Gary Siegel is a journalist with more than 35 years of experience. He started his professional career at the Long Island Journal newspapers based in Long Beach, N.Y., working his way up from reporter to Assistant Managing Editor. Siegel also worked for Prentice-Hall in Paramus, N.J., covering human resources issues. Siegel has been at The Bond Buyer since 1989, currently covering economic indicators and the Federal Reserve system.

-

Jack Janasiewicz, senior vice president, portfolio manager and portfolio strategist at Natixis Investment Managers Solutions, discusses inflation and why there is disagreement on whether it will become an issue this year. He talks about how stimulus money and the employment situation factor in. Gary Siegel hosts. (Taped March 9 / 30 minutes).

By Gary SiegelApril 6 -

The services sector showed improvement and employment made big gains in March, but economists note the labor market remains far from full employment.

By Gary SiegelApril 5 -

Veneta Dimitrova, senior U.S. economist at Ned Davis Research, says the COVID pandemic showed us the government has more fiscal space than thought. She also discusses inflation, housing, the manufacturing sector, global supply chain challenges and the Fed’s balance sheet. Hosted by Gary Siegel. Taped Feb. 24. (32 minutes)

By Gary SiegelMarch 25 -

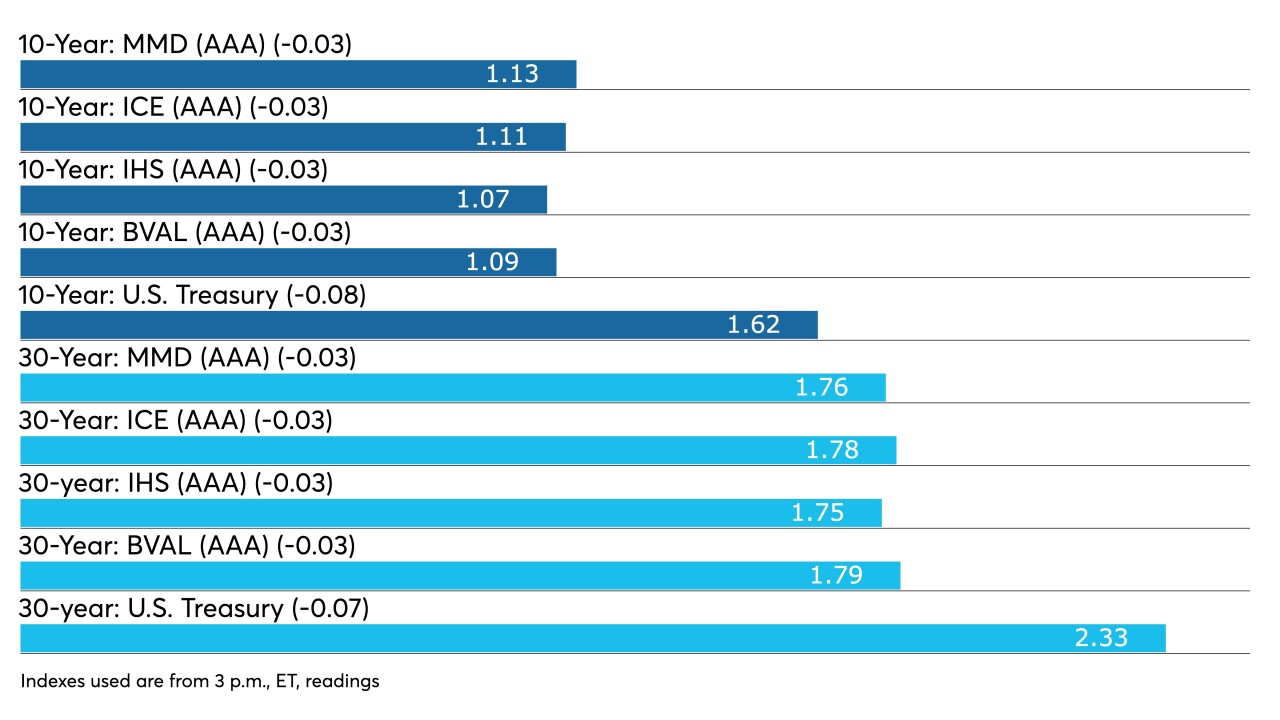

The primary led the secondary to lower yields as UST 10-year fell to lows last seen a week ago. Regional service sector surveys released Tuesday showed improvement, which feeds into the belief that inflation will rise in the near term.

