-

The top municipal FA's accounted for 20% less volume, as their par amount of deals handled dropped to $273.869 billion from $345.829 billion. The number of transactions fell by 1,199.

January 16 -

The top muni bond counsel firms accounted for $318.67 billion in 8,474 transactions in 2018, down from $407.47 billion in 10,519 deals the year before.

January 16 -

Municipal bond issuance totaled $320.25 billion in 2018, as New York issuers led the charge.

January 16 -

Municipal bond underwriters suffered from muted issuance under the new tax laws, as Bank of America Merrill Lynch remained on top of the year-end rankings.

January 16 -

Hiring, firings, corruption, the new tax law and a volatile political climate shaped The Bond Buyer's list of most-read articles of 2018.

December 21 -

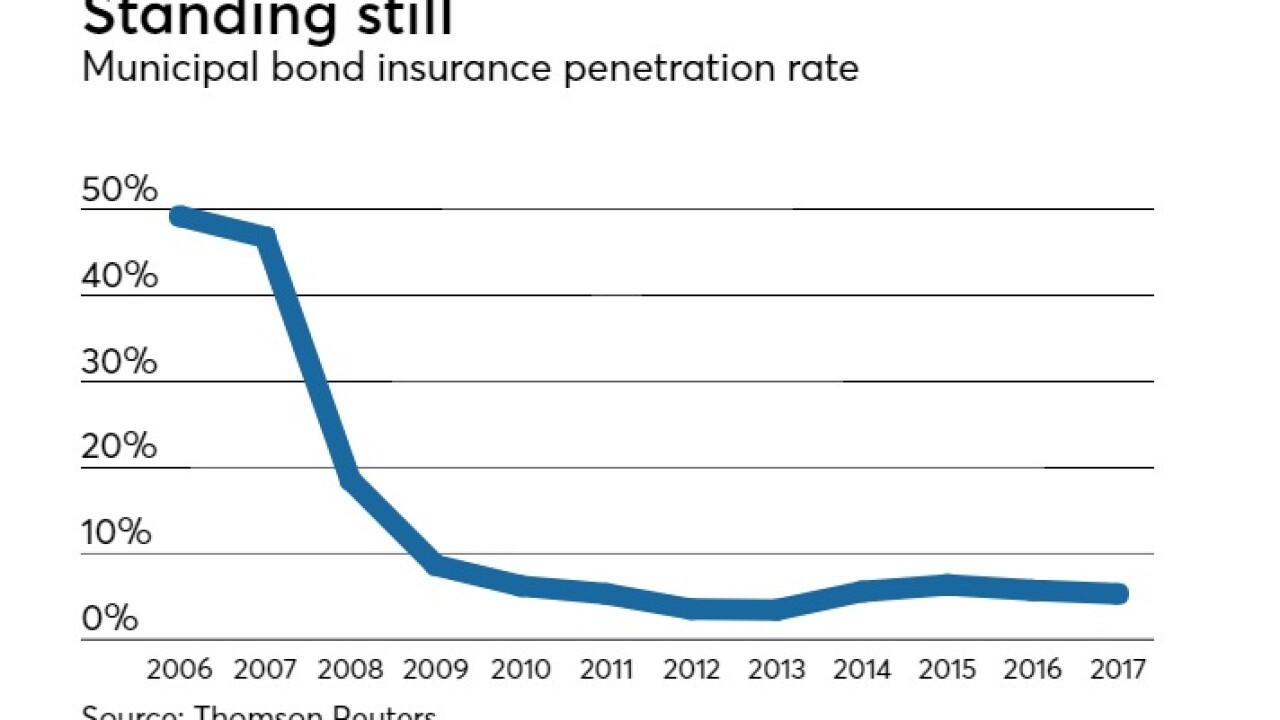

The tax overhaul and rising rates started to bolster demand, partly offsetting the decline in issuance.

