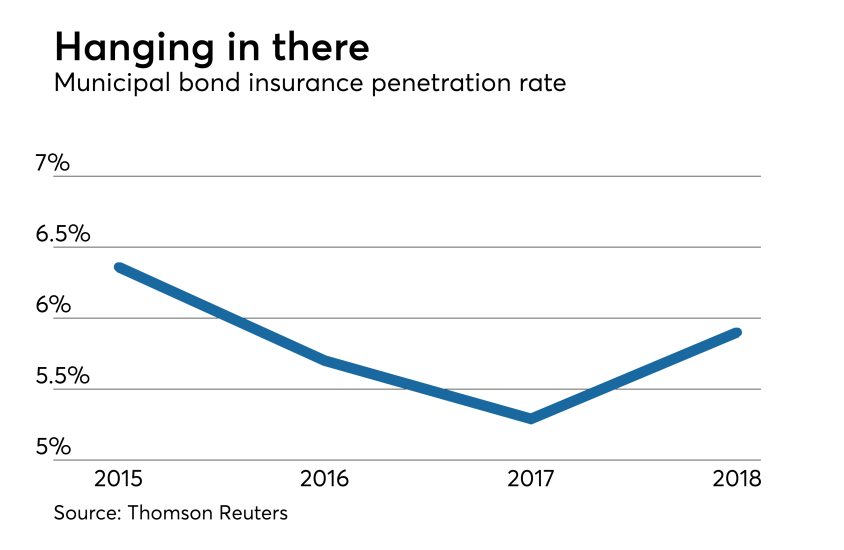

While the municipal bond insurers suffered from the curtailment of issuance under newly effective U.S. tax laws, the insurance penetration rate ticked higher.

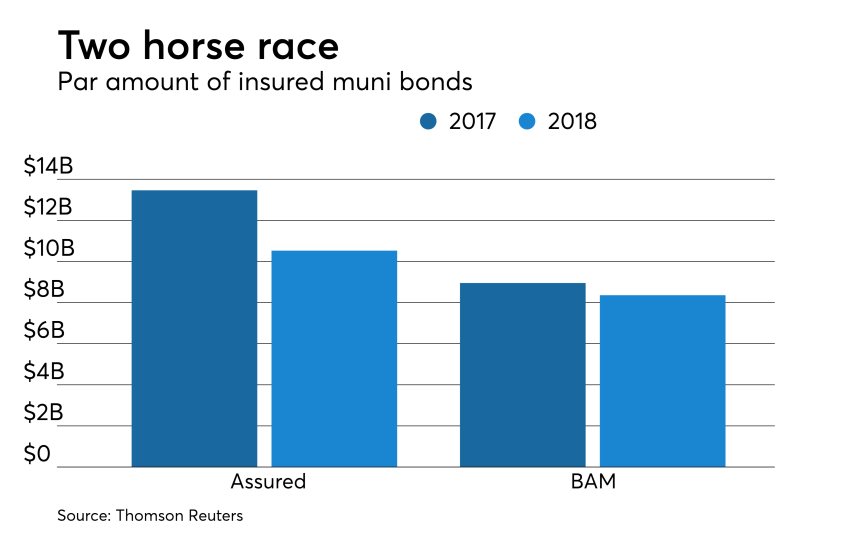

The total amount of insured volume stood at $18.53 billion in 1,246 transactions in 2018, down from $23.02 billion in 1,635 deals. The insurance penetration rate inched up to 5.90% at the end of 2018 from 5.29% at the end of 2017.