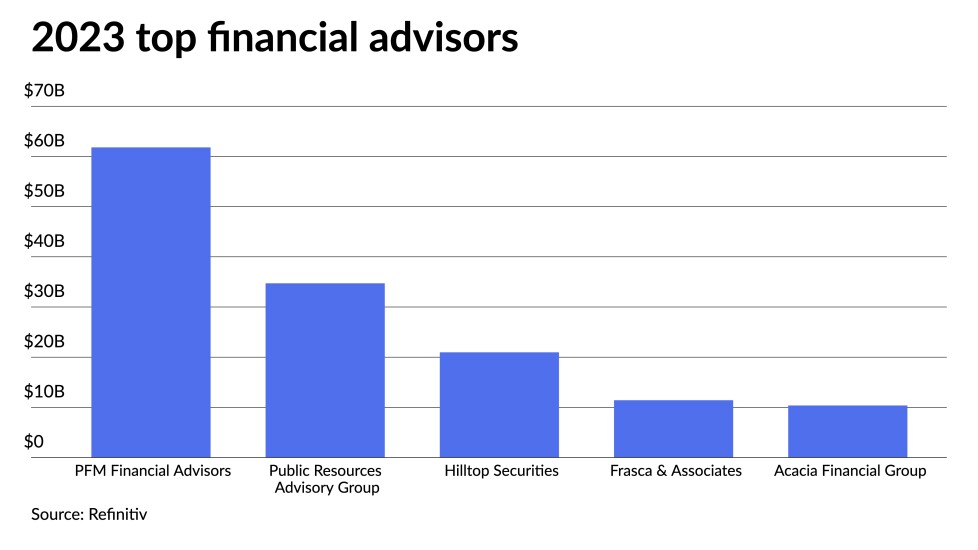

Of the $312.508 billion of par issued, municipal financial advisors saw $312.178 billion of business in 5,531 transactions in 2023. This compares to the $305.035 billion in 5,934 deals in 2022, out of a total of $305.149 billion.

Caine Mitter & Associates and RBC Capital Markets moved into the top 10, while Piper Sandler & Co. and Kaufman Hall & Associates were bumped to the top 15.