End-of-year rating agency national reports about local government and state trends cast a poor light on Chicago and Illinois when compared to peer governments.

Chicago fares poorly in this week's Moody’s Investors Service report about how well-positioned the 25 largest cities are to weather a recession.

“Most of the largest 25 cities in the U.S. are prepared to handle a recession of similar magnitude to the previous downturn without a material adverse credit impact,” Moody’s wrote in a report that put 17 cities in the moderately prepared category and six — Boston, Charlotte, Denver, San Antonio, San Francisco and Seattle — in the strong category.

Chicago and Detroit were rated as weak in the assessment that considered fiscal volatility, reserve coverage, financial flexibility and pension risk in assessing whether the cities could weather a downturn similar to what occurred in 2008-2009. Both carry junk-bond ratings from Moody’s with Chicago at Ba1 and Detroit at Ba3.

Fund balances declined across the board during the last recession even for stronger cities, but most have now rebuilt reserves with the median at 32.4% of revenues in 2018, up from 24.3% a decade earlier.

While most of the cities, including Chicago, didn’t take too big a single year revenue hit during the last recession, a city like Chicago weighed down by high fixed costs could be strained to deal with a revenue drop of less than 5%.

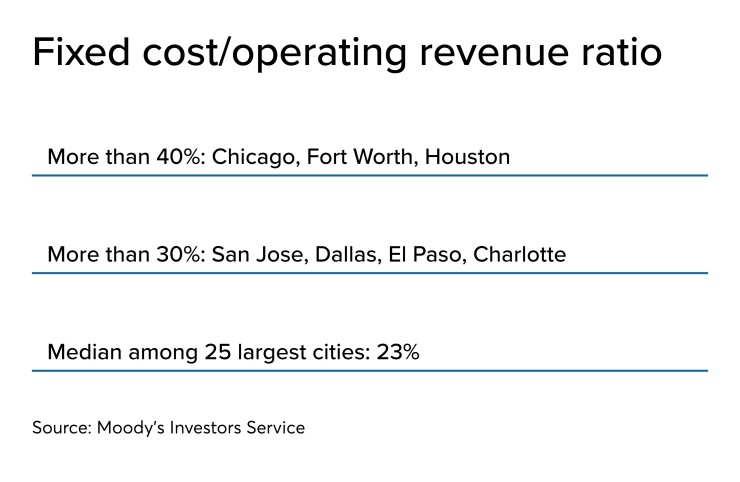

Overall median fixed costs for the group came in at 23%, while seven cities’ costs exceeded 30% of revenue. Houston, Chicago and Fort Worth, Texas, stood out as negative outliers on that factor.

Aa3-rated Houston and Aa3-rated Fort Worth join Chicago in standing out “as material negative outliers for fixed costs.”

Chicago’s fixed costs amount to more than 40% of revenues straining the city’s ability to adjust spending if needed to offset revenue declines with much of the burden related to its $30 billion of net pension liabilities.

“The size and diversity of Chicago's tax base and its substantial legal flexibility to tap into that base for revenues are material credit strengths,” Moody’s said. “However, its leverage due to debt and unfunded pension liabilities — both direct city obligations and those of overlapping units of government — continue to weigh heavily on its credit profile…Chicago's extraordinarily high fixed costs, coupled with its escalating pension liabilities, make it one of the cities least prepared for a near-term recession.”

Chicago Mayor Lori Lightfoot’s 2020 budget moves to actuarial funding for two funds driving a $270 million increase with another $300 million funding hike expected in 2022 when the other two funds move to actuarial contributions.

Chicago also fares poorly in a pension risk analysis that weighs volatility in a recession due to both revenue declines and asset losses. “Chicago is a negative outlier in both the pre-stress and stress scenarios, with calculated ANPL at 575% and 626% of revenue, respectively,” Moody’s said.

In a Fitch Ratings report about state pensions, Illinois stands as continuing to carry the heaviest liability burden that amounts to 27.5% of personal income. Illinois is followed by Connecticut, Kentucky, New Jersey, Alaska and Hawaii while 37 states have what Fitch views as low liability burdens. Illinois has $137 billion of unfunded liabilities and Fitch rates it BBB with a stable outlook.

Fitch warns that a national drop in pension burdens to 3.1% of personal income in 2018 from 3.6% in 2017 and a median 6.7% drop in the rating agency’s adjusted net liabilities figures are just a “short-term breather.”

The lower fiscal 2018 state net pension liabilities are capturing the lagged recognition of strong market gains most pension plans experienced as of their 2017 measurement dates, said Douglas Offerman, a Fitch senior director.

In a separate report holding local government state government outlooks at stable for 2020, Fitch identifies Illinois as one of three states where developments in 2020 could have rating implications given the November ballot measure on a progressive income tax.

Gov. J.B. Pritzker is counting on the $3 billion his progressive rates would generate to move the state toward structural balance.

“The credit implications depend on whether Illinois uses any increased revenues to address structural budget challenges, or if the state can adequately adjust its budget to work toward structural balance if the amendment fails,” Arlene Bohner, a Fitch senior director, wrote.