Municipal bond issuers in the Southeast sold $28.8 billion of debt in the first half of 2019, an amount buoyed by big gains in the transportation sector.

The total volume was up 9.8% over the same period last year, according to Refinitiv, making the Southeast one of only two regions in the country to post an uptick in issuance during the first two quarters. Issuers in the Midwest posted the largest gain of The Bond Buyer’s five regions with a 34.2% boost in supply this year.

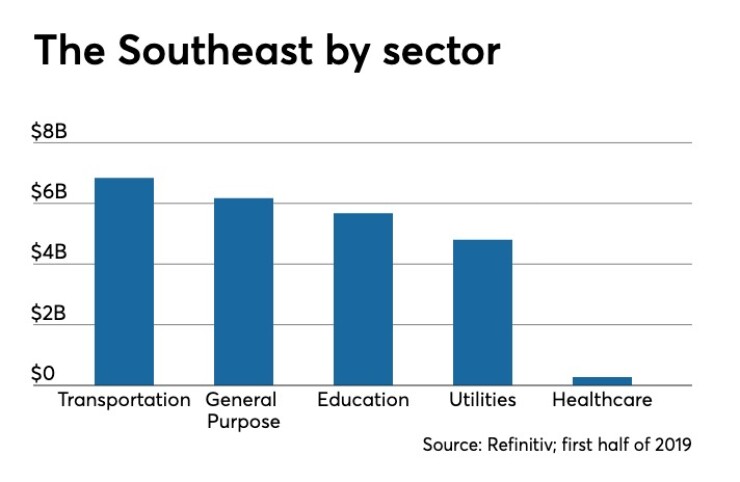

Borrowing for transportation projects totaled $6.84 billion in 31 deals, a spike of 158.8% over the prior year and the largest jump in total financing of any category. Without the sector's $4.2 billion gain, the region would have seen a year-over-year decline.

Two big deals for

The Florida Development Finance Corp., the conduit issuer for the deals, sold $2.84 billion of bonds helping to propel the agency to become the largest issuer in the region, the first time that has occurred.

Two of FDFC’s private activity bond sales for Virgin Trains USA were the first and third largest single deals in the Southeast: $1.75 billion of private activity bonds issued April 2 and $950 million issued June 13.

The U.S. Department of Transportation allocated the PABs issued by FDFC to finance portions of the higher speed passenger train project from Miami to Orlando. The project currently has stops in Miami, Fort Lauderdale and West Palm Beach, and developers say they are planning to add new stations at PortMiami, Aventura and Boca Raton. Passenger service to Orlando is expected to begin in 2022.

Across the 11-state Southeast, issuance was $10.18 billion in the first quarter, a 6.9% year-over-year increase, while borrowing totaled $18.62 billion in the second quarter, up 11.4%, according to data from Refinitiv.

Issuers brought 568 deals to market between January and June, after selling 623 transactions in the first six months of 2018.

Bonds classified by Refinitiv as being issued for general purposes came in a close second with $6.17 billion, an increase of 9.4%, while debt sold for education totaled $5.67 billion, up 4%.

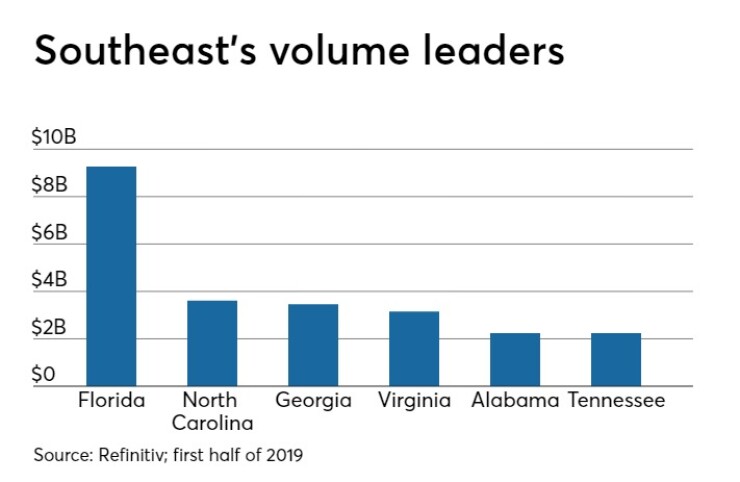

Florida was the largest source of bonds among Southeast sales with $9.27 billion in volume, more than doubling its output over the first two quarters of 2018.

