-

Refunding volume in the Midwest was down 57% in 2018, while new money deals rose just 1.8%, leaving the region down more than 28%.

February 26 -

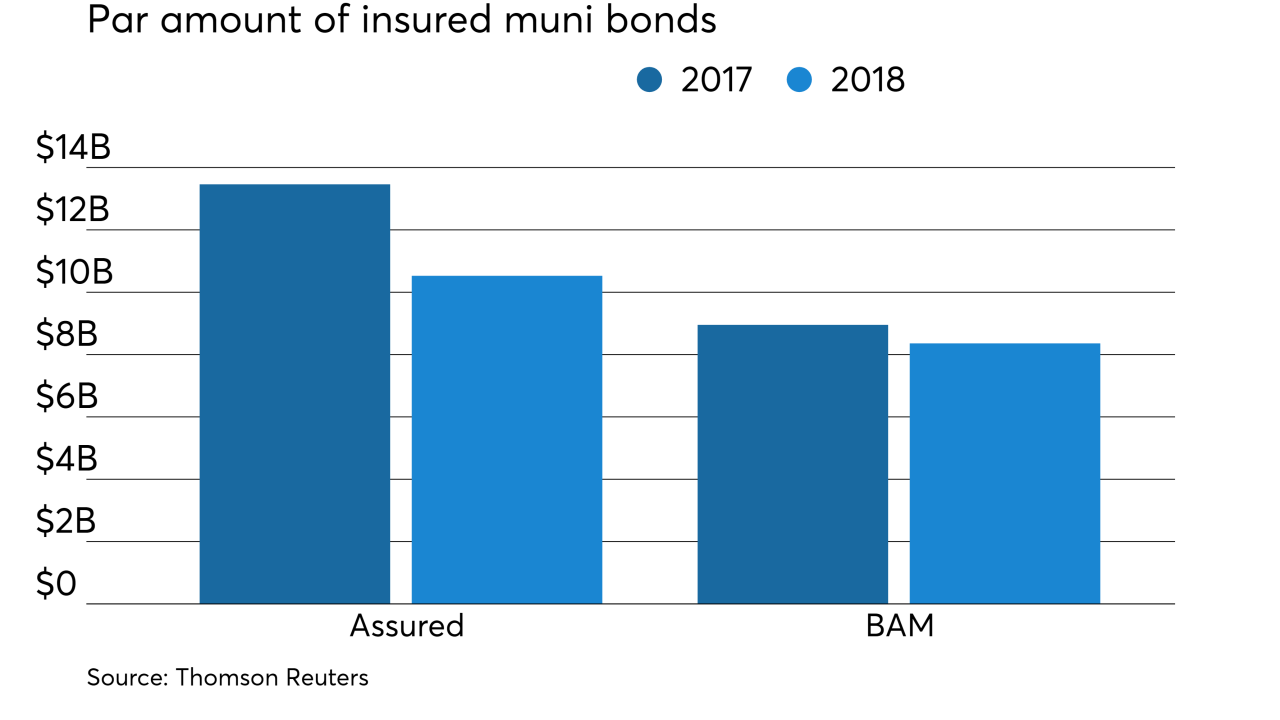

While the municipal bond insurers suffered from the curtailment of issuance under newly effective U.S. tax laws, the insurance penetration rate ticked higher.

January 16 -

The top municipal FA's accounted for 20% less volume, as their par amount of deals handled dropped to $273.869 billion from $345.829 billion. The number of transactions fell by 1,199.

January 16 -

The top muni bond counsel firms accounted for $318.67 billion in 8,474 transactions in 2018, down from $407.47 billion in 10,519 deals the year before.

January 16 -

Municipal bond issuance totaled $320.25 billion in 2018, as New York issuers led the charge.

January 16 -

Municipal bond underwriters suffered from muted issuance under the new tax laws, as Bank of America Merrill Lynch remained on top of the year-end rankings.

January 16 -

Hiring, firings, corruption, the new tax law and a volatile political climate shaped The Bond Buyer's list of most-read articles of 2018.

December 21 -

The tax overhaul and rising rates started to bolster demand, partly offsetting the decline in issuance.

October 23 -

After three quarters, only Morgan Stanley and Jefferies have increased par amount underwritten from last year.

October 4 -

The region's volume numbers were supported by favorable market conditions that drove several large gas prepay deals.

August 22