-

Key institutional players like banks and insurance companies may have less incentive to buy tax-exempt munis if the provision becomes law.

October 29 -

October has, on average, been the heaviest new-issue month of the year. Analysts said the lower volume, particularly taxables, was led by many issuers sitting on the sidelines, waiting for a potential package from Washington, D.C.

October 29 -

Underwriter Cantone Research’s alleged fraudulent misrepresentations are tied to two defaulted bond offerings.

October 28 -

ICI reported the lowest inflows since outflows in March, while exchanged-traded funds saw an uptick.

October 27 -

The SALT deduction cap could be increased, suspended or repealed.

October 27 -

The tax on unrealized capital gains would be straightforward for securities that trade frequently, but less so for less-frequently traded assets like many munis.

October 27 -

Senate Banking Committee Chair Sherrod Brown said he expects President Joe Biden will release a combination of nominations to the board of the Federal Reserve at the time he unveils his decision on the central bank chair.

October 26 -

Transportation and transit projects would be eligible uses of ARPA funds under the bill, which also extends the deadline to spend the funds.

October 26 -

Jeffrey Cleveland, chief economist at Payden & Rygel, discusses the Federal Reserve’s upcoming meeting, inflation, what taper will mean, when the Fed might decide to lift off, and possible leadership changes. Gary Siegel hosts. (30 minutes)

October 26 -

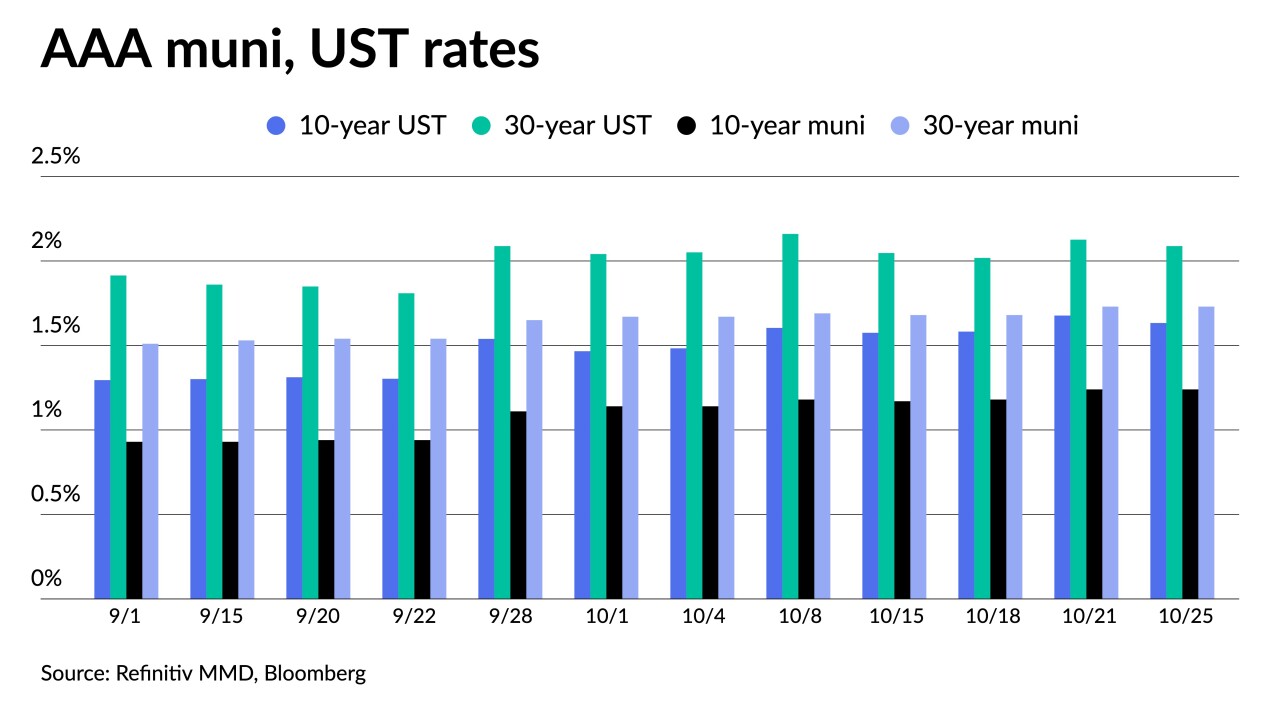

Despite a short-end U.S. Treasury rally, municipals face pressure on the one- and two-year as participants look to month-end positioning.

October 25