The train deals elevated FDFC’s financial advisor, Larson Consulting Services, to its debut appearance in the Southeast’s financial advisor league table.

PFM Financial advisors topped that table, credited with advising on $4.21 billion of deals. Larson Consulting came in second with $2.7 billion, and Hilltop Securities was third with $2.12 billion.

“We were pleased to serve as financial advisor to FDFC on the bond issues for Virgin Trains USA,” said Jeff Larson, president of Larson Consulting. “The $4 billion-plus project is a great example of a well-structured [public-private partnership], and a project that will provide much needed transportation options to many individuals and business travelers.”

Larson said the project also will serve as a positive economic development force in many of the cities with connections.

“The project was well received by the institutional investors and Morgan Stanley did a fine job on underwriting the $1.75 billion and $950 million issues,” he added.

The Virgin Trains deals also helped Morgan Stanley rise to the top ranked senior manager’s position, up from third place last year, credited with $5.7 billion in total sales.

Bank of America Merrill Lynch came in second with $4.45 billion and Wells Fargo placed third with $3.5 billion.

Greenberg Traurig also advanced in the rankings because of the train deals to become the top Southeast bond counsel firm, up from eighth place last year, credited with $3.8 billion. Squire Patton Boggs came in second with $1.8 billion, while Kutak Rock was third with $1.7 billion.

North Carolina was the second-largest source of Southeast bonds in the first half, with issuers there borrowing $3.6 billion. The state government supported the volume with a $600 million bond sale on May 23 and $300 million deal on June 13. The North Carolina Medical Care Commission issued $307 million of debt on June 27.

Georgia, typically the region's second-largest source of issuance, was bumped to third place with $3.46 billion in the first half. The state of Georgia issued $950.6 million of general obligation bonds on June 19, which was the second-largest single deal in the region. Main Street Natural Gas issued $695.6 million on Feb. 14 and $675.4 million on April 30, fifth and sixth among the region's largest deals.

Virginia issuers sold the region’s fourth-largest amount of debt with $3.15 billion, up 0.1% over last year. The Virginia College Building Authority issued $513.2 million on May 15 and Fairfax County sold $269.6 million on Jan. 29.

Alabama and Tennessee tied for fifth place with each issuing $2.24 billion, although the sales volume was down 38.1% and 6.9%, respectively. Alabama's Black Belt Energy Gas District sold a $747 million deal in April; the prepaid natural gas deal was the region's fourth-largest of the first half.

South Carolina issuers sold $1.49 billion of bonds, an increase of 22.3%. That volume was bolstered by the South Carolina Transportation Infrastructure Bank’s issuance of $350.4 million on May 22.

Kentucky issuers went to the market to sell $1.18 billion, a drop of 42.6%.

Louisiana issuers borrowed $1.1 billion of bonds, more than doubling their volume a year earlier. The Louisiana State Bond Commission sold $306.7 million of general obligation bonds on Feb. 21 to finance projects statewide.

In Mississippi, issuers sold $871 million, up 113.2%. West Virginia issuers sold $190.4 million, down 85.3%.

Southeast issuers $24.29 billion of tax-exempt debt, up 1.5%. Bonds subject to the alternative minimum tax totaled $3.29 billion, a nearly five-fold increase thanks in large part to the Virgin Trains USA bonds. Taxable debt issuance was down 30% to $1.21 billion.

New money bond sales were $19.68 billion, down 5.9%, while refundings rose by 48% to $5.22 billion. Combined new money bond issuance and refundings were $3.9 billion, an increase of 117.3%.

Negotiated deals totaled $18.74 billion, up 17%, while competitive transactions amounted to $9.25 billion, an increase of 19.7%. Private placements plummeted by 67.1% to $823.5 million.

Revenue bond sales were $22 billion, an increase of 18.6%, while general obligation bond deals totaled $6.76 billion, down 11.6% from the prior year. Fixed-rate issuance amounted to $22.4 billion, up 12.7%.

Variable rate long/no put issuance rose 26.7% to $5.29 billion.

Debt wrapped with bond insurance fell 18.2% to $968.4 million; debt with guarantees was down 34% to $739.4 million. Bank-qualified bonds were down 22.1% to $376.2 million.

State agencies issued $9.2 billion of bonds, up 80.6%, while local authorities came next with $6.21 billion in deals, down 9.6%. Counties and parishes issued $3.84 billion, up 35%, while cities and towns sold $3.07 billion, down 11.5%.