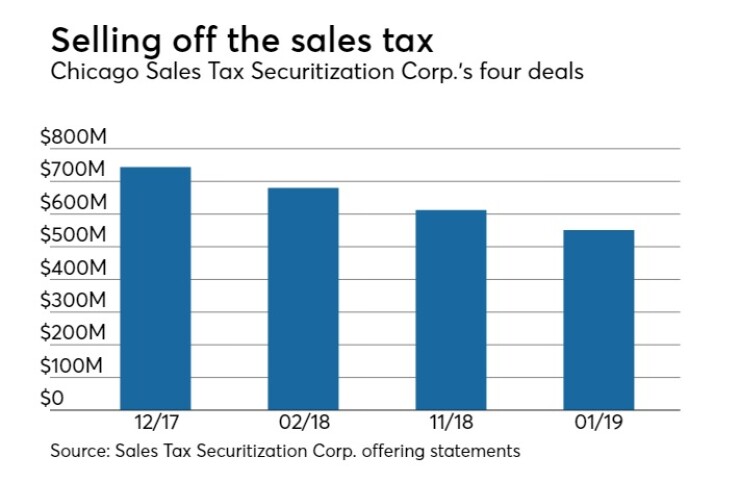

CHICAGO — Chicago returns to the market Wednesday with a $551 million deal that wraps up the sales tax securitization refunding program it launched in 2017 to trim existing interest costs by bypassing the city’s weaker general obligation ratings.

The issue selling through the city’s Sales Tax Securitization Corporation offers taxable paper in two fixed-rate term bonds, one maturing in 2038 for $222 million and the other maturing in 2048 for $329 million, both with make-whole call provisions typical in the corporate market.

The proceeds will refund GOs. The program carries S&P Global Ratings' AA-minus rating and a AAA from both Fitch Ratings and Kroll Bond Rating Agency, compared to the city’s GO ratings that range from a low of junk to a high in the single-A category.

“The series 2019A financing represents the final issue of sales tax securitization bonds,” Chicago’s chief financial officer, Carole Brown, said in a recorded investor presentation outlining the structure. The city “sells and conveys all of its state collected sales tax received by the city to the STSC which is a bankruptcy-remote special purpose entity.”

Citi and Ramirez are joint bookrunners. Columbia Capital Management LLC and PFM Financial Advisors LLC are advising the corporation. Nixon Peabody LLP and Pugh Jones & Johnson PC are co-transaction counsel.

“The bonds have strong legal and structural protections that separate the pledged sales tax revenues from ongoing operating and financial risk of the city and KBRA believes these protections apply even in the unlikely event of an insolvency or bankruptcy of the city,” Kroll said in its report published this week. The new issue will come close to maximizing the corporation’s 4 times coverage requirements as maximum annual debt service will hit $166.5 million.

The sale allows the city to wrap up the program before Mayor Rahm Emanuel leaves office in May. He announced in September that he would not run for a third term in the February municipal election. The securitization program was Brown’s idea and the city won state legislation in 2017 paving the way for its use by any home rule unit. Two other municipalities have since joined the ranks of borrowers.

The city’s first issue for $744 million was well-received in December 2017. A followup that eventually settled at $680 million required more structuring work to cater to a post-federal tax code reform market. The city anticipated strong demand in its third tranche planned for late October last year and so doubled it to $1.3 billion to complete the program.

The city delayed the deal and scaled back the size, however, as it faced headwinds from rockier market conditions and concerns about a long-dated 2053 maturity that extended 10 years past the GO portfolio’s final maturity. At the time, market demand on the long end was also weak.

The market was still digesting S&P's five-notch cut to the state’s sales tax bonds based on a criteria change that a week earlier had resulted in a one-notch cut to the sales tax credit. After a two-week delay, the city sold $612 million with plans to finish the job early this year.

The spreads on the last sale landed between the single-A and triple-B benchmarks. The upcoming taxable sale will price off Treasuries.

The securitizations generate net present value savings over the long term and smooth debt service to provide $700 million in budget relief over five years. That eased the impact of the administration’s decision to end scoop-and-toss, in which annually the city had used new borrowing to meet some principal payments as they came due.

Critics in the past have raised a series of questions about the securitizations, from the impact of leveraging sales taxes that previously flowed to the city’s corporate fund and the potential negative effect on the value of existing GOs from the loss of that revenue to the uncertainty over whether the bankruptcy-remote structure could withstand an actual challenge.

Brown has defended the program as a successful means to lower the city’s debt service costs and she argues that should translate into an improved overall credit profile that should benefit the value of the city’s GO. She also notes the city lacks the ability to file Chapter 9 under existing state statutes.

The sales tax collections sold off by the city totaled $662 million in 2017, up from $521 million a decade earlier, and were up 3.9% in 2018 through last November, Brown said in the presentation.

The city would use residual sales tax receipts not needed to cover debt service along with other state-collected city tax revenues including its share of income taxes and the personal property replacement tax to repay borrowing under a new special entity like the STSC. It would issue $7.7 billion of POBS. Another $2.3 billion of special water-sewer excise tax bonds would be issued, with all $10 billion of proceeds going to reduce the city’s $38 billion net pension liability.

The city would put those residual sales tax receipts not needed to cover debt service to work elsewhere.

One of those places may be to back a huge pension obligation bond deal.

The revenue would be sold along with other state-collected city tax revenues including its share of income taxes and the personal property replacement tax to repay pension borrowing under a new special entity like the STSC. The new entity would issue $7.7 billion of POBs. Another $2.3 billion of special water-sewer excise tax bonds would be issued, with all $10 billion of proceeds going to reduce the city’s $38 billion net pension liability.

The legal groundwork for the transaction was introduced in city council in December and could be considered in the coming months, but the administration has said a subsequent ordinance authorizing the actual deals would still be needed and it likely will fall to Emanuel’s successor to decide to go ahead or not.

The STSC offering statement notifies potential holders that the corporation would enter into a supplemental indenture that would prohibit the issuance of any subordinated indebtedness. Bondholder consent would not be needed.