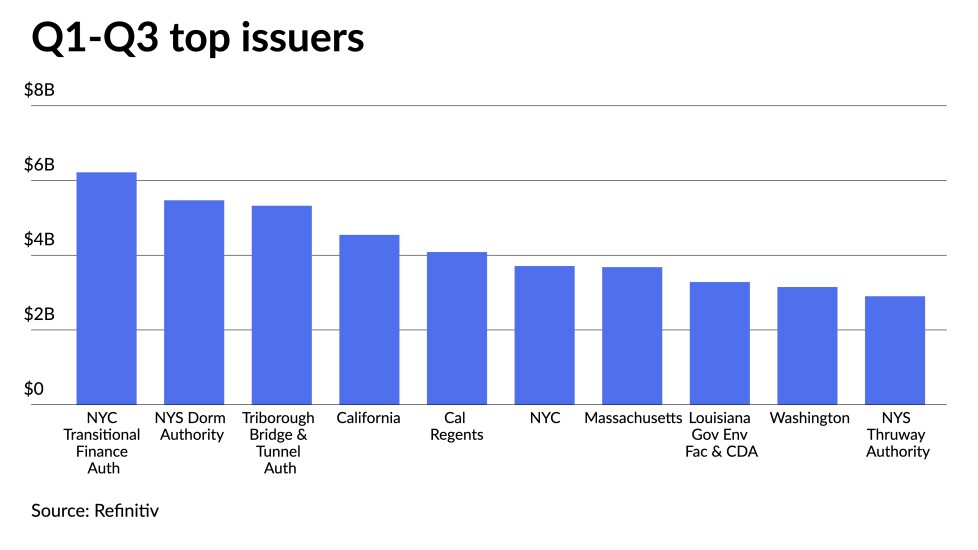

The New York City Transitional Finance Authority headlined the top 10 issuers of the first three quarters 2022, almost all of which outperformed their par amounts year-over-year.

Three new issuers entered the top 10. The three issuers who fell out of the top 10 — the New York City Municipal Water Finance Authority; Miami-Dade County, Florida, and the New York City Housing Development Corporation — are still among the top 20 issuers.

Most top 10 issuers are from New York and California, with five from New York and two from the Golden State.