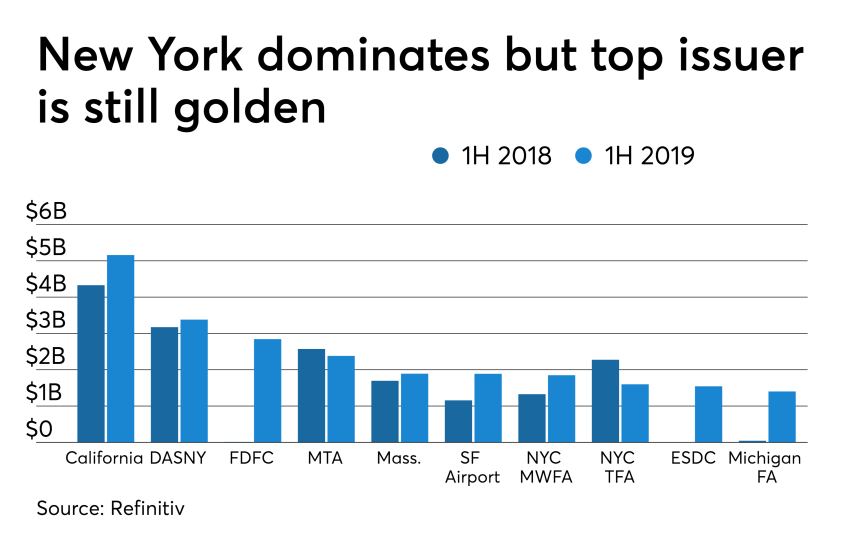

The top 10 municipal bond issuers in 2019 have priced slightly more bonds halfway through the year than they did halfway through 2018. Those issuers have amassed $164.76 billion in 4,638 transactions versus $156.19 in 4,310 deals.

California once again topped the list. The State of New York, however, dominated with deal size, as it priced two deals in the top five and five in the top 10 in 2019.