Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Investors will be greeted Monday with a new-issue calendar estimated at $7 billion. While issuance will likely come in above average this month, negative net issuance is still expected.

July 15 -

Investors added $206.127 million to municipal bond mutual funds, according to Refinitiv Lipper data.

July 14 -

Primary market takes focus for large revenue deals from the New York State Thruway Authority and the Colorado Health Facilities Authority.

July 13 -

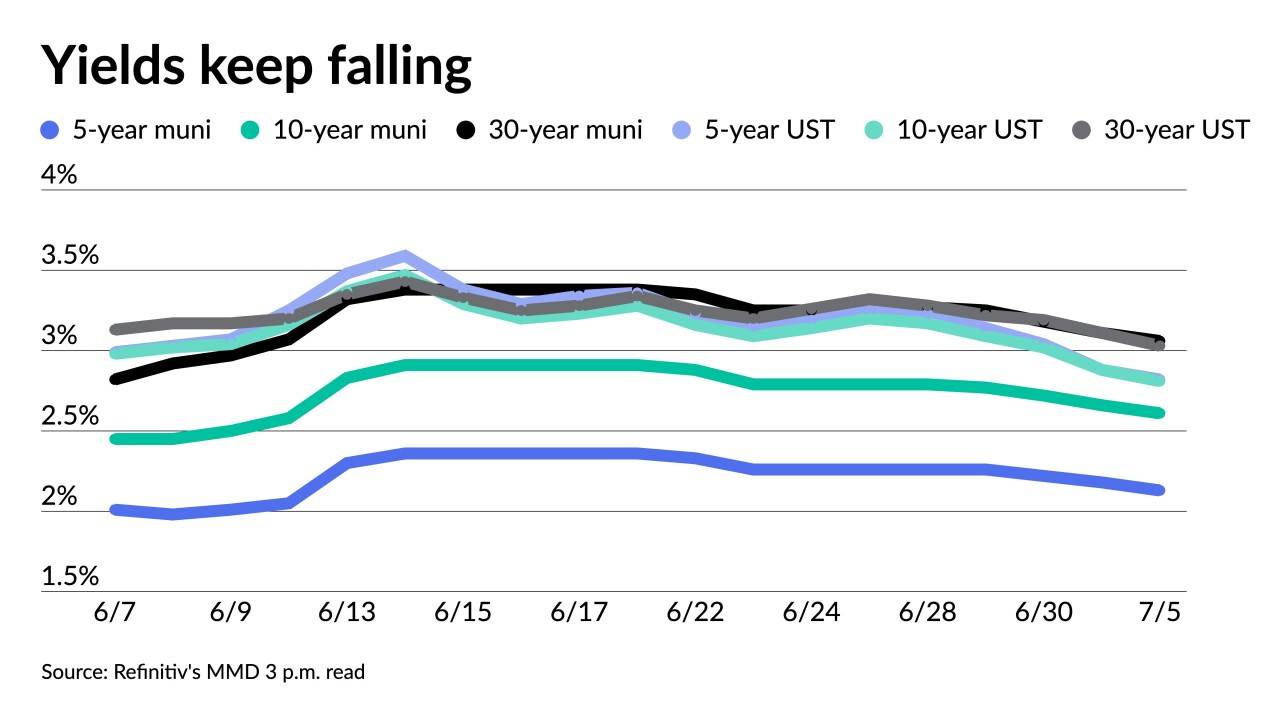

Munis have been steady to firmer in spots over the past few trading sessions as fundamentals have taken over. Triple-A 30-year munis dipped below 3% Tuesday, the first time since early June.

July 12 -

The $11-billion-plus calendar is the largest in eight weeks and includes two large high-grade issuers which may entice buyers into the market.

July 11 -

The ISS ESG Muni QualityScore was previously designed for the buy- and sell-side, but it has expanded its offerings to issuers with datasets focused on their specific locations.

July 11 -

Investors will see almost $11.5 billion of volume head their way in the largest new-issue week of the year. More participants expect municipals to improve in the second half of 2022.

July 8 -

Despite rising U.S. Treasuries, municipals are making gains and are in the black to start July.

July 7 -

The Investment Company Institute reported investors pulled $1.372 billion from muni bond mutual funds in the week ending June 29.

July 6 -

As investors shift the focus from inflation to recession concerns, fixed income markets, including munis, may regain some of the year's losses.

July 5