-

After eight oil-producing states recovered from the 2014 oil price collapse, they face another downturn, S&P Global Ratings said.

March 11 -

Gov. John Bel Edwards kicked off Louisiana's legislative session by asking lawmakers to share accurate details about the coronavirus with constituents.

March 11 -

The world remains on edge about the rapidly spreading COVID-19 and those fears once again have Treasury yields digging down even deeper. COVID-19 fears have now impacted fund flows, as municipals suffers outflows for the first time in 60 weeks.

March 5 -

Refundings and taxable deals were also up substantially, driving the region to $75 billion of municipal bond volume, up 32.6% from 2018.

February 26 -

John Schroder's refusal to transfer unclaimed property funds to the state budget led the state to file suit.

February 7 -

The first hard evidence of how this is affecting ratings in the public finance sector came from a downgrade two months ago involving Princeton Community Hospital in West Virginia.

January 14 -

Neveu works in Butler Snow’s New Orleans office and has represented different issuers while focusing on affordable housing finance.

January 9 -

Despite opposition to tolls, Louisiana completed its P3 agreement with Plenary Infrastructure to build the Belle Chasse Bridge and Tunnel Replacement Project.

January 8 -

State Treasurer John Schroder said he will go to court to stop Louisiana’s state government from spending the money.

December 17 -

Louisianans re-elected their Democratic governor, but gave Republicans a Senate supermajority; New Orleans voters authorized $500 million of GO bonds.

November 18 -

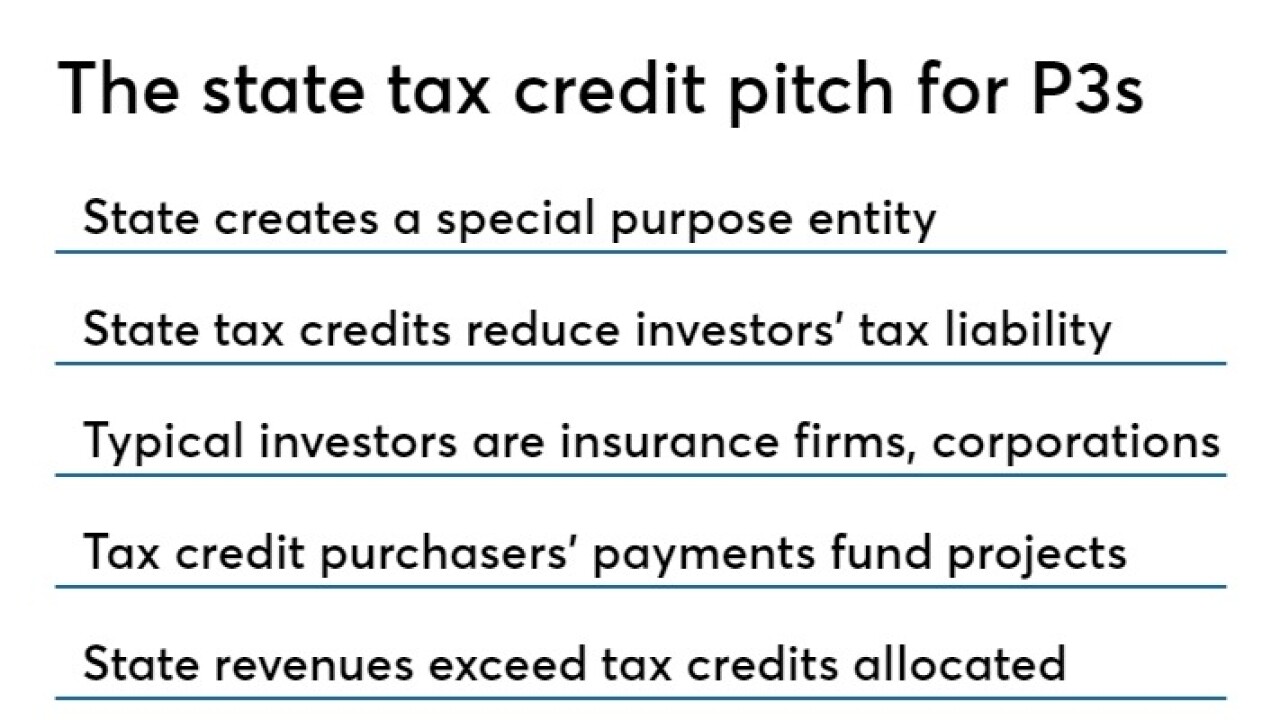

NDH founder Scott Haber told Louisiana officials that state tax credits can provide seed funding for public-private partnership projects.

November 13 -

The suit challenges the State Bond Commission's policy of excluding bond underwriters with policies that limit their lending to some gun makers and sellers.

October 18 -

Attorneys for the State Bond Commission said the lawsuit was filed too late and there was no violation of law.

September 27 -

Moody's Investors Service changed its outlook to positive on the state's Aa3 general obligation rating after Louisiana estimated a $500 million surplus.

September 19 -

Two Virgin Trains USA deals from Florida helped push the region's volume up 9.8% over last year, making it one of only two regions to sell more bonds.

August 21 -

The $450 million in bond-financed improvements are part of negotiations to extend the contract of the NFL's New Orleans Saints.

August 15 -

The Louisiana State Bond Commission unlawfully banned two banks from underwriting bond deals because of their corporate gun policies, the lawsuit said.

July 19 -

The governor approved a law authorizing the state to issue bonds to finance transportation projects backed by Deepwater Horizon settlement revenue.

July 3 -

Through February of this year, 20 P3-related bills were enacted by 14 states since 2016.

July 1 -

Citibank joins UBS and Deutsche Bank in settling with the State Bond Commission over manipulation of the Libor rate.

June 20