U.S. inflation accelerated in May to the fastest pace in more than six years, reinforcing the Federal Reserve's outlook for gradual interest-rate hikes while eroding wage gains that remain tepid despite an 18-year low in unemployment.

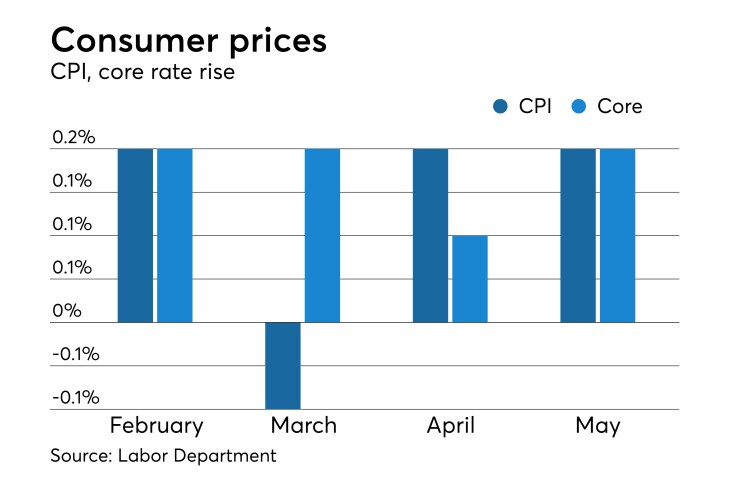

The consumer price index rose 0.2% from the previous month and 2.8% from a year earlier, matching estimates, a Labor Department report showed Tuesday. The annual gain was the biggest since February 2012. Excluding food and energy, the core gauge was up 0.2% from the prior month and 2.2% from May 2017, also matching the median estimates of economists.

The pickup in headline inflation partly reflects gains in fuel prices, though the annual gain in the core measure — seen by officials as a better gauge of underlying inflation trends — was the most since February 2017. While the Fed is widely projected to raise borrowing costs this week for the sixth time in 18 months, the path of inflation will figure into policy makers' thinking on the pace of increases for the second half and in 2019.

The Fed's preferred gauge of inflation — a separate consumption-based figure from the Commerce Department — came in at the central bank's 2% goal during March and April, and the figure tends to run slightly below the Labor Department's CPI. At the same time, several Fed officials have indicated that a modest overshoot of the inflation goal wouldn't necessarily warrant faster interest-rate hikes, after years of below-target price gains.

A separate Labor Department report on Tuesday illustrated how higher prices are pinching wallets: average hourly wages, adjusted for inflation, were unchanged in May from a year earlier, even as nominal pay accelerated to a 2.7% annual gain from 2.6% in April. For production and nonsupervisory workers, real average hourly earnings fell 0.1% from a year earlier.

Seasonally adjusted gasoline prices rose 1.7% in May from the previous month, after a 3% gain in April.

The shelter category, which accounts for about one-third of the CPI, rose 0.3% from the previous month, continuing a trend of steady increases. Owners-equivalent rent, one of the categories designed to track rental prices, advanced 0.2%. Lodging away from home, which includes hotel and motel rates, rose 2.9% in May, the most since August.

Investors see the Fed as on track to raise interest rates at its two-day meeting that starts later on Tuesday in Washington, while policy makers will issue updated forecasts showing whether they expect one or two hikes in the second half. The unemployment rate fell to 3.8% in May, matching the lowest in 48 years and signaling the central bank is nearing its maximum-employment goal.

Commerce Department figures released May 31 showed the Fed's separate preferred gauge of inflation met policy makers' 2% target in April for the second straight month as U.S. consumer spending rose by the most in five months. The preferred core index was up 1.8% from the prior year.