Municipal bond supply projections for next year range from a high of $750-plus billion to a low of $520 billion, with most firms expecting issuance to hover around $600 billion, easily surpassing 2025's record.

-

"We sued to take a stand against the SROs on principle," an ASA spokesperson said Wednesday in a reference to both the MSRB and FINRA.

December 10 -

AllianceBernstein hired four municipal credit special situations analysts based in its Dallas office.

December 10 -

Hosting a single World Cup match can cost cities roughly $100 to $200 million, said House lawmakers that introduced the bill.

December 10 -

-

Muni yields were little changed, and have barely moved over the past several trading sessions, said Kim Olsan, senior fixed income portfolio manager at NewSquare.

December 10

Legislation to increase the affordable housing supply which often includes bond sales is getting attention in Congress as the bipartisan ROAD to Housing Act hits a speed bump.

Dozens of lawmakers are bailing out of Congress before the midterm elections adding new wrinkles to the fading possibility of a second budget reconciliation which could require revenue raisers detrimental to the muni market.

A budget forecast prepared by the Virginia House Appropriations Committee shows tightening financial constraints in 2026 —including a higher cap on state and local tax deductions — could result in the state's issuing bonds.

Photos from The Bond Buyer's 2025 California Public Finance conference.

Tom Falcone of the Large Public Power Council unpacks the massive infrastructure push driven by AI and manufacturing, and the policy hurdles standing in the way.

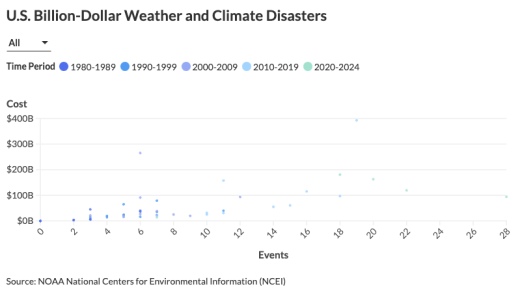

The steady demand for municipal bonds in high-risk areas underscores the complex relationship between climate change and financial markets.

Oppenheimer's Head of Public Finance Beth Coolidge and Columbus Auditor Megan Kilgore delve into the future of public finance and human infrastructure on a wide range of topics, from affordable housing and workforce development to public health, climate resiliency, and digital access.

As extreme weather events occur with more frequency across the country, Michael Gaughan, executive director of the Vermont Bond Bank, says municipal bond banks can help smaller communities deal with the effects of them. Gaughan speaks with The Bond Buyer's Lynne Funk on the effects of climate change and how the various levels of government can work together to address it.

After terminating the project in September, the council approved an initial deal with a new contractor team to develop design and construction options.

The Texas city could revisit plans for a desalination project to boost its dwindling water supply with the city council scheduled to consider it next week.

Concerns over the Texas city's future water supply after a desalination project was terminated, led to negative rating outlooks from Fitch and S&P.

-

A vote Wednesday by Chicago's city council would speed up budget hearings and signals that a majority of alders may go their own way on the budget.

23m ago -

A 2025 state law prohibits cities from increasing their property tax revenue if they fail to produce a timely annual financial audit.

December 9 -

Omaha Public Power District will go to market the week of Jan. 5 with about $164 million of Series 2026A separate electric system revenue refunding bonds.

December 9 -

While muni returns moved lower last week, year-to-date returns still hover around 4%, said Jason Wong, vice president of municipals at AmeriVet Securities.

December 9 -

Concerns about Brightline have dragged down performance in the high yield sector this year.

December 9