-

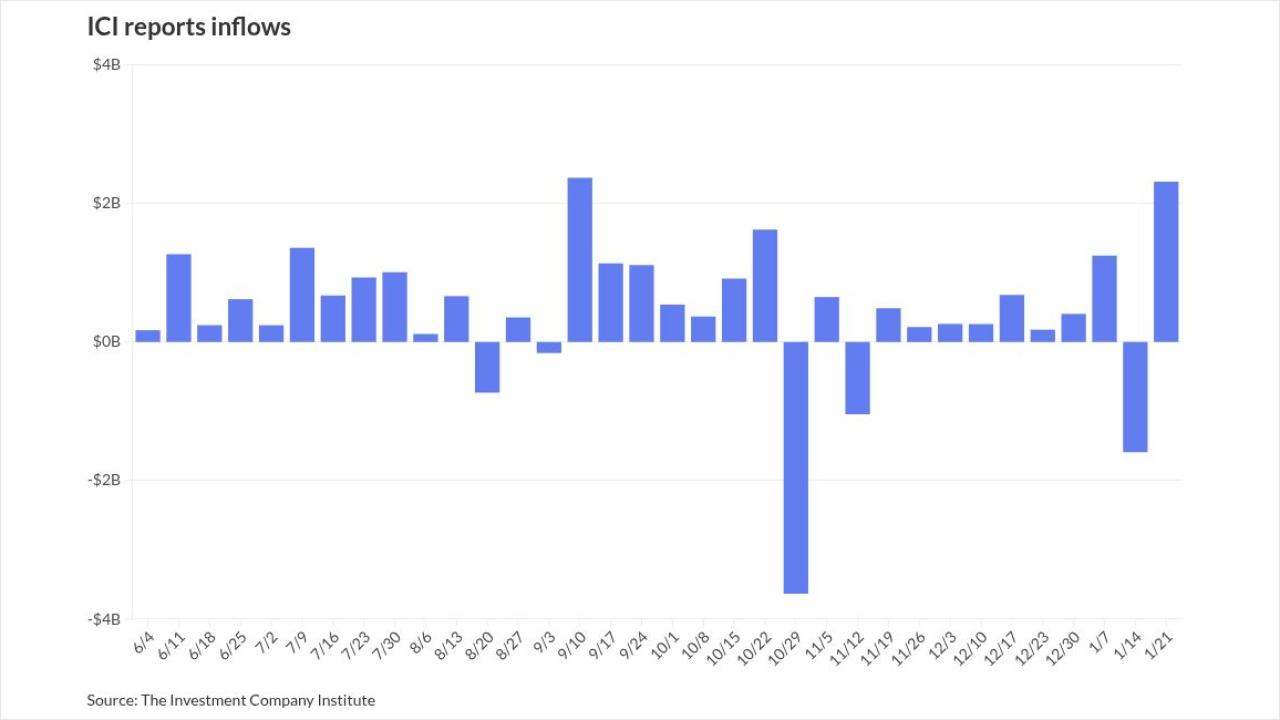

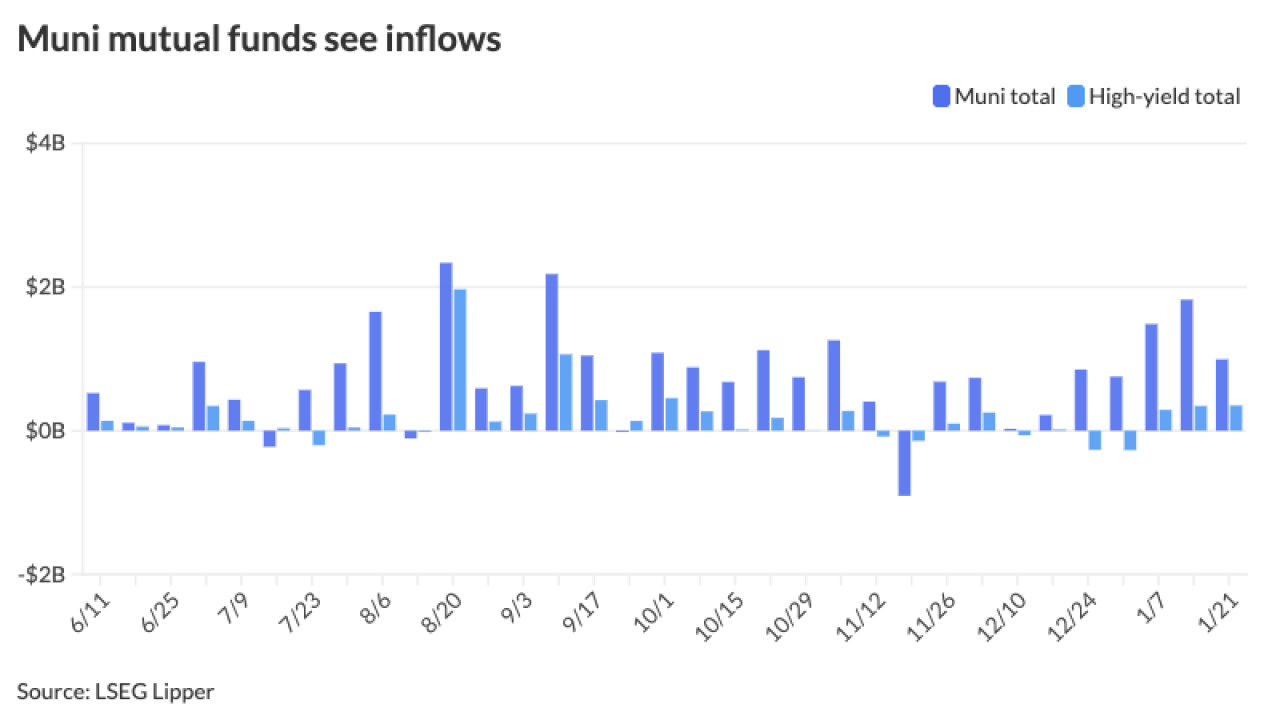

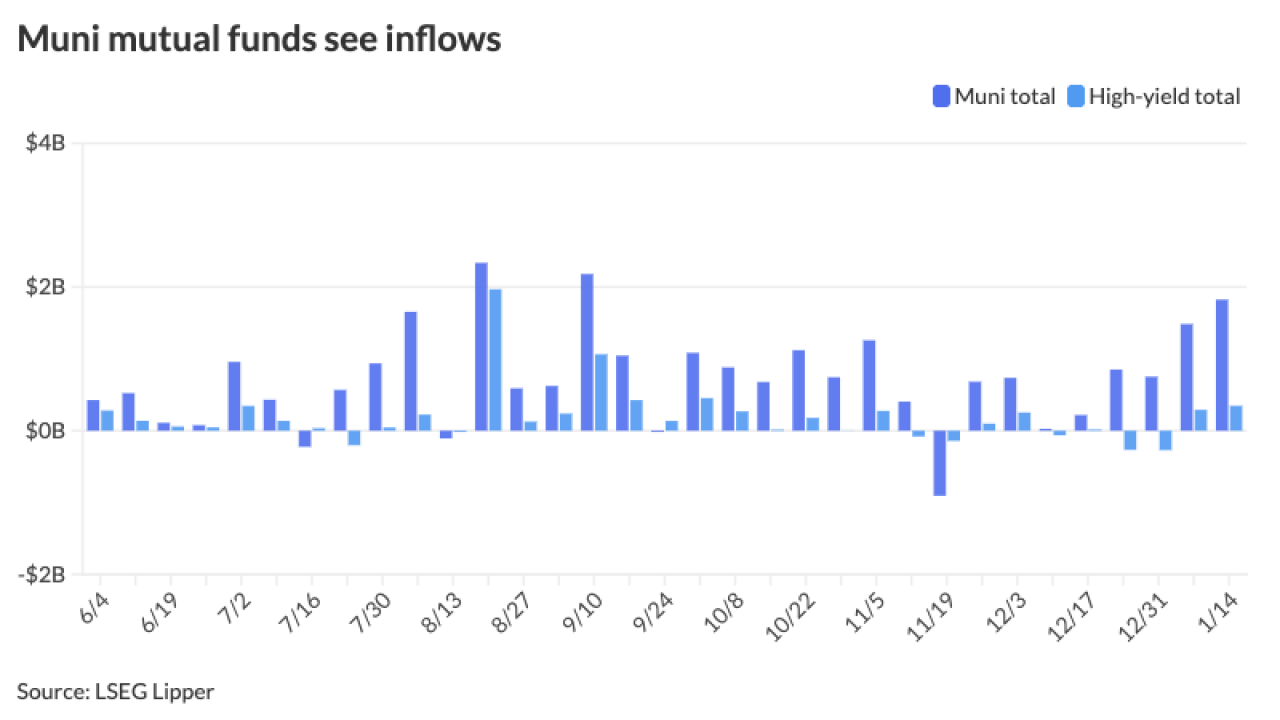

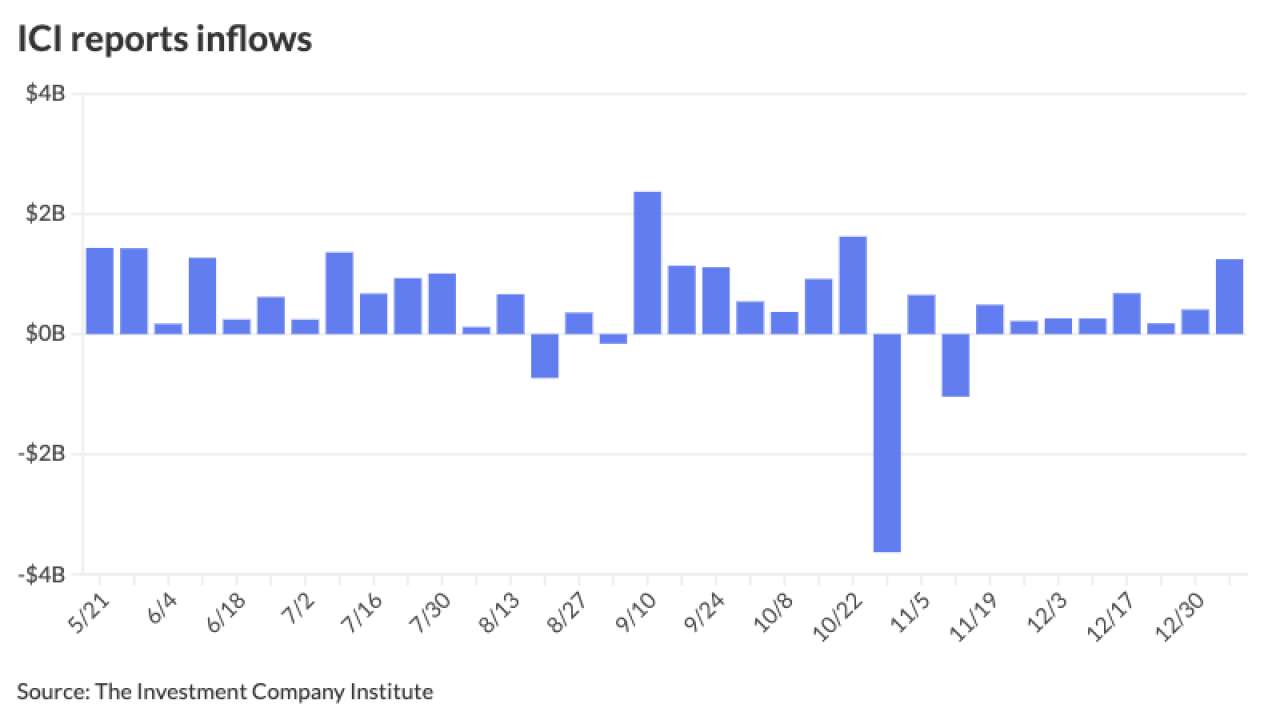

Supply should be "well-received, given strong inflows and the increase in reinvestment capital for the new month," said Chris Brigati, managing director and CIO at SWBC, and Ryan Riffe, senior vice president of capital markets at the firm.

February 3 -

The market is well-positioned for February, after January's near-record tax-exempt supply, said J.P. Morgan strategists led by Peter DeGroot.

