Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Total volume in the first half of the year was $180.882 billion in 3,853 deals, down 17.1% from the $218.230 billion in 5,444 over the same period in 2022, according to Refinitiv data.

August 21 -

In comparison to the $17.689 billion of transactions completed in the first half of 2022, the top two municipal bond insurers wrapped $15.571 billion in 2023.

August 21 -

"Bearish Treasury moves have kept some pressure on the muni market and prevented an attempt to rally during the summer season when large redemptions trump issuance," BofA Global Research said in a report.

By Lynne FunkAugust 18 -

Refinitiv Lipper reported $264.046 million of outflows from municipal bond mutual funds for the week ending Wednesday after $278.559 million of inflows the previous week.

August 17 -

Municipal CUSIP request volume decreased in July on a year-over-year basis, following an increase in June, according to CUSIP Global Services.

August 16 -

Summer redemption season ends Tuesday when issuers return $9 billion of matured or called bond principal, said CreditSights strategists Pat Luby and Sam Berzok.

August 15 -

The top two municipal bond insurers wrapped $15.571 billion in the first half of 2023, a 12% decrease from the $17.689 billion of deals done in the first half of 2022, according to Refinitiv data. Insurance was up in Q2.

August 15 -

Late summer is "rarely a good time for our asset class," Barclays strategists said, noting the municipal investment grade index lost money in August three years in a row, and 2023 seems to follow this trend.

August 4 -

"The limited scope of muni debt affected suggests a marginal impact on the muni market, if any," BofA strategists said.

August 4 -

Municipal bond mutual fund saw outflows return with Refinitiv Lipper reporting investors pulling $989.852 billion from funds for the week ending Wednesday, led by ETFs and long-end funds.

