Municipals were weaker on the long end of the curve, largely ignoring the U.S. Treasury rally where yields fell double-digits Thursday, while outflows from municipal bond mutual funds returned. Equities made gains.

Triple-A yields were cut up to three basis points while UST saw yields fall 12 to 16 basis points 10-years and in. Muni to UST ratios were at 65% in five years, 84% in 10 years and 98% in 30 years, according to Refinitiv MMD's 3 p.m. read. ICE Data Services had the five at 65%, the 10 at 86% and the 30 at 98% at a 3:30 p.m. read.

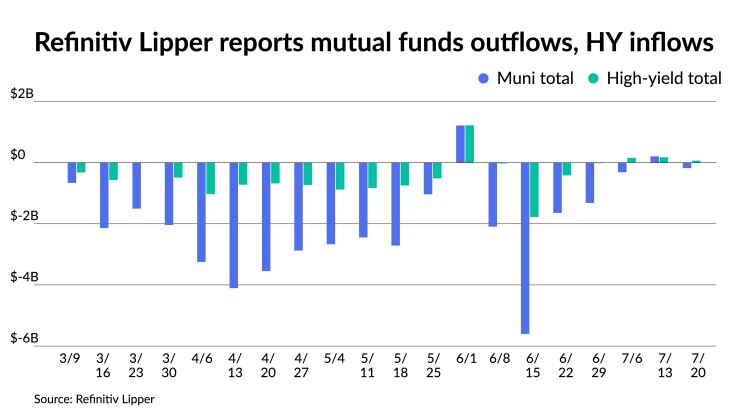

Investors pulled $698.782 million out of municipal bond mutual funds, per Refinitiv Lipper data, versus the $206.127 million of inflows the week prior.

High-yield saw $64.981 million of inflows after $176.886 million of inflows the week prior.

“It’s definitely a mixed bag,” said Pat Luby, a municipal strategist at CreditSights, of mutual funds. Mutual funds saw inflows last week but reported outflows for the week ending June 20, while ETFs did the opposite by reporting inflows this week after outflows the week prior.

“It suggests to me that there are income buyers who are out there, looking to take advantage of the higher yields and higher rates, but there remains a lot of anxiety,” he said. “There's clearly still money exiting mutual funds, money exiting the market, and there's plenty of headlines that can induce people to either want to exit or to do nothing.”

In the primary Thursday, Barclays Capital priced for the New York City Housing Development Corporation (Aa2/AA+//) $152.460 million of sustainable development multi-family housing revenue bonds, 2022 Series E, with 1.55s of 5/2023 at par, 2.85s of 5.2027 at par, 5s of 11/2027 at 2.87%, 3.70s of 5/2032 at par, 3.75s of 11/2032 at par, 4s of 11/2037 at par, 4.20s of 11/2042 at par and 4.30s of 11/2045 at par, callable 11/1/2030.

In the competitive market, the New York State Thruway Authority sold $436.045 million of tax-exempt climate bond certified state personal income tax revenue green bonds Series 2022C, Bidding Group 1, to J.P. Morgan Securities, with 5s of 3/2053 at 3.93% and 5s of 2055 at 3.96%, callable 9/15/2032.

The authority also sold $296.260 million of tax-exempt climate bond certified state personal income tax revenue green bonds Series 2022C, Bidding Group 2, to J.P. Morgan Securities, with 5s of 3/2056 at 4.37% and 5s of 2057 at 4.38%, callable 9/15/2032.

Luby said the reinvestment demand at the beginning of the month — a “big chunk of money” — helped help support the market.

“But we're getting into the steamy part of the month,” he said.

The new-issue calendar, he said, is not inspiring excitement among buyers but some of the deals are getting “ridiculous amounts of demand at the short end.” Luby believes this will persist and the market will continue to see outsized demand for short paper and investors will be willing to stomach very tight spreads.

Prints with longer maturities have been light in secondary trading this week. He said the longer-duration spreads are more in keeping with the current market environment. The secondary market, he said, generally trades less consistently and without consistent demand from mutual funds demand component for long duration is low.

Luby doesn’t anticipate a dramatic shift between now and the end of summer, noting new-issue volume will start ticking up in October, which historically has been the heaviest month of the year for new paper. Bond Buyer 30-day visible supply sits at $8.92 billion.

And despite a temporary distraction from summer vacation plans, many buy-side investors are interested in the municipal market and should keep demand healthy for the remainder of the third quarter.

“The overall municipal market should be in good shape going into the third quarter as the massive selloff in the first half of the year has produced a good buying opportunity,” Roberto Roffo, managing director and portfolio manager at SWBC Investment Services, LLC, said Thursday.

“Additionally, a weakening macro-economic environment should make fixed-income investors even more comfortable wading back into the market,” he said.

JB Golden, portfolio manager at Advisors Asset Management, agreed that investors are positive on the market going forward.

“It seems the overall tone for the municipal market is one of optimism — especially after the rough first half with most seeing a much better second half of the year in store,” Golden said Thursday.

“Municipals are having one of the better months this year in July and with a little more than a week left it looks like we will get only the second up month for municipals this year,” he added.

He said the municipal market has proven quite resilient over the last few weeks given the Treasury market volatility.