By Lynne FunkMarch 23 -

Yields jumped as much as 10 basis points as new deals saw some concessions as munis played catch up to the run-up in U.S. Treasury rates after the 10-year hit 1.75% mid-session. Refinitiv Lipper reports nearly $1.3 billion of inflows.

By Lynne FunkMarch 18 -

Inflows return, stimulus set, new deals on fire — the municipal market reaped all the benefits. Initial jobless claims dropped more than expected in the week, as reopening continued slowly, but the total remains higher than any week before the COVID crisis hit.

By Lynne FunkMarch 11 -

Hank Smith, head of Investment Strategy at Haverford Trust, discusses the upcoming Federal Open Market Committee meeting, the coronavirus pandemic, inflation, and economic growth. He says, “at some point the Fed will have to acknowledge the economy may really take off.” Gary Siegel hosts. (Taped March 2. 26 minutes)

By Gary SiegelMarch 11 -

The Investment Company Institute reported outflows from municipal bond mutual funds but inflows into exchange-traded funds. The February consumer price index came in as expected, while the core was below expectations, and analysts expect bigger rises ahead.

March 10 -

Despite the recent outflows and volatility of the Treasury market, municipal bonds have and should continue to outperform as stimulus from Washington provides some respite.

By Gary SiegelMarch 8 -

With the reset in yields in the rear view, valuations — especially relative to Treasury — will likely support continued robust demand.

March 5 -

Refinitiv Lipper reported $600 million of outflows from municipal bond mutual funds as the market correction caught up. High-yield funds lost a massive $722 million after $330 million a week prior.

By Lynne FunkMarch 4 -

The Beige Book suggests the economy is recovering, with optimism for 6-12 months ahead, while economists don't envision inflation rising enough for the Fed to take action any time soon.

By Lynne FunkMarch 3 -

Institutional pricing of New York City and competitive deals from Baltimore and Cambridge, Mass., should help give a sense of where yields are heading, while Ohio offers up GOs for a market that's been little changed for three days after a large sell-off.

By Lynne FunkMarch 2 -

The sell-off in the back half of February brought negative 1.59% returns for the month and a negative 0.96% return for the year so far. Taxables and high-yields fared slightly better.

By Lynne FunkMarch 1 -

Municipal bond mutual funds took notice of rate movements with Refinitiv Lipper reporting $37 million of inflows after 15 weeks of multi-billion inflows, the lowest since Dec. 2. High-yield funds took a big hit with $330 million of outflows.

By Lynne FunkFebruary 25 -

In a wide-ranging conversation, Manulife Investment Management Global Chief Economist & Global Head of Macroeconomic Strategy Frances Donald discusses the COVID pandemic, inflation, how the markets may be misreading the Fed, why economic indicators may not be telling economists what they need to know, ESG and green spending, and the economy. Gary Siegel hosts. (35 minutes)

By Gary SiegelFebruary 25 -

Global bond yield move suggests financial markets are much more optimistic about the economy than the Fed.

By Lynne FunkFebruary 24 -

Data released Monday showed economic strength with further improvement ahead. U.S. Treasuries were off by five basis points but municipals saw aggressive eight to 10 basis point swings to higher yields across the curve.

By Lynne FunkFebruary 22 -

The municipal secondary gave way to higher-yields and triple-A benchmarks rose two to five basis points. U.S. Treasuries pared back Tuesday's losses, even on the heels of better economic data.

By Lynne FunkFebruary 17 -

With the U.S. Treasury sell off, municipal to UST ratios fell below 55% in 10-years.

February 16