Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

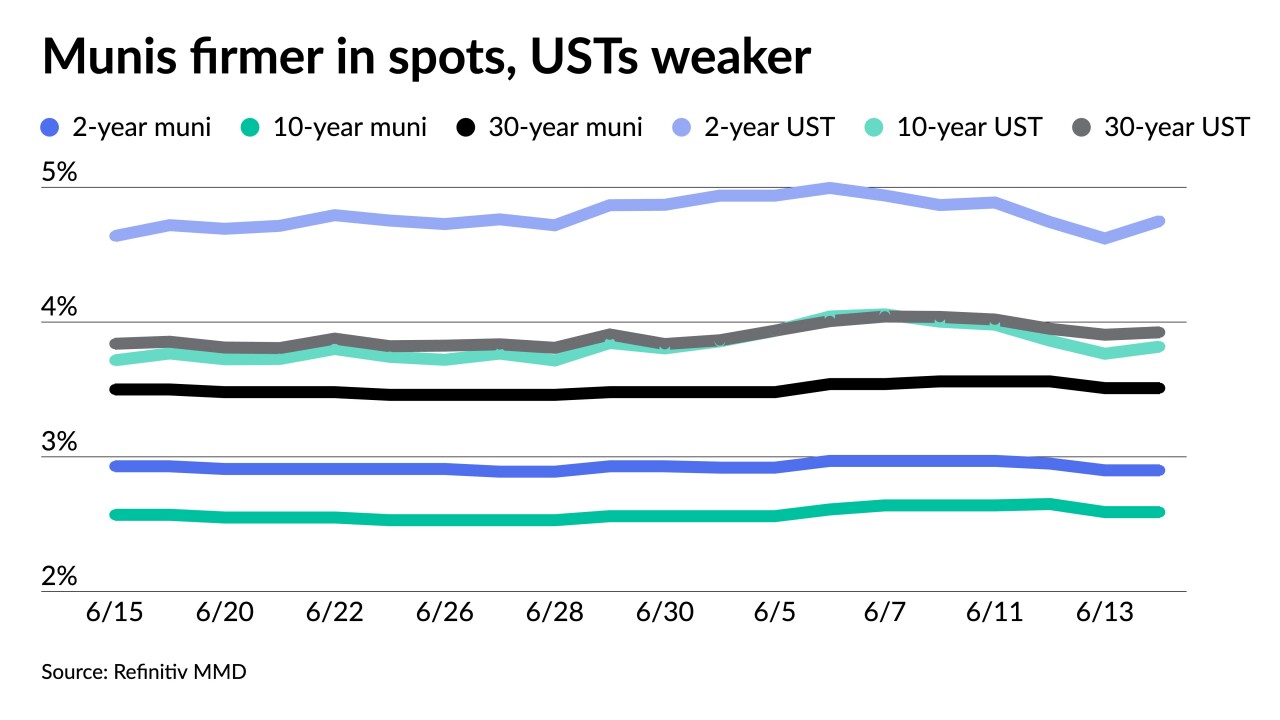

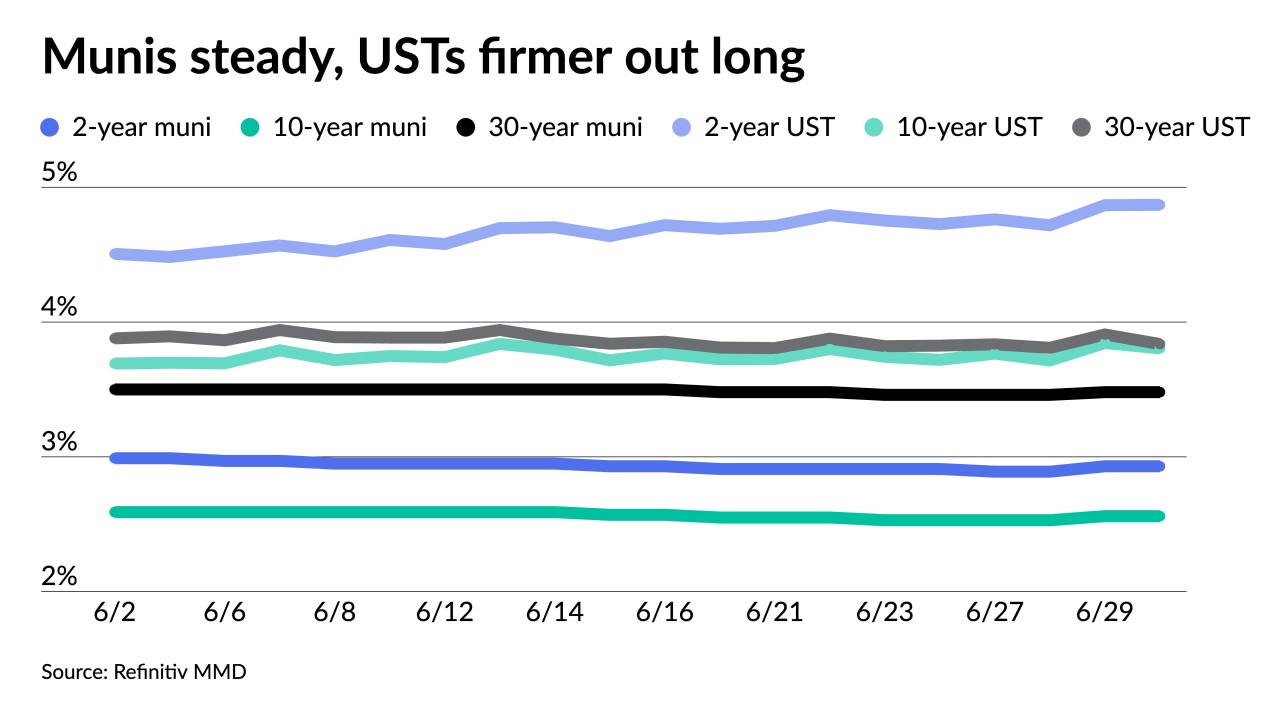

"Longer-dated bonds look attractive, as investors are locking in long-term rates before the expected decline in 2024," while "a tremendous amount of money is also invested in the short end of the curve," Nuveen strategists said.

July 24 -

