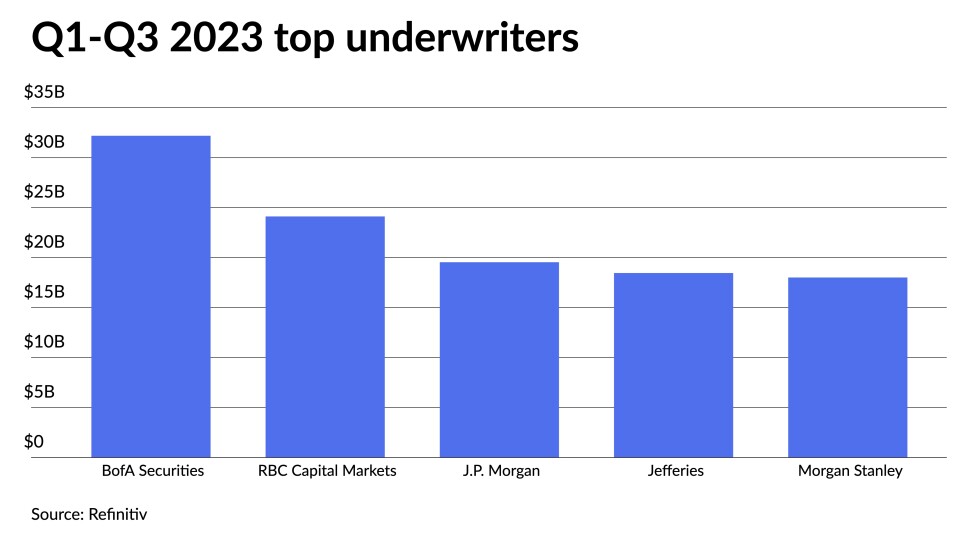

The top municipal underwriters accounted for $265.047 billion in 5,383 issues in the first three quarters of 2023, down from $291.908 billion in 6,417 transactions over the same time period in 2022.

BofA Securities remained in the top spot despite accounting for less par and a smaller market share than in 2022.

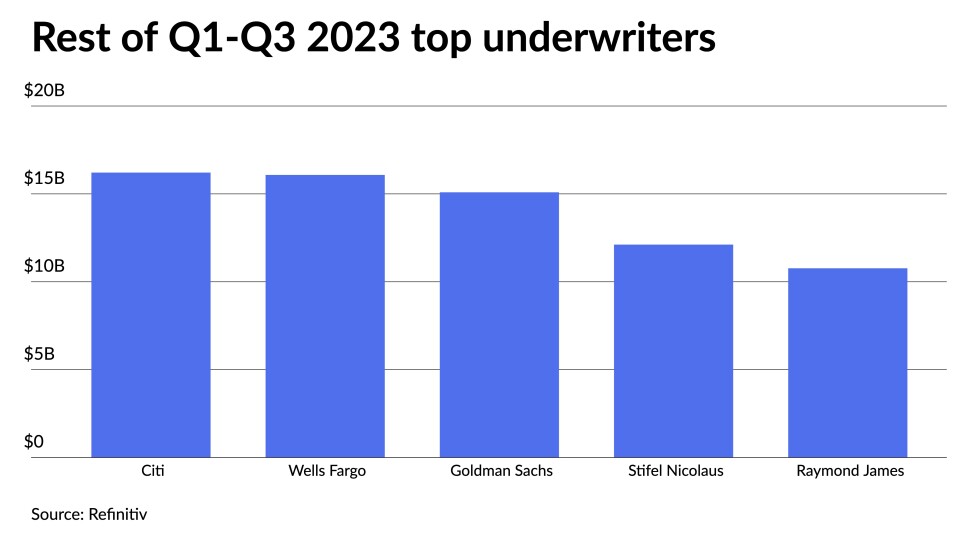

Minor shuffling among the top municipal underwriters characterized the year-over-year differences, with only Raymond James entering the Top 10, knocking Piper Sandler to 11th.