October 23 -

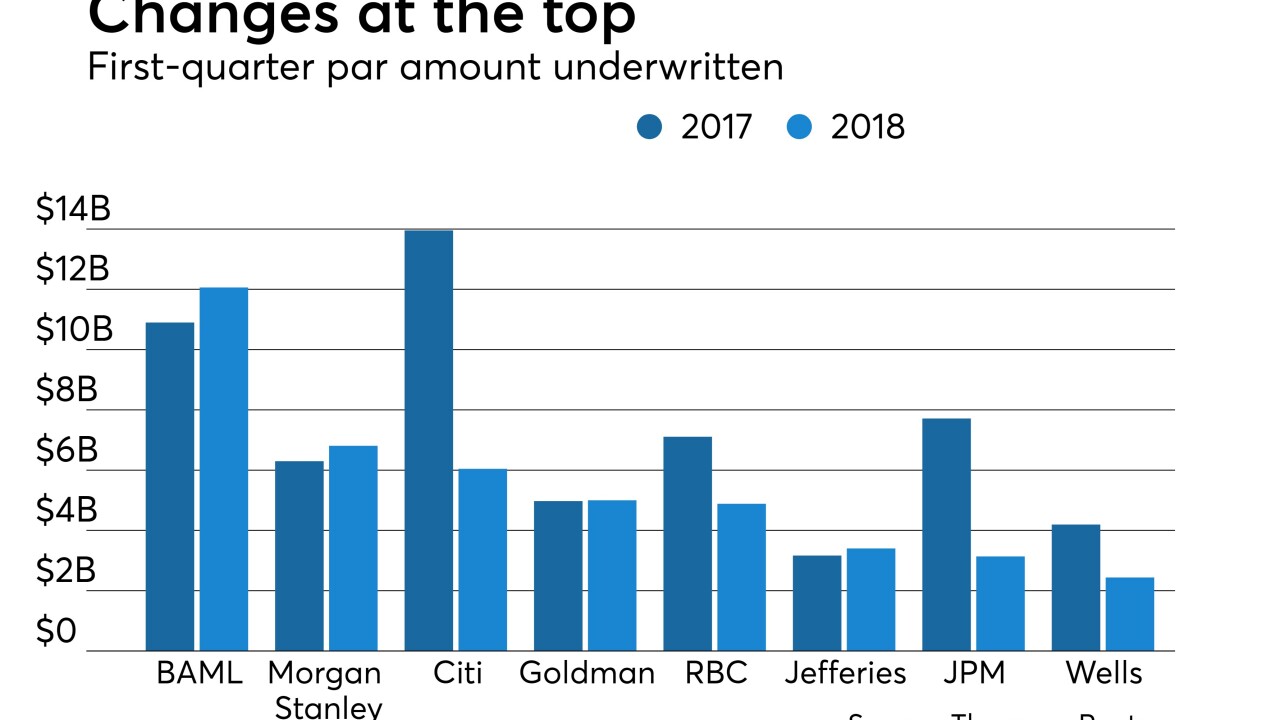

After three quarters, only Morgan Stanley and Jefferies have increased par amount underwritten from last year.

October 4 -

The region's volume numbers were supported by favorable market conditions that drove several large gas prepay deals.

August 22 -

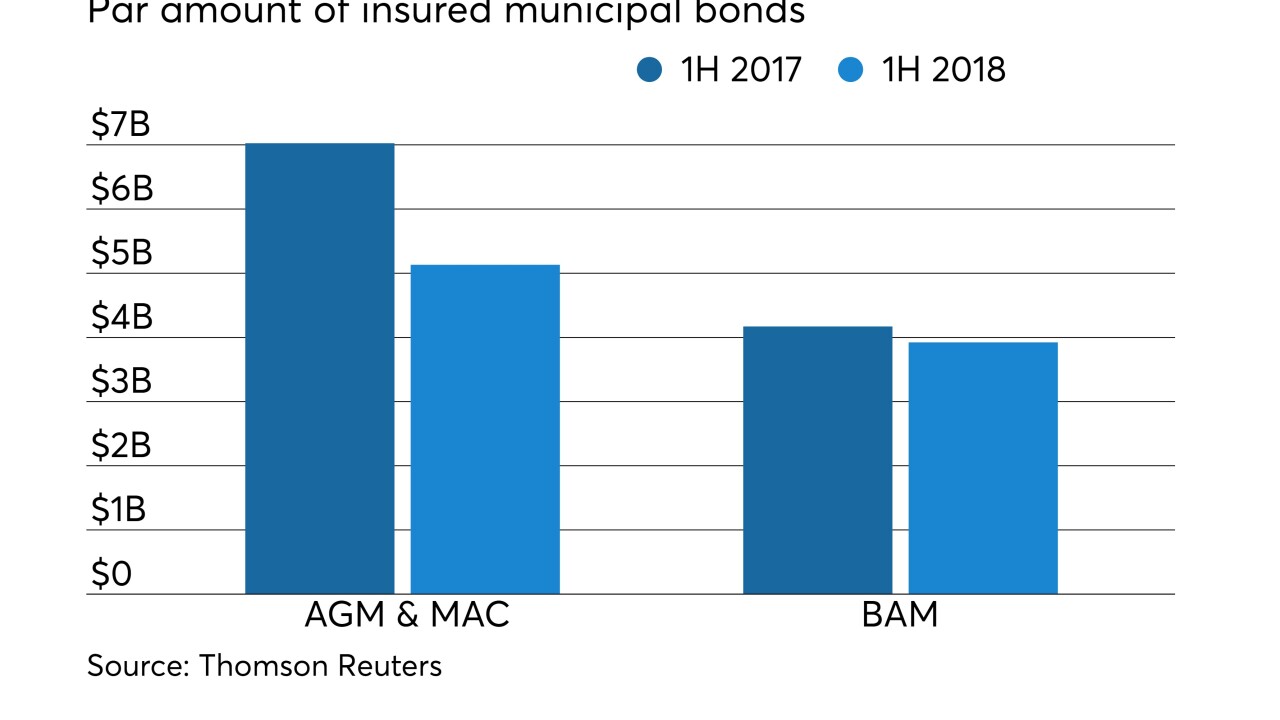

Bond insurers and legal counsel battled for share of a smaller market as Assured Guaranty and Orrick Herrington & Sutcliffe LLP stayed atop the rankings.

