-

After the year-end rally, "2024 bond investors have been reluctant buyers, prices creeping lower perhaps until the data and the Fed's next steps are more clear," said Matt Fabian, partner at Municipal Market Analytics.

January 23 -

Growing new-issue supply is "adding to bidders' 'wait-and-see' mentality with a variety of credits coming to market at favorable spreads," said FHN Financial's Kim Olsan. Next week's calendar hits $8.4 billion.

January 19 -

Opponents of the state's capital gains tax will turn their efforts to a repeal ballot initiative following rejection by the high court.

January 18 -

S&P's outlook revision to positive means there is a one-in-three chance the state could have its AA-plus rating upgraded to AAA over the next two years.

January 12 -

Three districts are under Washington's state fiscal oversight and the largest, Marysville School District, took a multi-notch Moody's bond rating downgrade.

January 4 -

The muni market saw $379.992 billion of debt issued in 2023, only $11.076 billion less than the lackluster $391.068 billion seen in 2022.

December 29 -

The stars are starting to align for the long-awaited bridge replacement which received a $600 million federal grant toward the project expected to cost up to $7.5 billion.

December 18 -

Washington Gov. Jay Inslee announced the state would use better-than-expected carbon-pricing revenues to accelerate the state's climate change efforts.

December 12 -

The downgrade of Issaquah School District 411 to Aa1 affects $670 million in debt.

November 28 -

The state asked the U.S. Supreme Court to deny a request to hear arguments seeking to overturn a capital gains tax expected to bring in $500 million annually.

November 8 -

California and Washington sold four large refunding GO deals in the competitive market while several deals of size priced in the negotiated market led by a $650 million for Arizona's Salt River Project. A constructive secondary led yields to fall three to five basis points.

November 7 -

October's total volume rose 29.3% to $37.156 billion in 661 issues from $28.738 billion in 614 issues a year earlier. New-money grew more than 30% while refundings were up by nearly 75%.

October 31 -

The top five bond financings have an average dollar volume of more than $1.2 billion.

October 17 -

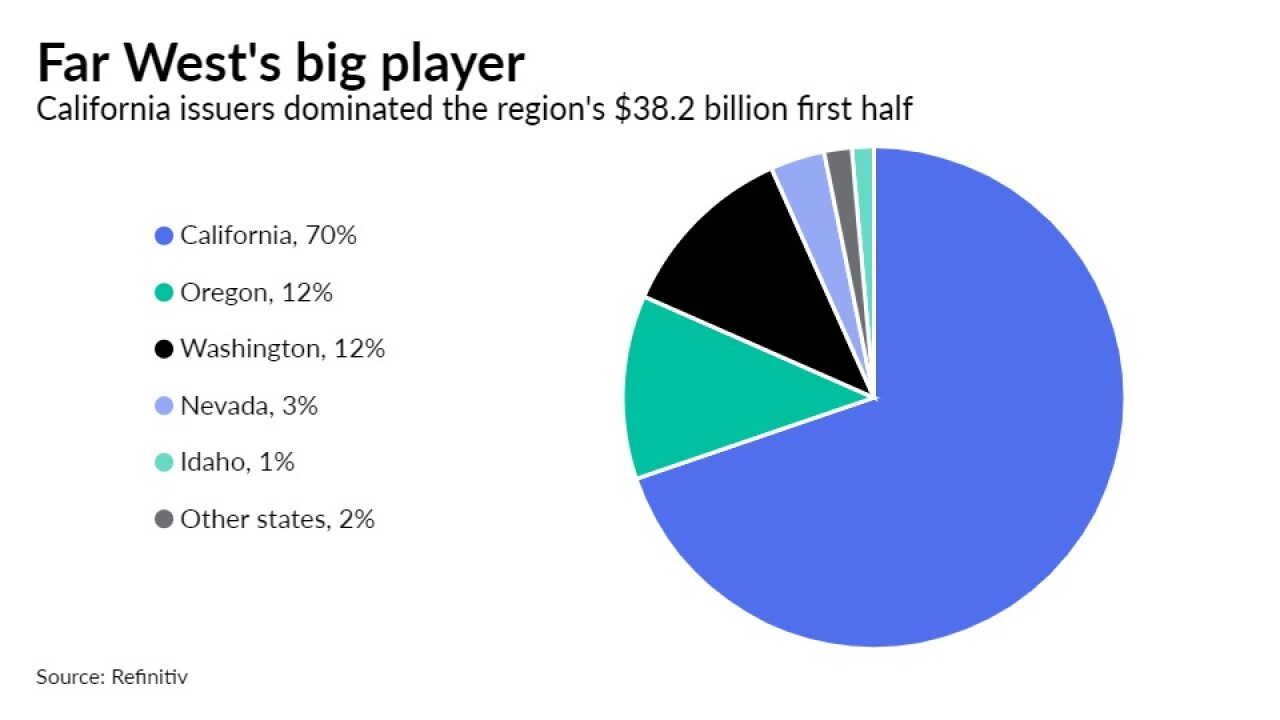

Municipal bond issuance in the Far West was down 2.3% in a first half that saw volume drop 17.1% nationally.

August 24 -

July's total volume was $25.939 billion in 542 issues, down from $28.258 billion in 619 issues a year earlier, the smallest percentage drop in monthly issuance year-over-year in 2023, according to Refinitiv data.

July 31 -

The offered side "has continued to pack the primary market with value to manage their (and the market's) potential downside if disruption did occur; this also helps the context for muni buyers headed into the Fed," said Matt Fabian, partner at Municipal Market Analytics.

July 25 -

Most top 10 issuers for 1H are from New York and California, with three from New York and three from California.

July 10 -

The $6.9 billion new-issue calendar features high-grade deals from Georgia, Washington and Massachusetts, among other frequently traded credits, which should provide direction for scales.

June 23 -

The Biden Administration has partnered with five cities and the State of California in efforts to reduce homelessness.

May 19 -

Washington Gov. Jay Inslee signed legislation Tuesday improving a tax increment financing program created in 2021 that wasn't working as intended.

May 10