Babson College founder Roger Babson memorialized his favorite inspirational mantras on a series of rocks.

“Keep out of debt,” one of them reads.

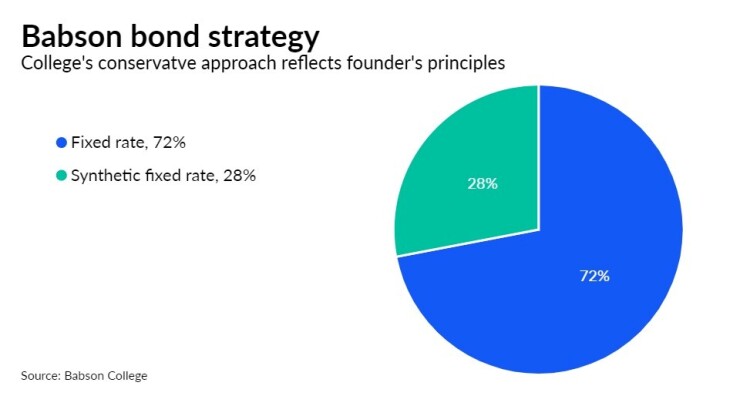

Fast-forward to today, Babson’s conservative approach to debt management has generated rating upgrades from Moody’s Investors Service and S&P Global Ratings — rare amid negative outlooks for higher education overall — into Wednesday’s planned $50.8 million Series 2022 revenue refunding.

The Massachusetts Development Finance Agency is issuing the bonds on behalf of Wellesley, Massachusetts-based Babson, with Ramirez & Co. the lead underwriter.

The sale is Babson’s first since 2017. The business-and-entrepreneurial themed private college, which opened in 1919, has about $150 million of outstanding bonds, according to its presentation to Moody’s last month.

It sits on 375 acres, 14 miles west of Boston and enrolls about 2,553 undergraduate and 700 graduate students from the U.S. and more than 75 countries.

Moody’s uplifted Babson to A1 from A2 while S&P raised it to A-plus from A. The rating agencies cited a strong demand profile, high-quality students, positive operating performance, effective fundraising and material growth in financial reserves.

“The ability to borrow at competitive rates not only saves Babson money as we invest in priorities across our college, but also is a boost to our institutional reputation in the marketplace,” said Katherine Craven, Babson’s chief administrative officer since 2014.

Craven, well-known in Massachusetts public finance circles, is a former executive director of the Massachusetts School Building Authority and later the UMass Building Authority.

She is also a former commonwealth first deputy treasurer who early in her career ran point on the state budget under then-House Speaker Thomas Finneran.

Proceeds from Wednesday’s sale will refund all outstanding Series 2011 bonds and the 2013 and 2015B direct placements. The school projects roughly $5.8 million of debt-service savings.

“We have served Babson College since 2015 and are honored with their trust in us to successfully manage their bond issues,” said Ramirez & Co. president and chief executive Samuel Ramirez. “Babson is a recognized worldwide educational leader and the college administration has done a tremendous job in skillfully navigating these uncertain times.”

Babson implemented remote learning in spring 2020, when the COVID-19 pandemic mushroomed, and adopted a hybrid approach for the 2020-2021 academic year. This fall, the school mandated vaccines for all students, faculty and staff. S&P called the school’s pandemic management “prudent.”

According to S&P, full-time equivalent enrollment rose 10.5% for fall 2021 versus the previous year, with international student numbers increasing at the undergraduate and graduate levels.

Moody’s cited Babson’s “very strong brand.”

The college two years ago received a $50 million donation from 1963 alumnus

The gift propelled Babson to $92 million in fundraising in fiscal 2019, its centennial year and biggest fundraising year to date.

“As a result, the college is creating new innovative programming, thought leadership and networking opportunities for entrepreneurial leaders through the newly created Arthur M. Blank School for Entrepreneurial Leadership,” S&P said.

Babson’s current fundraising campaign started with a target of $300 million by the end of fiscal 2023, but as Babson met that amount in February 2020, it raised the goal to $500 million. To date, $380 million has been raised in the campaign, according to S&P.

The school originated on Sept. 3, 1919 as the Babson Institute with 27 students.

It held its first classes in the former home of Roger and Grace Babson on Abbott Road in Wellesley Hills. Roger Babson, which emphasized a business environment, combined class time with actual workforce training, while faculty consisted of veteran business leaders.