Washington will bring $1.1 billion of GOs in four competitive sales Tuesday, leading a new-issue calendar estimated at $5.439 billion.

July 21 -

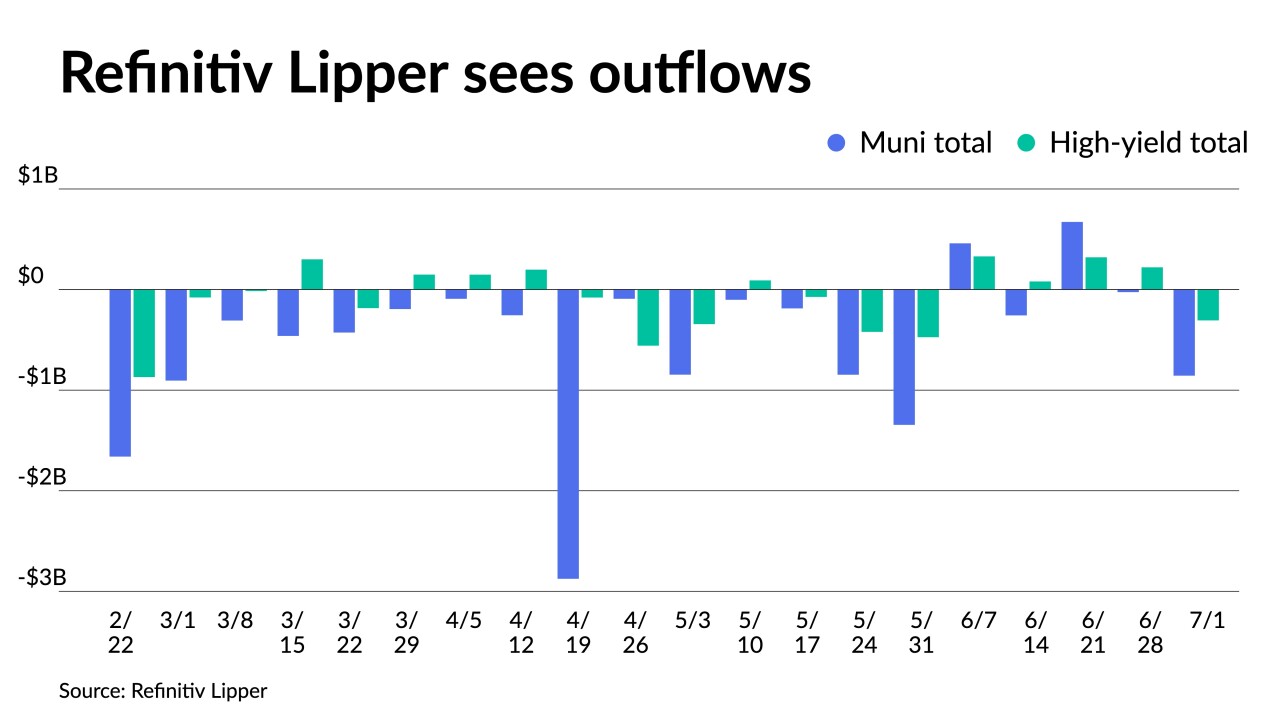

Municipal bond mutual fund saw inflows with Refinitiv Lipper reporting investors added $1.040 billion to funds for the week ending Wednesday following $136.174 million of outflows the previous week.

