Christine Albano is a reporter in the Investor’s & Investing beat, which she has covered for the past two decades. She has a wide range of buy side sources in the municipal market and has covered trends affecting retail investors, institutions, municipal mutual funds, tax-exempt money market funds, and the high-yield beat. She has also written about some of the industry’s biggest issues, such as historic defaults in Orange County, Calif., Puerto Rico, and Jefferson County, Ala., as well as the collapse of the variable-rate demand market. In addition, she reported on the subsequent 2008 financial crisis, and the death of municipal bond pioneer Jim Lebenthal. She provided next day coverage of the impact on the municipal bond market of the Sept. 11 terrorist attacks on the World Trade Center, and recently interviewed The Vanguard Group Inc. founder, former chief executive officer, and investment guru John C. Bogle about the best investing advice for the municipal market.

-

The new video-sharing app will combine social media technology with crowdsourced content to inform on all things investing, says founder Charles Qi.

October 6 -

Bids wanteds have been elevated, municipal bond mutual fund outflows large and consistent and the short end of the U.S. Treasury curve continues its march upward, moves that muni investors cannot ignore.

By Lynne FunkSeptember 26 -

Triple-A yields rose 11 to 15 basis points five years and in.

September 23 -

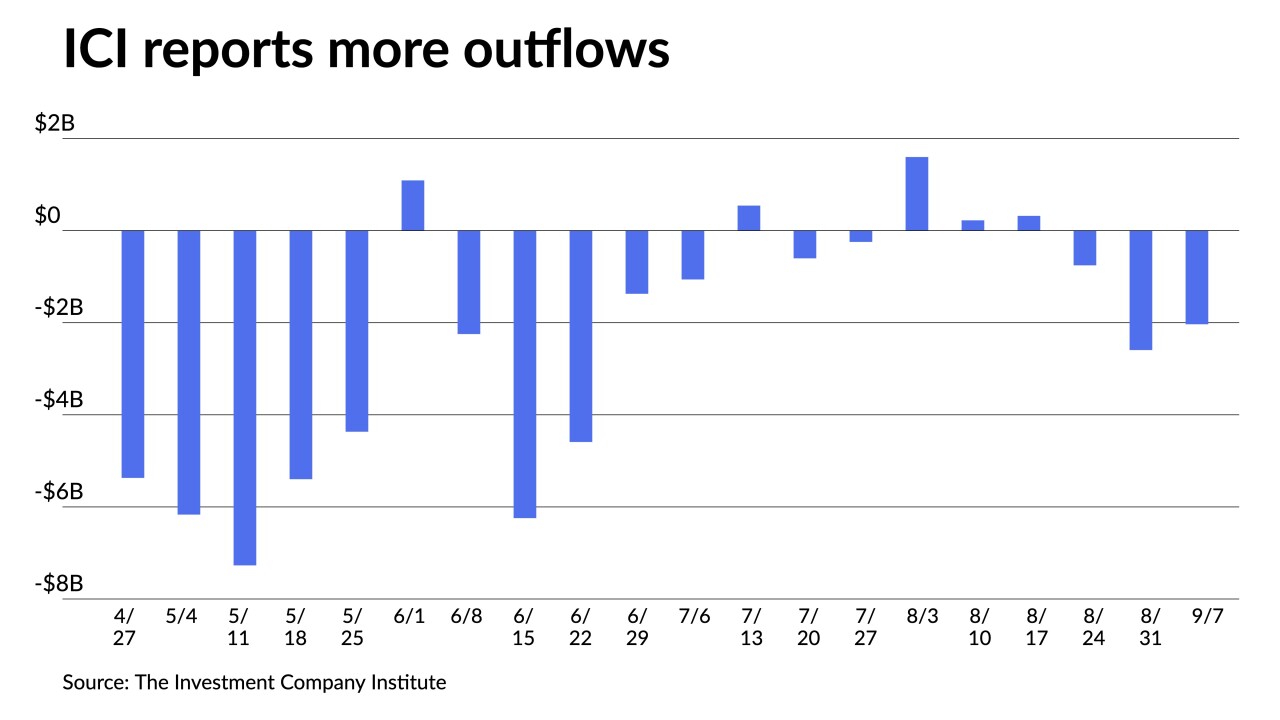

The Investment Company Institute reported $2.034 billion of outflows from muni bond mutual funds in the week ending Sept. 7 compared to $2.594 billion of outflows the previous week.

September 14 -

The Investment Company Institute reported $755 million of outflows from muni bond mutual funds in the week ending August 24 compared to $320 million of inflows the previous week.

August 31 -

The veteran-owned and operated firm complements its continued growth with experienced public finance professional to oversee Southeast banking.

August 31 -

Fed Chair Jerome Powell's message on rates last week combined with seasonal factors to give the market a "weird" vibe this week, one trader said.

August 29 -

Outflows from municipal bond mutual funds continued as investors pulled $1.180 billion out of funds in the latest week, according to Refinitiv Lipper data.

August 25 -

Investors will be greeted Monday with a decrease in supply with the new-issue calendar estimated at $6.711 billion, down from total sales of $10.318 billion.

August 19 -

The short end was hammered in the secondary with large blocks of high-grades showing big swings to higher yields while the rest of the curve wasn't spared the damage and triple-A yields rose by seven to 16 basis points.

August 17 -

Spreads on underwriting municipal bonds dipped to below $4 per $1,000 on issues in the first half of 2022 due to heavy competition and a shrinking volume of deals — the lowest figures reported in two decades.

August 15 -

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

Investors pulled $698.782 million out of municipal bond mutual funds, per Refinitiv Lipper data, versus the $206.127 million of inflows the week prior. High-yield saw small inflows.

July 21 -

Primary market takes focus for large revenue deals from the New York State Thruway Authority and the Colorado Health Facilities Authority.

July 13 -

After 40 years in the municipal bond industry — 35 of them at American Century — Steve Permut left the California-based mutual fund firm on June 30 for retirement.

July 8 -

Elizabeth Funk is the new managing director of institutional sales and trading in the municipal underwriting group amid a wave of recent new additions. Natalie A. Brown has taken over as CEO.

July 1 -

A new-issue supply-focused buy-side had their sights on the $8 billion-plus flowing into the primary market this week, while municipal traders remained cautious, keeping an eye on bid-wanted lists in the secondary market.

June 28 -

Investors will be greeted Monday about $6.4 billion of new issuance led by triple-A Georgia general obligation bonds and Los Angeles notes.

June 17 -

The 75 basis point hike, prompted partly by hotter-than-expected inflation data, is the largest since 1994.

June 15 -

The 25-basis-point move to higher yields is the largest one-day change in triple-As since March 2020 when COVID began roiling markets. Munis could not ignore a continued selloff in UST led by inflation and recession concerns.

June 13