February 2 -

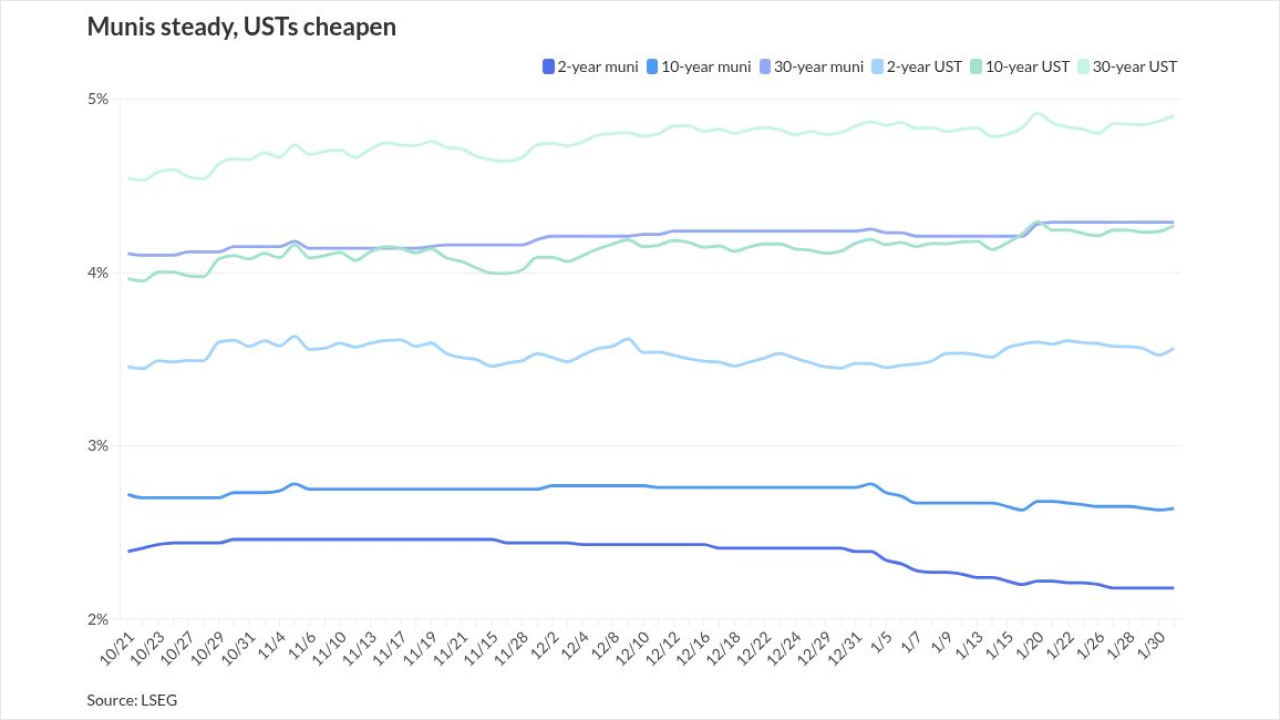

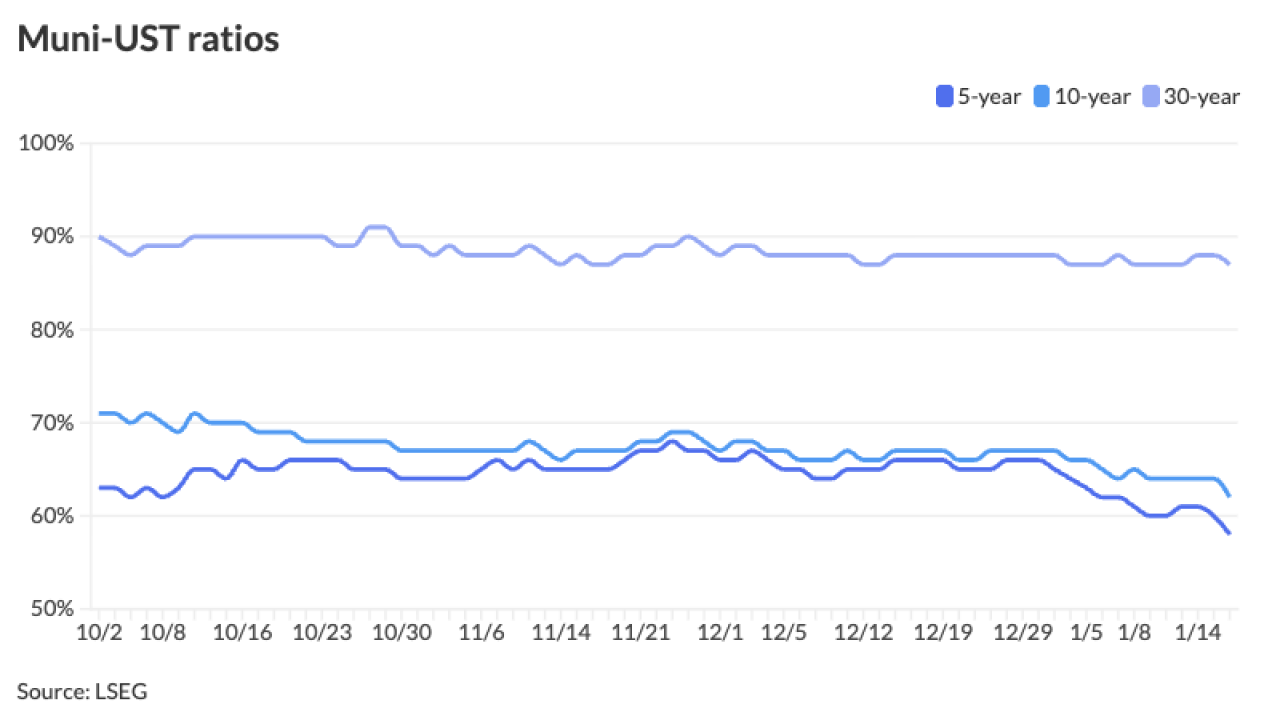

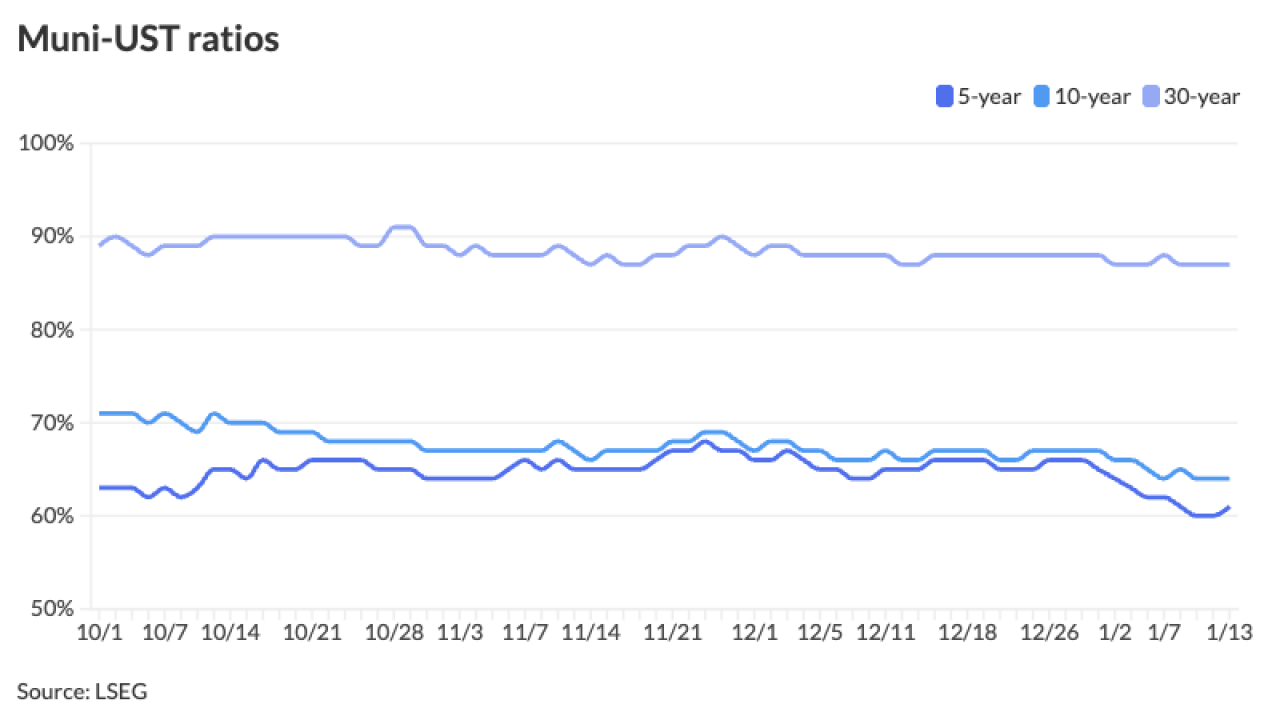

Munis were largely unchanged this week and tax-exempts continue to be "quite unattractive" at current levels, said Barclays strategists led by Mikhail Foux.

