Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

"The curve slope has undergone a massive flattening this year and recent trends suggest demand pockets are developing in specific ranges," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

October 20 -

Outflows continued as investors pulled $4.532 billion from mutual funds in the week ending Oct. 12 after $5.172 billion of outflows the previous week, according to the Investment Company Institute.

October 19 -

Triple-A curves were a touch firmer in spots as secondary trading took a backseat to the larger primary activity with Connecticut and Massachusetts pricing general obligation bonds, a large CommonSpirit healthcare and several competitive issues led by Rhode Island GOs.

October 18 -

Volume rebounds eightfold this week with a new-issue calendar of $8.5 billion, including several billion-dollar deals.

October 17 -

"Despite a pick-up in volatility in the rates market, municipals have been performing relatively well in October," according to Barclays PLC.

October 14 -

Refinitiv Lipper reported $2.262 billion of outflows from municipal bond mutual funds for the week ending Wednesday after $2.057 billion the week prior.

October 13 -

The Investment Company Institute reported $5.128 billion of outflows for the week ending Oct. 5 after $5.374 billion of outflows the previous week.

October 12 -

Most top 10 issuers are from New York and California, with New York issuers overtaking the Golden State year-over-year.

October 11 -

Minor shuffling among the top municipal underwriters characterized the year-over-year differences, with the same underwriters remaining in the top 10.

October 11 -

Munis are in the black so far in October and some participants see signs of continued improvement.

October 11 -

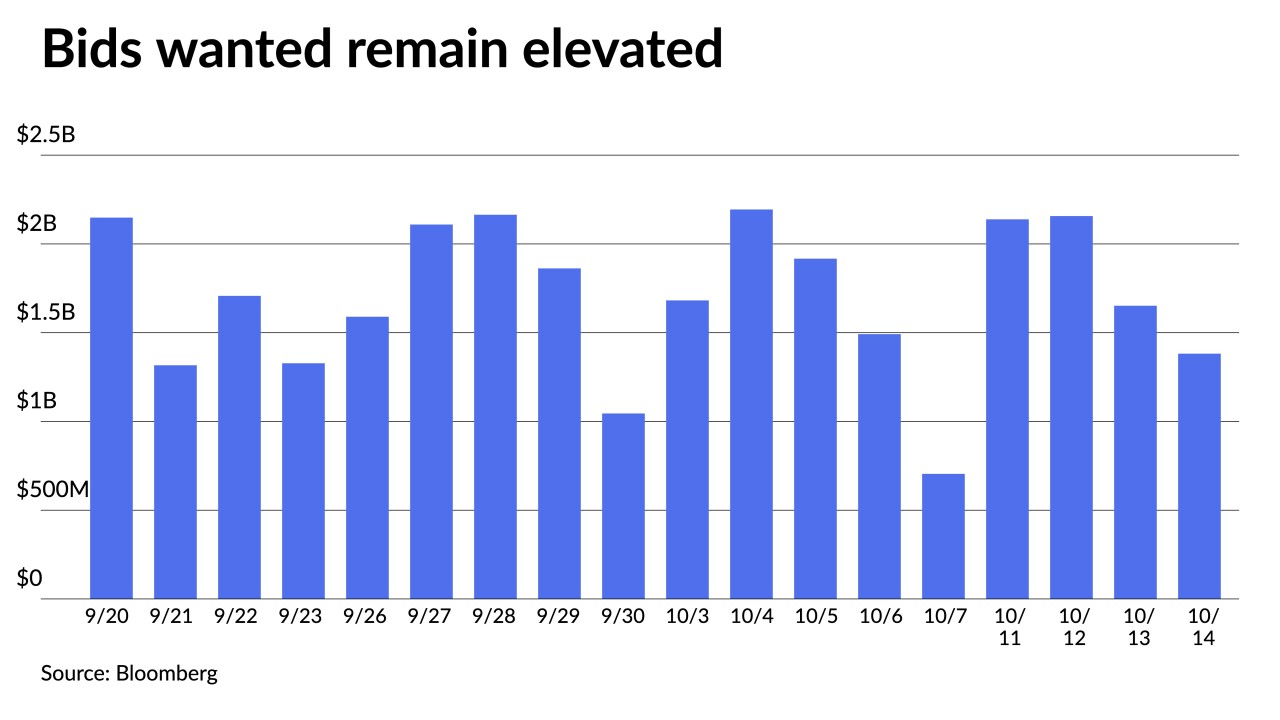

Bids wanteds are on the rise, but a constructive secondary market showed a steady to firmer market in the past two sessions. ICI's latest outflows figure is the highest since June.

October 5 -

Triple-A yields fell four to 10 basis points across the curve amid robust secondary trading with high-grade names showing clear moves to lower yields.

October 4 -

Munis open October firmer, underperforming a UST rally, but September closed out the month with 3.84% losses — the single largest monthly loss since September 2008.

October 3 -

The launch helps Schwab to broaden its footprint in munis, allowing the firm to expand its line-up for investors who are looking for broad muni exposure at a much lower price point.

October 3 -

Triple-A yields rose more than three-quarters of a point on the front end and nearly half a point out long in September as munis posted 3.84% losses.

September 30 -

For the first three quarters, total issuance sits at $308.440 billion, down from $361.932 billion in 2021. Taxables are down 48.0% to $45.724 billion from $87.979 billion.

September 30 -

Upon integration, the Lumesis DIVER product suite will provide additional municipal asset class workflow, analytics related to price transparency, and regulatory-related solutions to SOLVE'S Market Data Platform.

September 30 -

In the competitive market Thursday, the New York Urban Development Corp. sold $1.443 billion of tax-exempt personal income tax revenue bonds.

September 29 -

A larger new-issue slate led by large deals from the Texas Water Development Board and state of Illinois took focus away from the secondary.

September 28 -

The tool provides summaries of outstanding debt, maturity profiles, and debt service schedules for the entire public finance market and is an outgrowth of the company's legacy Debt Maps.

September 27