“Valuations, especially on the short end of the curve, have tightened but yield levels are still attractive given the economic backdrop and provide a much larger cushion against continued rate volatility,” Golden said.

To date this year, Golden said there has been an obvious preference for maturities 10 years and in, however, more recently it seems the market has a growing comfort level with longer duration holdings.

“Longer-dated municipal-to-Treasury ratios are still near 100% and look like the cheapest part of the curve,” he said. “If a recession is on the horizon, adding a bit of duration here could pay dividends but we would still be cautious given the Fed has yet to get inflation under control.”

Market technicals for the balance of the month, and likely throughout the balance of the summer months, look to be a tailwind for the markets, according to Golden.

Higher rates seemed to have constrained supply against a backdrop of heavy reinvestment demand and this should be the case into September, he noted

“Overall it seems we could be set up for a much better second half notwithstanding the potential for continued rate volatility,” Golden added. “Credit fundamentals are strong, municipals historically perform well late cycle, the worst outflow cycle on record seems to have ebbed and valuations and yield levels provide an attractive option in a recessionary environment.”

Informa: Money market muni assets drop

Tax-exempt municipal money market funds saw $2.17 billion pulled the week ending July 19, bringing the total assets to $103.92 billion, according to the Money Fund Report, a publication of Informa Financial Intelligence.

The average seven-day simple yield for all tax-free and municipal money-market funds fell to 0.37%.

Taxable money-fund assets added $13.26 billion to end the reporting week at $4.421 trillion of total net assets. The average seven-day simple yield for all taxable reporting funds rose to 1.17%.

Secondary trading

Maryland 5s of 2023 at 1.32%. NYC TFA 5s of 2023 at 1.58%. California 5s of 2023 at 1.54%.

District of Columbia 5s of 2025 at 1.94% versus 2.13% on 7/13. LA DWP 5s of 2026 at 1.83%-1.82%. Metropolitan Water District of Southern California 5s of 2026 at 1.82%-1.80% versus 1.88% on 7/12. North Carolina 5s of 2027 at 1.95% versus 1.97% Wednesday. Maryland 4s of 2028 at 2.25% versus 2.28% Wednesday.

NYC TFA 5s of 2033 at 2.96%. Triborough Bridge and Tunnel Authority 5s of 2034 at 3.04%-3.03%. Maryland 5s of 2035 at 2.74%-2.75% versus 2.73%-2.72% Tuesday.

Ohio 5s of 2041 at 3.14%-3.11%. Connecticut 5s of 2041 at 3.53%.

Washington 5s of 2046 at 3.43% versus 3.26% on 7/15 and 3.27% on 7/14.

AAA scales

Refinitiv MMD’s scale was cut up to three basis points on the long end at the 3 p.m. read: the one-year at 1.40% (unch) and 1.70% (unch) in two years. The five-year at 1.98% (unch), the 10-year at 2.44% (unch) and the 30-year at 3.03% (+3).

The ICE municipal yield curve was cut up to one basis point: 1.44% (flat) in 2023 and 1.73% (flat) in 2024. The five-year at 1.97% (flat), the 10-year was at 2.47% (flat) and the 30-year yield was at 3.04% (+1) near the close.

The IHS Markit municipal curve was cut out long: 1.40% (unch) in 2023 and 1.72% (unch) in 2024. The five-year was at 1.98% (unch), the 10-year was at 2.44% (unch) and the 30-year yield was at 3.00% (+3) at a 4 p.m. read.

Bloomberg BVAL was cut up to one basis points: 1.43% (unch) in 2023 and 1.71% (unch) in 2024. The five-year at 2.00% (unch), the 10-year at 2.48% (+1) and the 30-year at 3.01% (+1) at 3:30 p.m.

Treasuries rallied.

The two-year UST was yielding 3.104% (-13), the three-year was at 3.079% (-15), the five-year at 3.011% (-16), the seven-year 2.995% (-15), the 10-year yielding 2.909% (-12), the 20-year at 3.337% (-8) and the 30-year Treasury was yielding 3.075% (-8) at 3:45 p.m.

Primary on Wednesday:

RBC Capital Markets priced for the New York City Transitional Finance Authority (Aa2/AA/AA/) $492.295 million of tax-exempt building aid revenue bonds, Fiscal 2023 Series S-1, Subseries S-1A, with 5s of 7/2023 at 1.44%, 5s of 2027 at 2.15%, 5s of 2032 at 2.77%, 5s of 2037 at 3.31% and 4s of 2039 at 3.83%, callable 7/15/2032.

Mutual fund details

In the week ended July 20, Refinitiv Lipper reported $698.782 million of outflows Thursday, following an inflow of $206.127 million the previous week.

Exchange-traded muni funds reported inflows of $31.792 million after outflows of $264.769 million in the previous week. Ex-ETFs, muni funds saw outflows of $730.573 million after $470.895 million of inflows in the prior week.

The four-week moving average was at negative $530.561 million from negative $766.982 million in the previous week.

Long-term muni bond funds had inflows of $280.108 million in the last week after inflows of $141.376 million in the previous week. Intermediate-term funds had outflows of $266.672 million after $956,000 of outflows in the prior week.

National funds had outflows of $553.979 million after $147.048 million of inflows the previous week while high-yield muni funds reported $64.981 million of inflows after $176.886 million of inflows the week prior.