January 30 -

Over the past five years, January has seen a relatively stable market tone, said Jeff Timlin, managing partner and head of municipal bond investing at Sage Advisory.

January 29 -

"Markets are reading this as a strategic pause, not a policy shift," said Gina Bolvin, president of Bolvin Wealth Management Group.

January 28 -

The muni market has rebounded from the technical pressures of the first half of last year — a result of surging issuance — said John Miller, head and CIO of First Eagle's municipal credit team.

January 27 -

Chicago general obligation bond prices have dropped sharply since the start of the year, according to the Center for Municipal Finance's muni indices.

January 27 -

Munis were steady Monday following the large cuts the asset class saw last week, specifically on Tuesday, Jan. 20.

January 26 -

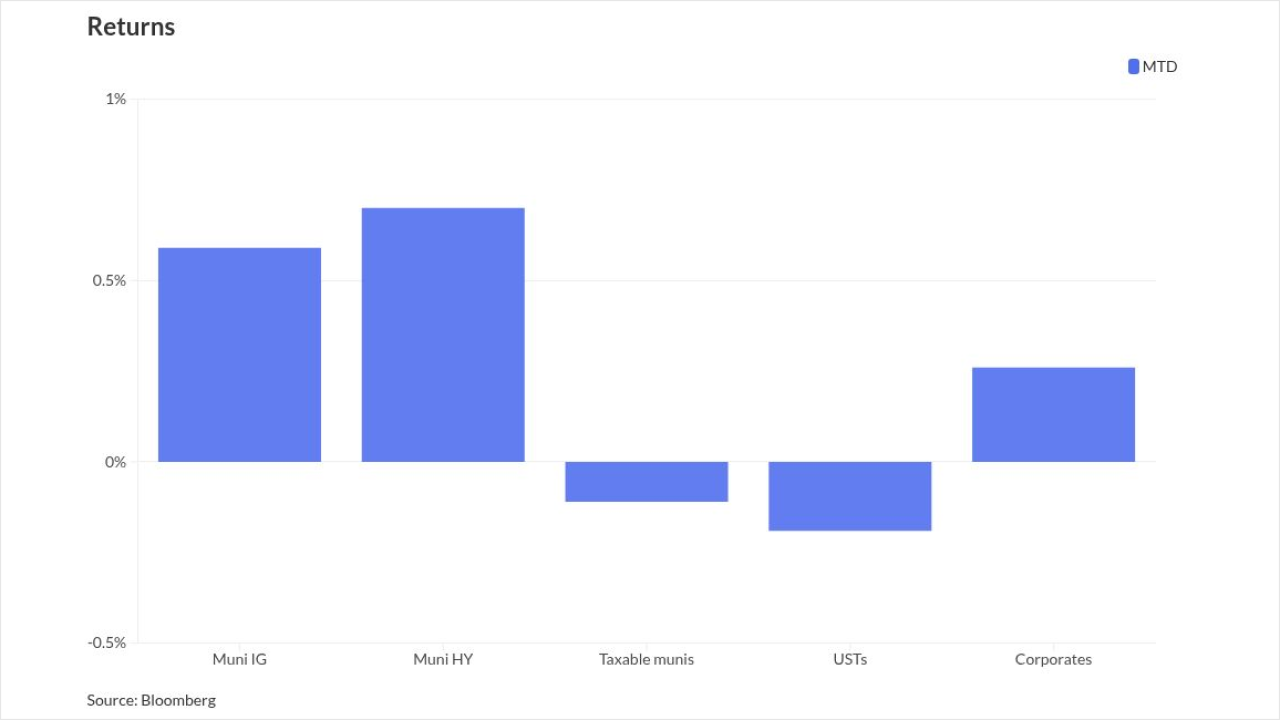

Munis were the best-performing U.S. fixed-income asset class through the first three weeks of January, but the strong performance has created some problems, Barclays strategists said.

January 23 -

"Of all these headlines, there's no direct concern for the muni market or municipal issuers. It's just tangential concerns of what this does for the economy and rates," said Brad Libby, fixed income credit analyst at Wellington Management and a fixed income portfolio manager with Hartford Funds.

January 22 -

Current events and financial developments outside of the muni sector mean that investors should hold off buying munis until rates correct, said Matt Fabian, president of Municipal Market Analytics.