July 20 -

Customers of Investortools can now access the MarketAxess products through the Investortools Dealer Network.

July 20 -

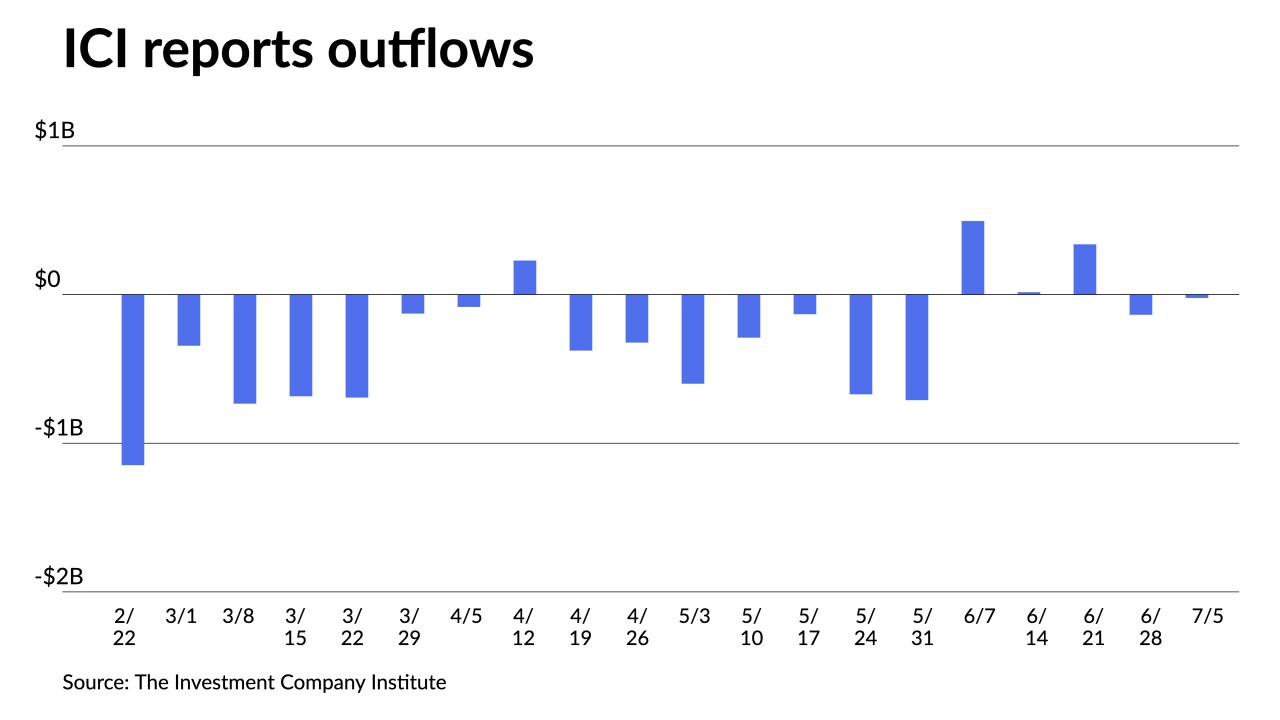

The Investment Company Institute reported investors added $111 million to municipal bond mutual funds in the week ending July 12, after $ 23 million of outflows the previous week.

July 19 -

The back half of July is starting "much like the front half with ongoing UST volatility and municipal supply staying in the forefront," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

July 18 -

Long-duration and shorter-coupon munis saw ample demand last week. Investors, believing rates will fall as early as the first part of next year, continue to lock in long-bond yields, Nuveen strategists said.