August 3 -

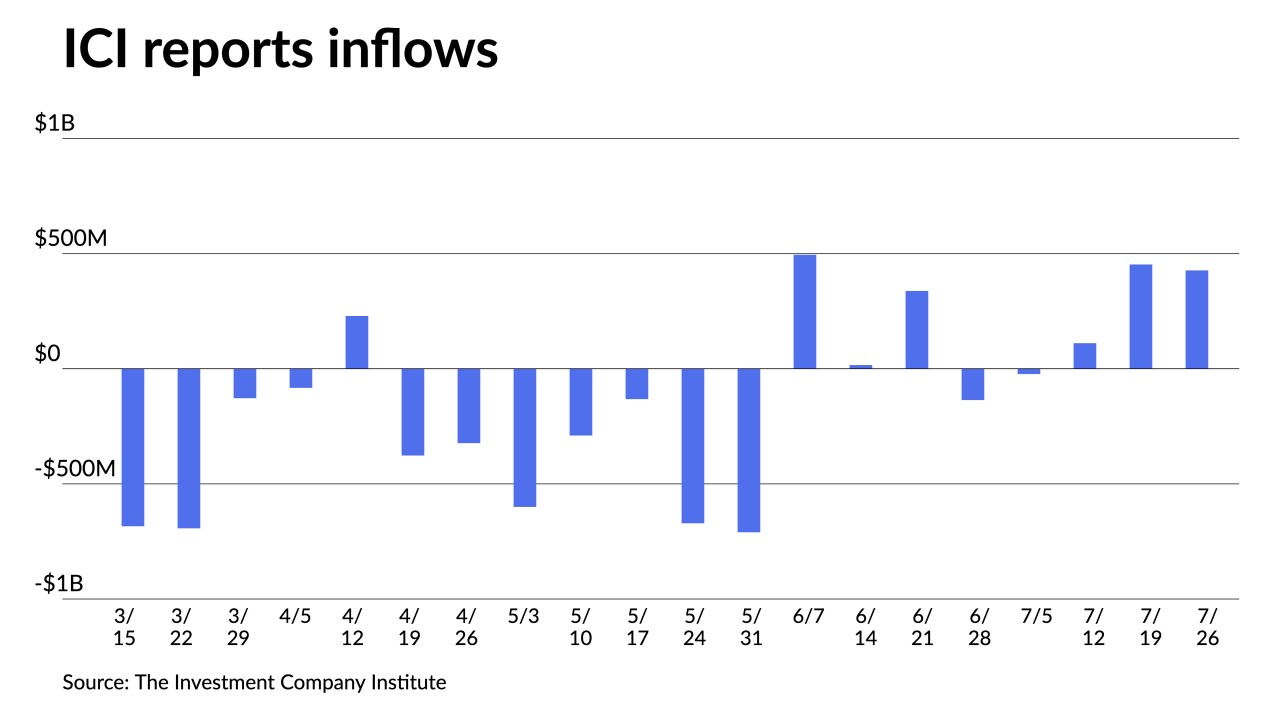

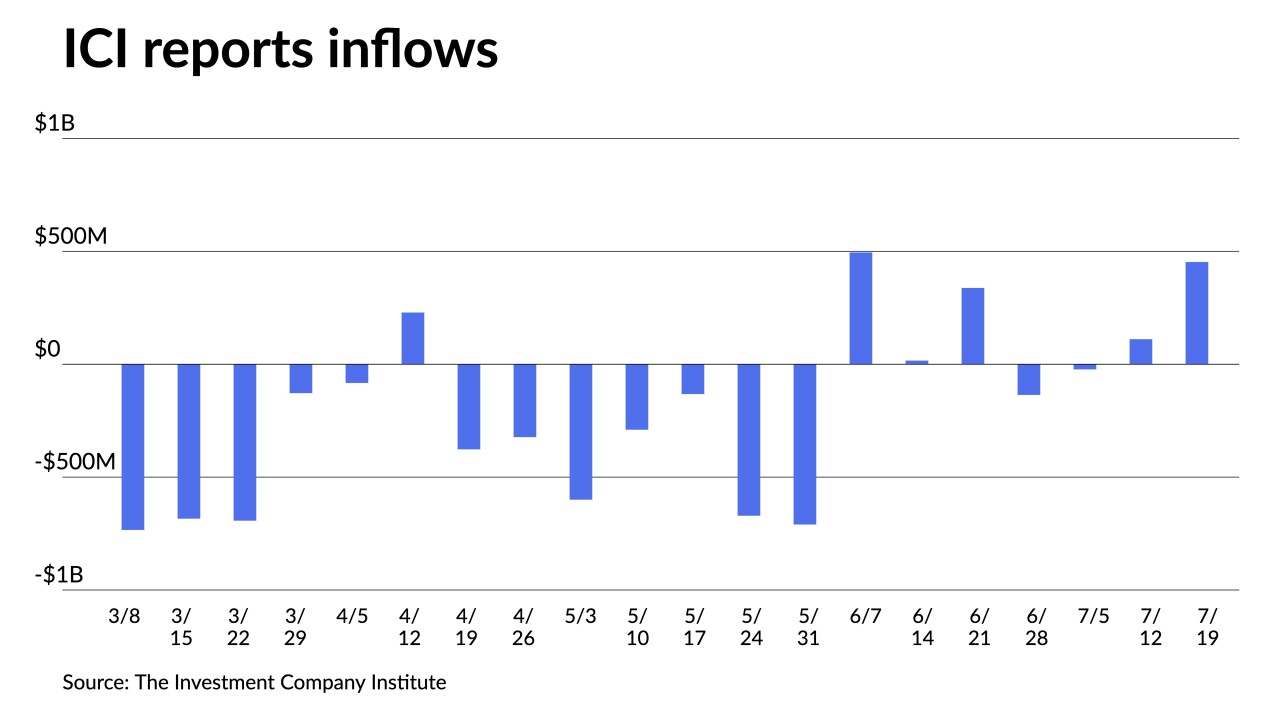

The Investment Company Institute reported investors added $427 million to municipal bond mutual funds in the week ending July 26, after $453 million of inflows the previous week.

August 2 -

While it's still relatively early to tell how much — if at all — the muni market will be impacted, Kara South, portfolio manager at GW&K Investment Management, said downgrades of certain municipal bonds are likely to follow.

August 2 -

J.P. Morgan held a one-day retail order for $1.65 billion of revenue bonds from the Dormitory Authority of the State of New York, while Minnesota sold $1.02 billion of GOs in the competitive market in five deals.

August 1 -

This week kicks off a flip of calendar to the final month of the summer reinvestment season and one of the larger new-issue calendars of the year.

July 31 -

July's total volume was $25.939 billion in 542 issues, down from $28.258 billion in 619 issues a year earlier, the smallest percentage drop in monthly issuance year-over-year in 2023, according to Refinitiv data.

July 31 -

For the coming week, investors will be greeted with a larger new-issue calendar led by large New York and Texas ISD issuers, along with gilt-edged Minnesota selling competitively.

July 28 -

While issuers continue to seek a clear successor to the eliminated option, tenders turned into a viable option to provide cost savings.

July 28 -

Municipal bond mutual fund saw inflows with Refinitiv Lipper on Thursday reporting investors added $552.219 million to funds for the week ending Wednesday following $1.040 billion of outflows the previous week.

July 27 -

The Investment Company Institute reported investors added $453 million to municipal bond mutual funds in the week ending July 19, after $111 million of inflows the previous week.

July 26 -

The offered side "has continued to pack the primary market with value to manage their (and the market's) potential downside if disruption did occur; this also helps the context for muni buyers headed into the Fed," said Matt Fabian, partner at Municipal Market Analytics.

July 25