Jessica Lerner is a senior reporter and buy-side specialist for Bond Buyer where she writes the daily market column, the monthly volume story and longer trend stories. Prior to this, she worked as a beat reporter at two Connecticut newspapers. She earned her master's in business and economics reporting from the Craig Newmark Graduate School of Journalism and her bachelor's in journalism and statistics from the University of Connecticut.

-

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

By Lynne FunkJuly 27 -

Investors sit on the sidelines, waiting to see how much the Fed will hike rates. The consensus appears to be another 75 basis point rate hike, though a full point hike could be on the table.

July 26 -

Only two firms remained in the same spot at this point last year: Orrick Herrington & Sutcliffe and Norton Rose Fulbright.

July 26 -

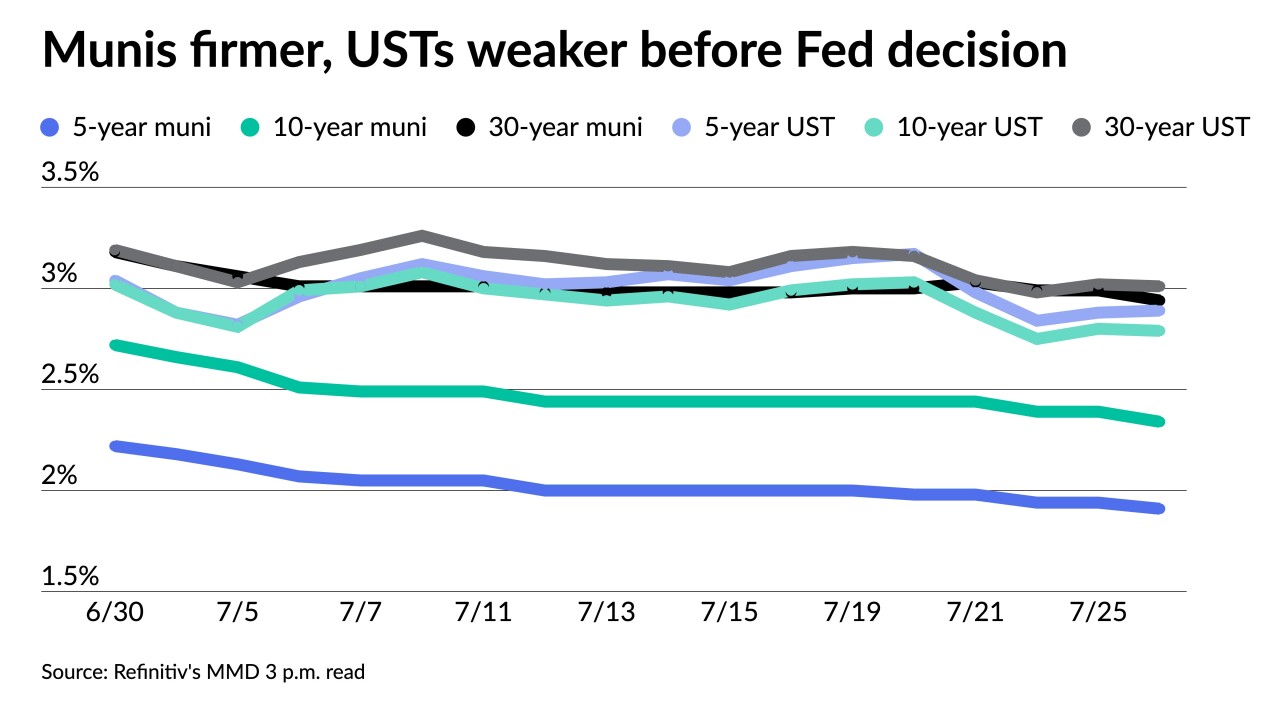

With the Fed rate decision coming this week, issuers are sitting on the sidelines in both primary and secondary Monday with little changed yield curves.

July 25 -

Munis were firmer to end the week but underperformed U.S. Treasuries.

July 22 -

Investors pulled $698.782 million out of municipal bond mutual funds, per Refinitiv Lipper data, versus the $206.127 million of inflows the week prior. High-yield saw small inflows.

July 21 -

The top two bond insurers — Assured Guaranty and Build America Mutual — accounted for $17.132 billion of deals in the first two quarters.