July 17 -

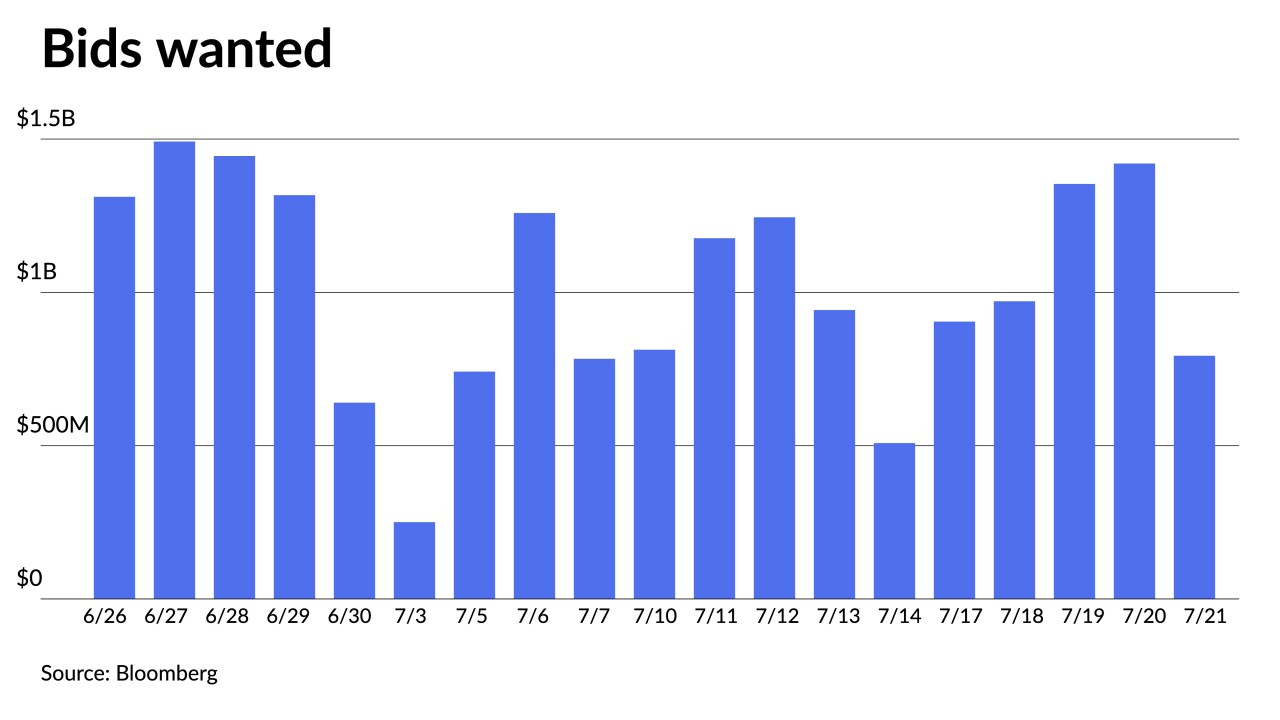

Bond Buyer 30-day visible supply climbs to $13.42 billion while the new-issue calendar is led by a $1 billion-plus New York City Transitional Finance Authority future tax-secured subordinate deal.

July 14 -

Municipal bond mutual fund outflows continued as Refinitiv Lipper reported investors pulled $136.174 million from the funds for the week ending Wednesday following $855.719 million of outflows the week prior.

July 13 -

"The bond market finally got the relief from inflation it was hoping for," said Bryce Doty, senior vice president and senior portfolio manager at Sit Investment Associates.

July 12 -

With the third quarter officially under way, municipal bond experts say the tax-exempt market is poised for better performance and stronger market technicals ahead in the second half.

July 11 -

Nick Venditti of Allspring Global Investments talks about evolving demand components, compelling yields and expectations for second half performance. Jessica Lerner hosts. (24 minutes)

July 11 -

This week should see a return to more normal supply, which might be a little higher than average for the year so far, said Daniel Solender, partner and director of tax-free fixed income at Lord Abbett & Co.

July 10 -

Municipal Capital Markets Group, Columbia Capital Management and Caine Mitter and Associates moved into the top 10, while Baker Tilly Municipal Advisors, Stifel Nicolaus & Co. and Swap Financial Group were ousted.

July 10 -

Most top 10 issuers for 1H are from New York and California, with three from New York and three from California.

July 10 -

For the coming week, investors will be greeted with a new-issue calendar estimated at $7.282 billion.

July 7 -

Municipal bond mutual fund outflows intensified as Refinitiv Lipper reported investors pulled $855.719 million from the funds for the week ending Wednesday following $25.331 million of outflows the week prior.

July 6 -

The Investment Company Institute reported investors pulled $136 million from municipal bond mutual funds in the week ending June 28, after $338 million of inflows the previous week.

July 5 -

"Lower volumes, lighter primary issuance, and heavier reinvestment cash flows are likely going to contribute to a continued bout of muni relative performance," said Birch Creek Capital strategists.

July 3 -

For the coming week, investors will be greeted with a new-issue calendar estimated at $304.5 million. This marks the lowest week of issuance in 2023.

June 30