July 17 -

The league tables show a return to normal from the first quarter, when PFM, Citi and JPMorgan all placed lower than usual.

July 11 -

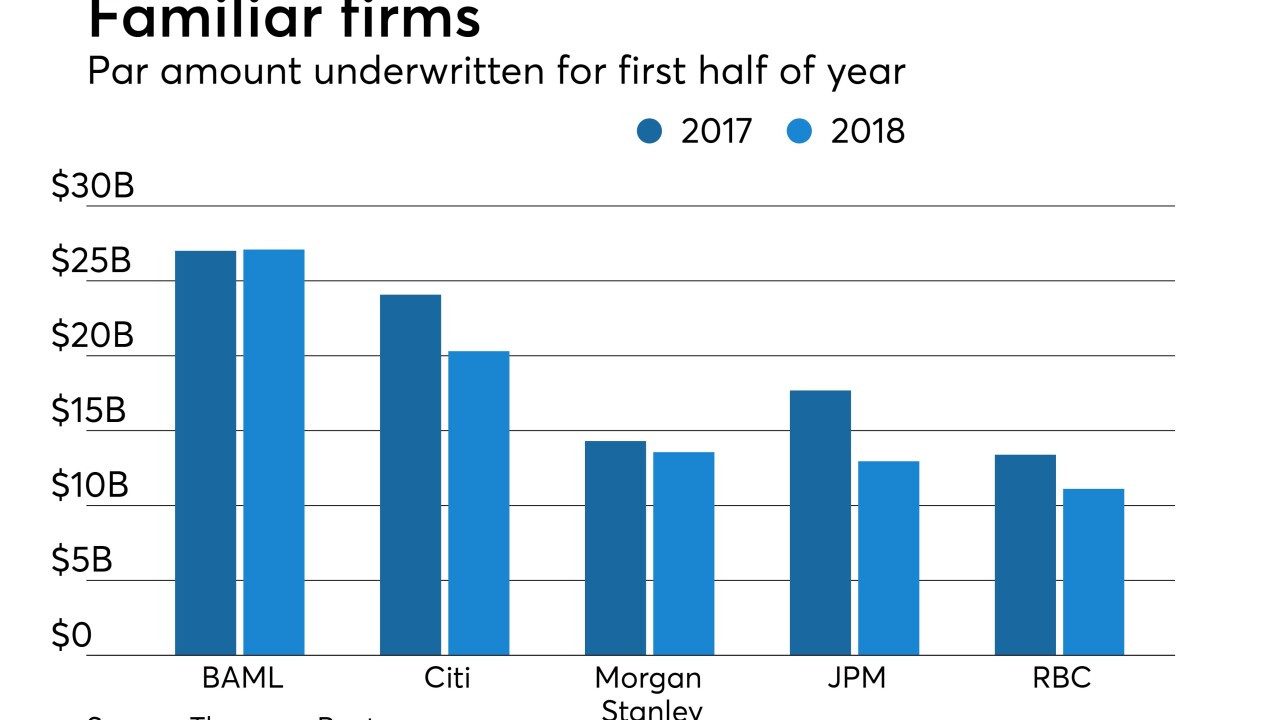

The top players maintained their positions atop the league tables, building their shares of a shrinking market.

April 17 -

Morgan Stanley rose to No. 2 and JPMorgan slipped out of the top 5 among municipal underwriters; PFM fell to second among financial advisors.

April 4 -

Topics that interested our listeners the most last year spanned the spectrum from the local to the national, ranging from New York City finances to federal tax reform legislation, and from advances in technology affecting the municipal bond market to current trends impacting the industry.

January 26 -

Among the topics that most interested our readers were the negotiations around tax reform and the financial crises in Puerto Rico.

January 19 -

Assured Guaranty and Orrick, Herrington & Sutcliffe LLP took advantage of a surge in issuance in the final two months of 2017 to solidify advantages over rival bond insurers and counsel.

January 17 -

The par value of muni underwriting fell for the top five firms as volume receded from the 2016 record.

January 5 -

Orrick, Herrington & Sutcliffe and Assured Guaranty retained their positions in third-quarter rankings, while Build America Mutual rebounded from a stint on negative credit watch to capture its typical market share.

October 16 -

Bank of America Merrill Lynch held its No. 1 ranking among municipal underwriters as the biggest firms battled for deals in a shrinking market for new issuance.

October 5 -

Regional bond issuance slipped by 31% in the first half and volume was down sharply in Florida.

August 23 -

Assured Guaranty and Orrick, Herrington & Sutcliffe LLP expanded their business even as muni volume shrank amid political uncertainty.

July 21