January 21 -

The rates market is "on edge" as global fiscal and geopolitical pressures collide, said James Pruskowski, managing director at Hennion & Walsh.

January 20 -

Fitch's three-notch senior bond downgrade reflects "substantial credit risk."

January 20 -

The new-issue calendar is an estimated $10.836 billion, with $6.979 billion of negotiated deals on tap and $3.857 billion of competitives.

January 16 -

The Florida train is struggling to generate enough revenue to pay its debt.

January 16 -

"We're starting off from a really high tax equivalent yield and that really starts the market from a position of strength," said Matt Norton, CIO for municipal bonds at AllianceBernstein.

January 15 -

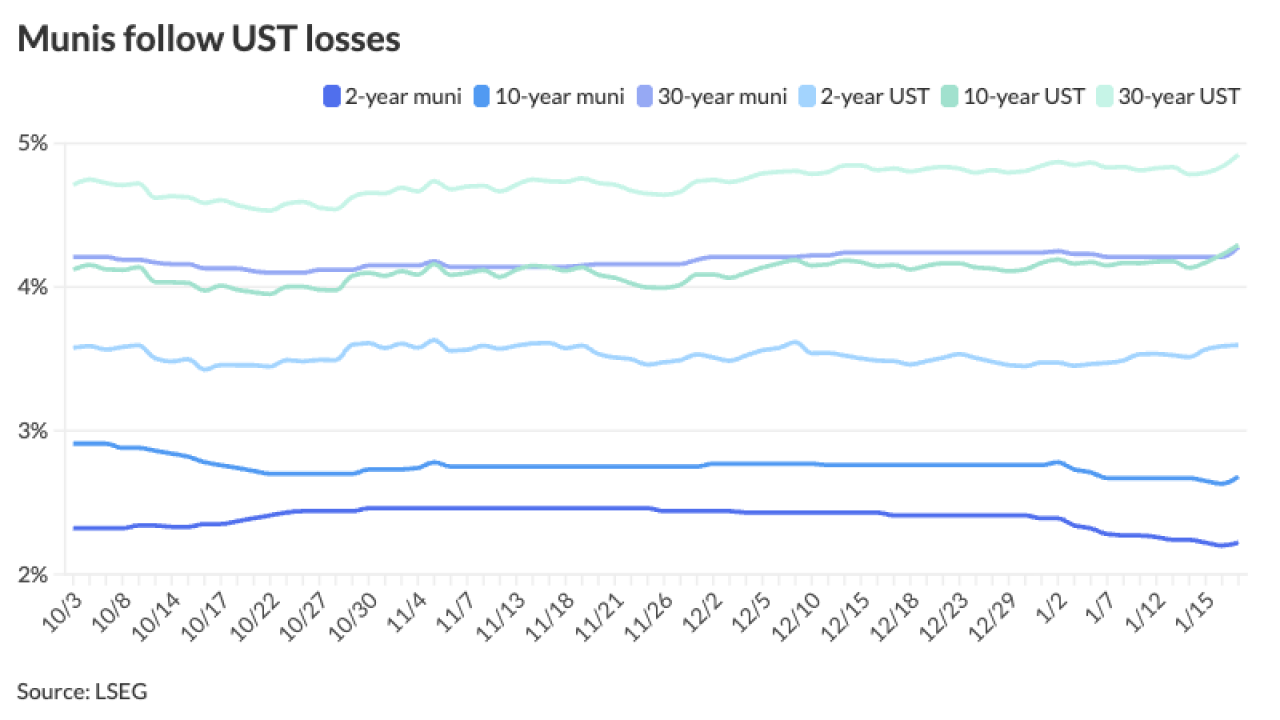

January got off to a good start, with muni yields rallying through Jan. 7. Since then, yields have been steady to slightly richer in spots, with muni yields seeing some strength in the front end and belly of the curve.

January 14 -

Eurostar veteran Nicolas Petrovic will oversee the Florida system while Mike Reininger will focus exclusively on Brightline West.

January 14 -

"The bond market breathed a sigh of relief this morning as the CPI inflation numbers came in a tad weaker than expected," said John Kerschner, global head of securitised products and portfolio manager at Janus Henderson Investors.

January 13 -

Despite the quiet start to the week for munis, all financial markets may feel a "heightened level of risk for rate volatility over the next few days," said Tim Iltz, a fixed income credit and market analyst at HJ Sims.

January 12