-

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14 -

Baby bonds provide a long-term remedy by fostering upward mobility, while current anti-poverty measures do not, according to panelist Scott Winship.

September 30 -

Moody's affirmed its Baa3 rating and concluded a two-month-old review of the troubled city, which is under state fiscal oversight.

September 27 -

Improved commitments to pension funding, coupled with other changes to the two states' retirement systems, have yielded bond rating upgrades for both.

September 16 -

Surging state revenues eased the burden of managing fixed costs, Moody's says in an examination of state liabilities based on fiscal 2021 financial reports.

September 7 -

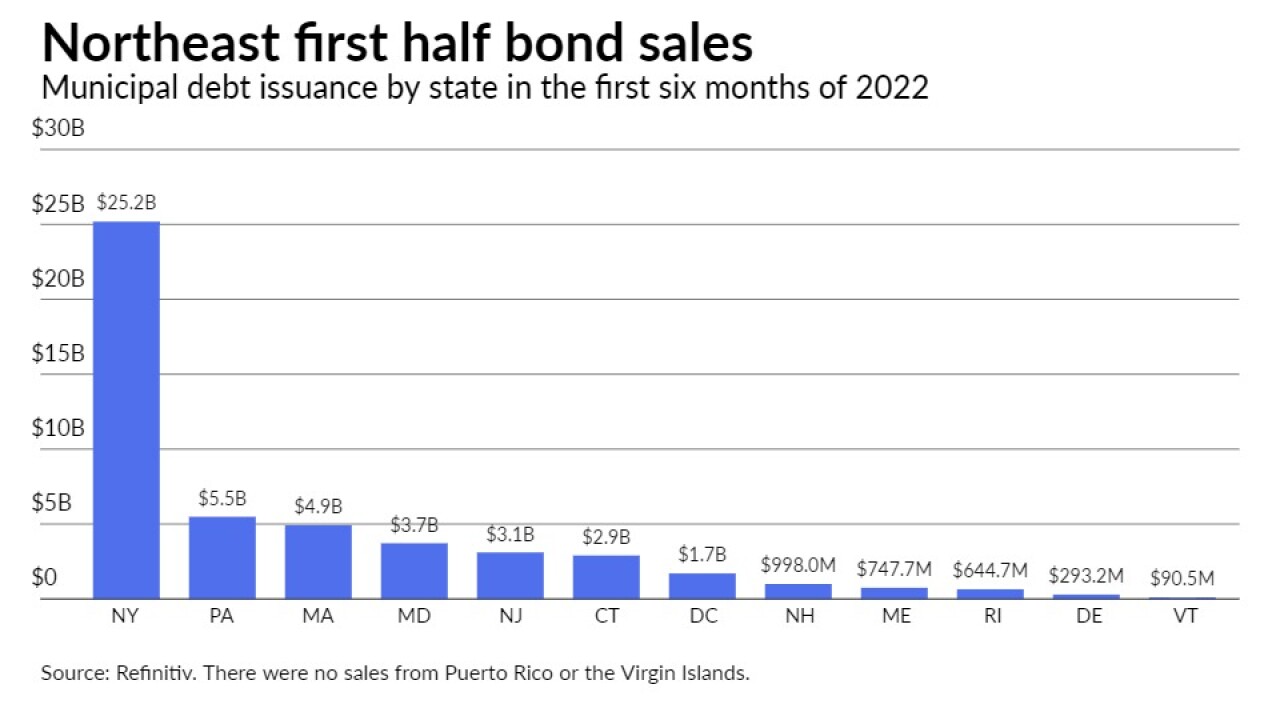

The Northeast's issuers sold $49.69 billion of municipal bonds in the first half of 2022, down more than 18% year-over-year.

August 12 -

Tom Wright, president and CEO of the Regional Plan Association, talks with Chip Barnett about the ongoing Gateway transportation project and its importance to the tri-state region. He also discusses the challenges and opportunities in transit, infrastructure, affordable housing, climate change and ESG. (30 minutes)

July 19 -

-

Municipals improved for the fifth session in a row with 10- and 30-year triple-A yields falling 30 basis points since Thursday. Connecticut priced $1 billion-plus of GOs and saw yields lowered in a repricing.

May 25 -

Given the volatility of risk assets is likely to remain high, and the focus on the flight to safety increases, all fixed-income assets could benefit as a result, including municipals, Barclays strategists say.

May 20