Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

The offered curve is "still deeply overbought" at all maturities outside of one year, which is "a signal for issuers and sellers to become aggressive," said Matt Fabian, a partner at Municipal Market Analytics.

January 9 -

Since November, 10-year munis have fallen 130 basis points, according to Refinitiv MMD. This has pushed ratios to near-record lows, said Jason Wong, vice president of municipals at AmeriVet Securities.

January 8 -

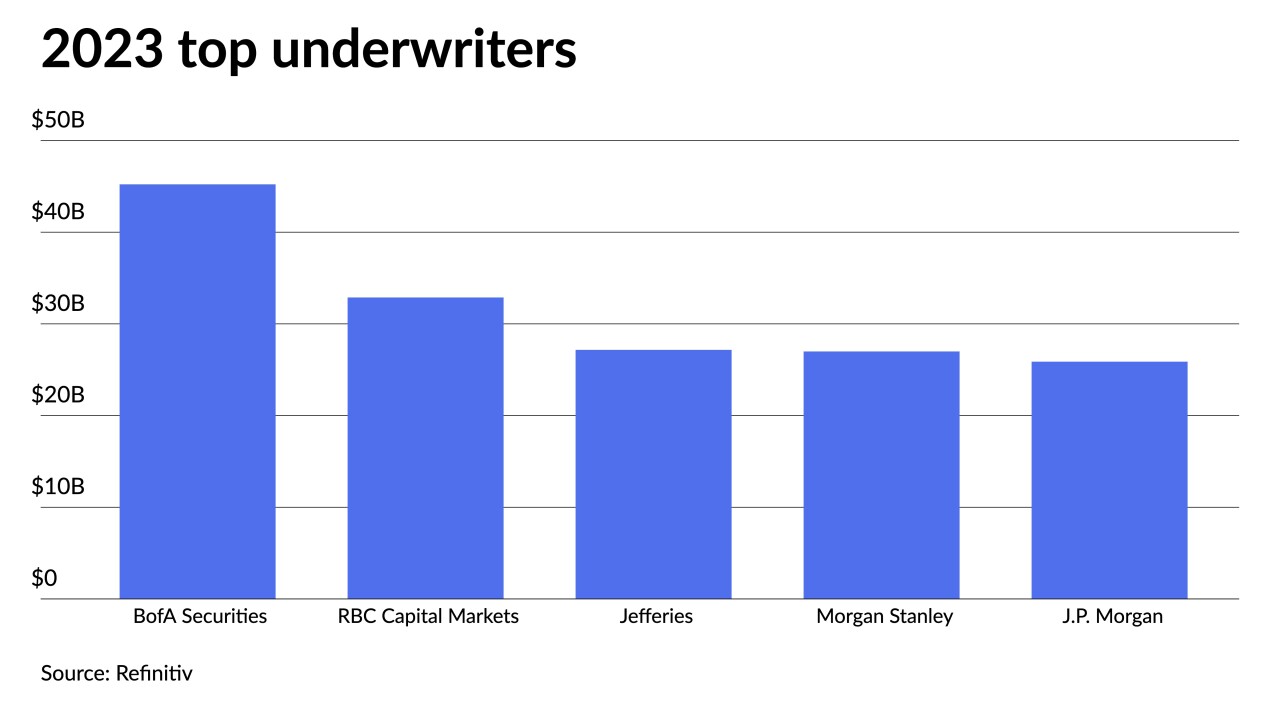

Caine Mitter & Associates and RBC Capital Markets moved into the top 10, while Piper Sandler & Co. and Kaufman Hall & Associates were bumped to the top 15.

January 8 -

Half of the top 10 issuers were new entrants: the California Community Choice Finance Authority, Main Street Natural Gas, the state of Washington, the Texas Natural Gas Securitization Finance Corp. and Illinois.

January 8 -

RBC ramped up business to land at second place and Jefferies rose to third while Raymond James entered the top 10, knocking Barclays to 11th. Citi, which exited the business, closed at sixth place.

January 8 -

Despite the outperformance this week, and while the asset class had "a stellar December, which rounded out a very solid year," Barclays PLC strategists said the high-grade muni market has become "quite rich."

January 5 -

The muni market enters this year from a relative position of strength, said Jeff Lipton, managing director and head of municipal research and strategy at Oppenheimer.

January 4 -

Blaylock Van is bolstering its overall institutional capabilities and reaffirming its commitment to the muni market, said Leonard Jones, executive director of municipal banking and head of public finance, at the firm.

January 4 -

This year has favorable potential for 1Q activity, noting an unusually large scheduled reinvestment potential in January and February, including $19 billion of maturities plus calls in January and $24.9 billion in February, noted MMA's Matt Fabian.

