levels, investment returns, membership and other details.

Chapman and Cutler LLP served as special disclosure counsel to help with the expanded section, said Scott, who Emanuel recruited away from her financial advisory firm to take the post soon after his election early this year.

Chicago is grappling with $15 billion in unfunded liabilities and faces a $550 million increase in annual payments in 2015 under an Illinois mandate. The city’s current statutorily set payment for 2012 to its four funds will rise to $476 million from $450 million this year.

“The unfunded liability to the retirement funds poses significant financial challenges and the city is considering its options to rectify this situation,” the offering statement reads. Those options could include union concessions and possible state legislative action.

The city’s unfunded liabilities totaled $15.3 billion at the close of 2010 based on a fair-market valuation and $14.3 billion on an accrued basis for a funded ratio of 42.7% and 46.6%, respectively.

The expanded section mirrors what many issuers have undertaken due to heightened regulatory scrutiny and investor demands.

Scott said the move is in keeping with Emanuel’s overall push to improve the transparency of government operations by providing better public access to information. “It makes sense to bring that same level of transparency to the investor marketplace,” Scott said.

That effort extends to the rating agencies who were briefed on the city’s proposed 2012 budget before its release last month. The city hosted an investor conference last month, during which Emanuel addressed potential bond buyers on his goals for the city while Scott and officials from the city’s sister agencies made presentations on their various credits.

Scott said the city’s finance team also will hold one-on-one meetings with investors. “What I heard from investors was that they greatly value the opportunity to meet with city officials and want a real dialogue about what’s going on in government,” she said.

The city paid a premium to borrow last year and early this year due to both its own negative headlines and the so-called Illinois effect that tacks on a penalty for state-based issuers ranging from 15 basis points to 100 — depending on an issuer’s timing and credit — because of the state’s budget and liquidity woes.

The investor outreach might help the city lower rates by attracting more buyers, said Thomas Spalding, senior investment officer at Nuveen Investments. “It was unique for the city to host a conference where all the agencies laid out their financial plans and the sales tax credit is definitely one of the city’s best,” he said.

After a round of downgrades last year, the city breathed a sigh of relief with rating affirmations announced last month. “We were very pleased. … It will have a direct financial and economic consequence,” Scott said.

Rating analysts all noted the city’s challenges, including its growing personnel and pension costs and a structural budget deficit that likely will take several years to correct. The city faces a tough political road in achieving pension reforms and its economic recovery has been sluggish.

But analysts praised Emanuel’s move towards structurally balancing the budget. His proposed $6.3 billion 2012 budget whittles away a $635 million deficit with new revenue from a series of increases in fees, fines, and taxes along with debt refunding savings, management reforms, and spending and job cuts.

Standard & Poor’s analyst Helen Samuelson wrote, “Further supporting the rating is the city’s recent budget-balancing efforts that strive for budget reforms under a newly-elected administration.”

Emanuel honored his pledge not to raise the sales or property tax and to forgo enacting an income tax. He also won’t further drain remaining reserves that hold about $624 million, and will add $20 million to them.

Though Emanuel vowed to avoid the use of non-recurring revenues to balance the books, his budget proposal does rely on $88 million in one-shots, including $66 million in debt restructuring and $10 million in swap-related savings. Emanuel’s estimates on management savings and on expected revenues also must come to fruition to keep the next budget balanced.

The sales tax bonds carry a first lien on the city’s home rule sales and use tax of 1.25% and the city’s local share of a state-distributed 6.25% sales and use tax. Debt service is expected to exceed a high of 15 times. The city adheres to a minimum five times coverage ratio before it can sell additional bonds under the credit.

A portion of the revenue depends on the state forwarding the city’s share of sales taxes, so the credit is somewhat exposed to state liquidity woes. However, the amount represents just 10% of the city’s pledged revenue, so Fitch said it doesn’t believe the exposure impairs the quality of the credit.