July 21 -

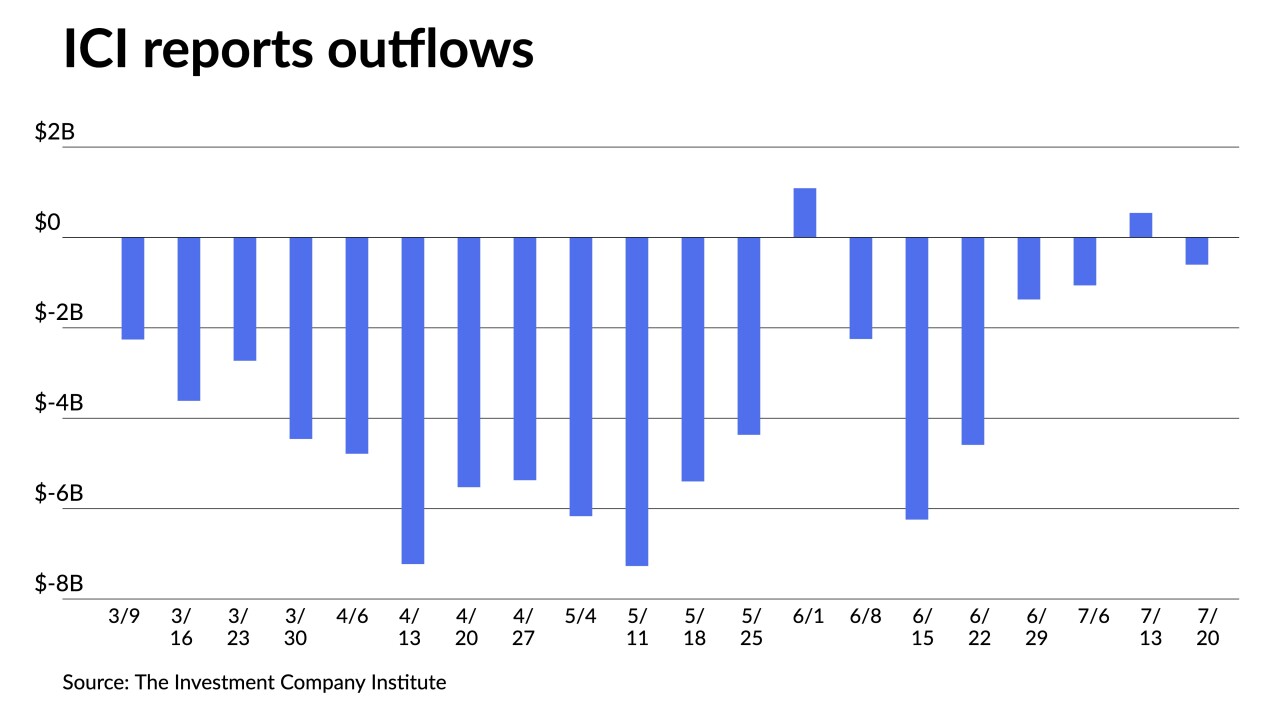

The Investment Company Institute reported investors added $543 million to muni bond mutual funds in the week ending July 13 compared to the $1.061 billion of outflows in the previous week.

July 20 -

Looking forward, a myriad of factors, including spiking fuel prices, fallout from the Russian invasion of Ukraine and the heat wave, “will facilitate recessionary(ish) economic outcomes by year end," noted an MMA report.

July 19 -

Estrada Hinojosa & Co., Stifel Nicolaus & Co. and CSG Advisors Incorporated moved into the top 10.

July 19 -

Munis are improving, but positive second-half municipal returns likely won’t be enough to offset the major losses of the first half of the year.

July 18 -

Investors will be greeted Monday with a new-issue calendar estimated at $7 billion. While issuance will likely come in above average this month, negative net issuance is still expected.

July 15 -

Investors added $206.127 million to municipal bond mutual funds, according to Refinitiv Lipper data.

July 14 -

Primary market takes focus for large revenue deals from the New York State Thruway Authority and the Colorado Health Facilities Authority.

July 13 -

Munis have been steady to firmer in spots over the past few trading sessions as fundamentals have taken over. Triple-A 30-year munis dipped below 3% Tuesday, the first time since early June.

July 12 -

The $11-billion-plus calendar is the largest in eight weeks and includes two large high-grade issuers which may entice buyers into the market.

July 11 -

The ISS ESG Muni QualityScore was previously designed for the buy- and sell-side, but it has expanded its offerings to issuers with datasets focused on their specific locations.

July 11 -

Investors will see almost $11.5 billion of volume head their way in the largest new-issue week of the year. More participants expect municipals to improve in the second half of 2022.

July 8 -

Despite rising U.S. Treasuries, municipals are making gains and are in the black to start July.

July 7