January 3 -

This performance is a dramatic rebound from 2022's losses.

By Lynne FunkDecember 29 -

The muni market saw $379.992 billion of debt issued in 2023, only $11.076 billion less than the lackluster $391.068 billion seen in 2022.

December 29 -

LSEG Lipper reported Thursday that investors pulled $463.7 million from muni mutual funds for the week ending Wednesday after inflows of $147 million the week prior.

December 28 -

Participants are mixed on whether there will be continued growth in 2024, but some still see a universe of taxable bonds that still can be tendered.

December 28 -

Late-month volumes are "waning as it appears the year's tax-loss harvesting was accomplished leading up to the holiday period," said Kim Olsan, senior vice president of municipal bond trading at FHN Financial.

December 27 -

Munis' strong performance from November continued into December, said Miguel Laranjeiro, a portfolio manager at abrdn.

December 26 -

The year is ending on a strong note, said Joshua Perry, a partner, portfolio manager and municipal credit analyst at Brown Advisory.

December 22 -

LSEG Lipper reported Thursday that investors added $147 million to muni mutual funds for the week ending Wednesday after outflows of $514.5 million the week prior. High-yield saw some outflows, though.

December 21 -

The issuer is set to come to market with general revenue bonds the week of Jan. 21, according to its investor website.

December 21 -

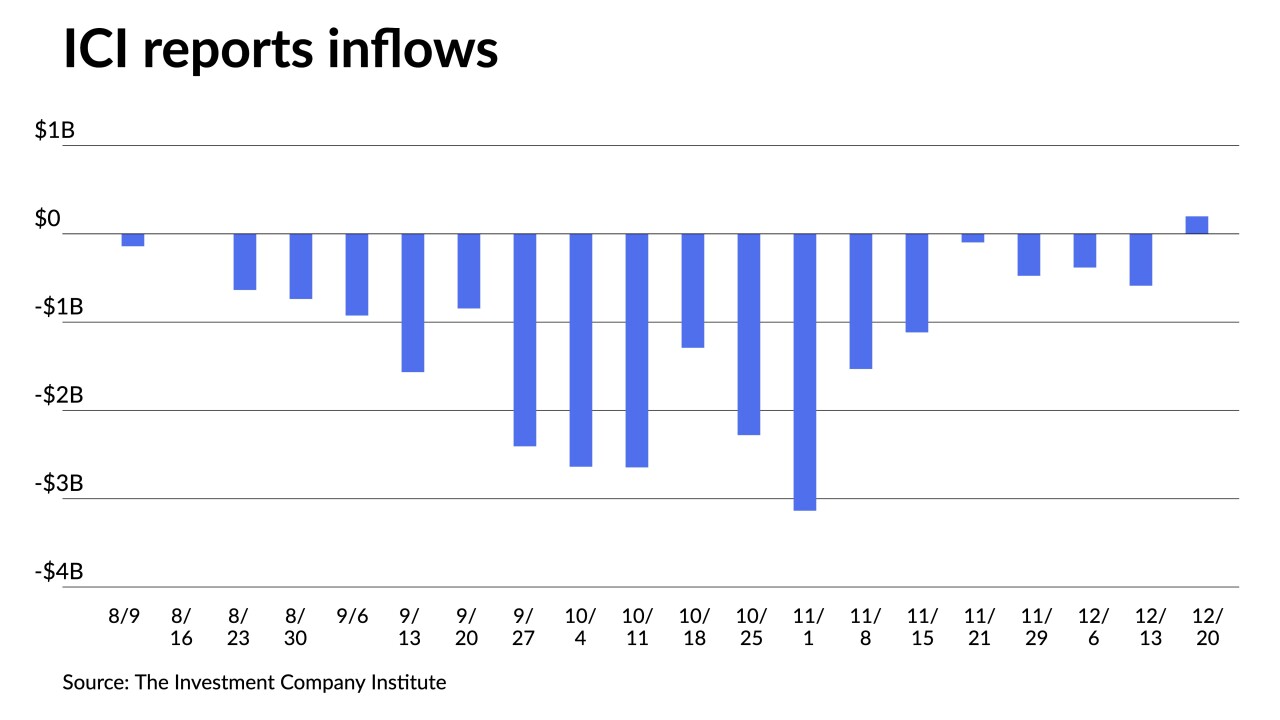

The Investment Company Institute reported more outflows from municipal bond mutual funds for the week ending Dec. 13, with investors pulling $588 million from the funds.

December 20 -

The Bloomberg Municipal Index has returned 1.90% so far in December and 5.96% year-to-date, while the High-Yield Index is up 2.75% this month and 8.94% in 2023. Taxable munis are returning 3.98% in December bringing year-to-date returns to 7.83%.

December 19