-

The August consumer price index showed inflation remains above the Federal Reserve's target level and makes a 50-basis-point rate cut next week unlikely, economists said. Further, many expect the market will be disappointed going forward, as future cuts will likely be shallower than expected.

September 11 -

The candidates touched on muni-adjacent issues like energy policy, housing and tariffs but offered little new information on infrastructure proposals or tax policies.

September 11 -

The House Financial Services Committee held a hearing Tuesday examining the practices of proxy advisors and their relationship with ESG investing.

September 11 -

Issuance as of Wednesday is at $345.327 billion, a 32.7% increase over 2023. The Bond Buyer 30-day visible calendar on Monday was at $20.02 billion, the largest in nearly four years.

September 11 -

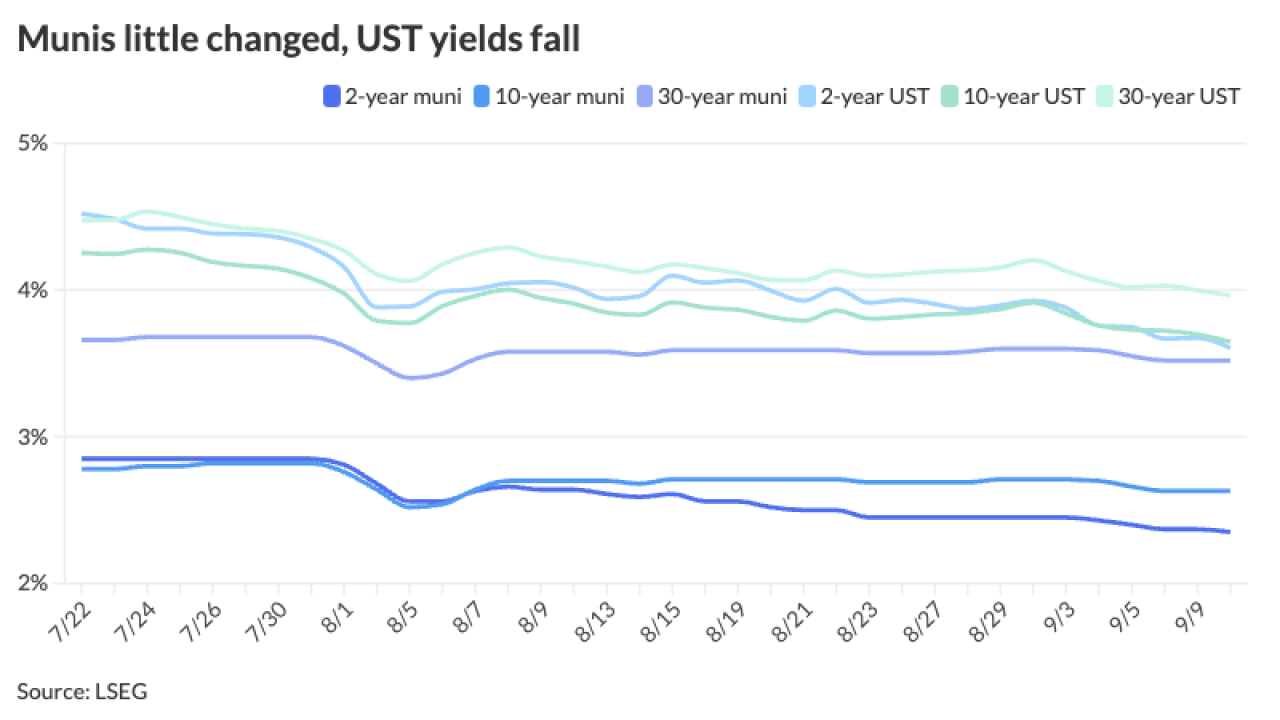

Municipals lagged the UST moves again, cheapening ratios and creating a valuable entry point for investors looking for compelling taxable equivalent yields, particularly 10-years and out.

September 10 -

Environmental regulations under fire in California.

September 9 -

The high-grade issue is expected to be well received by the market. D.C. joins a growing list of issuers refunding outstanding BABs amid lower rates.

September 9 -

It's the latest proposal for a type of national infrastructure financing structure in lieu of the municipal bond market.

September 6 -

"The numbers are weak, but not cusp of recession weak," Chris Low, chief economist at FHN Financial, said.

September 6 -

Iowa has the largest number of poor bridges, followed by Pennsylvania and Illinois.

September 5