-

The Federal Reserve is committed to cooling inflation and needs to raise interest rates to a little above 4% to ease demand, Cleveland Federal Reserve Bank President Loretta Mester said.

August 4 -

The sudden passing of Walorski and two of her staffers has left municipal market advocates and politicians stunned.

August 4 -

The agency overseeing what has been called the country's most expensive infrastructure project hopes to secure $8 billion in federal dollars and $4.2 billion of state borrowing for the first leg of the bullet train.

August 4 -

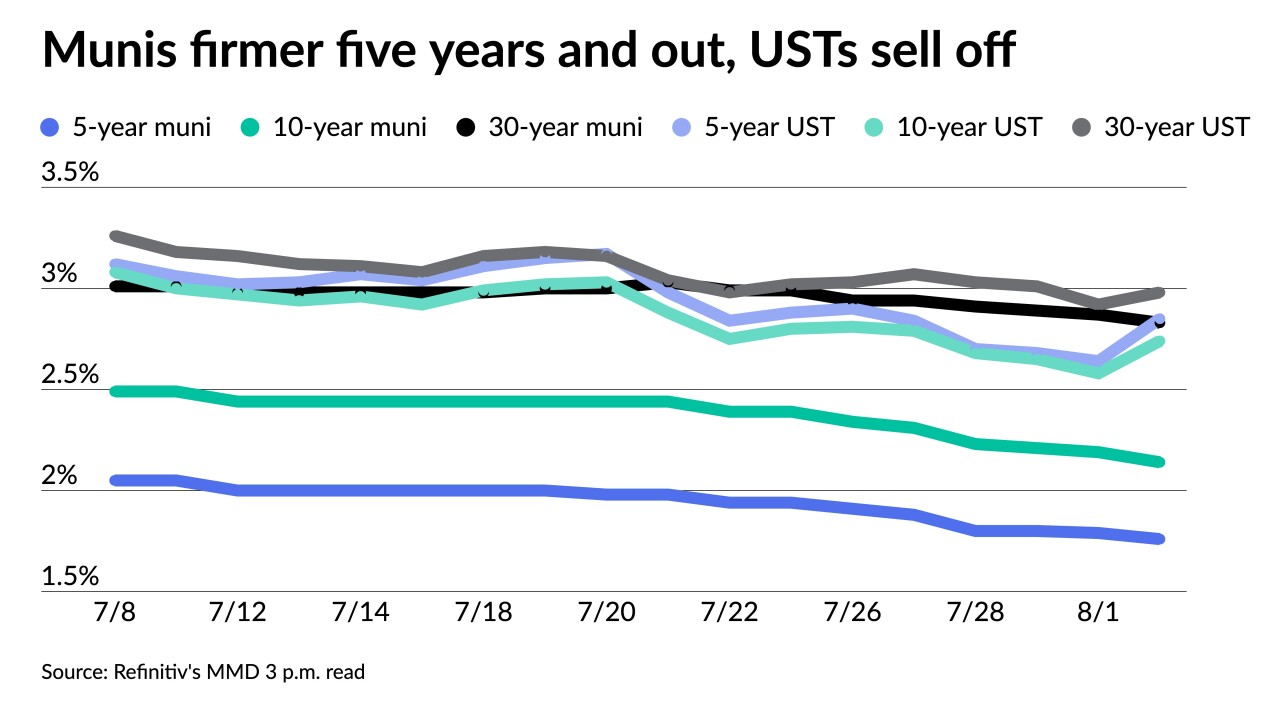

The Investment Company Institute reported investors pulled $246 million out of muni bond mutual funds in the week ending July 27 compared to the $602 million of outflows in the previous week.

August 3 -

Hospitals can expect more than $2.6 billion of in additional payments under the Centers for Medicare and Medicaid Services program, but some say that is not enough.

August 3 -

St. Louis Fed Bank President James Bullard said he favors a strategy of "front-loading" big interest-rate hikes, and he wants to end the year at 3.75% to 4%, while his Richmond counterpart, Thomas Barkin, said the central bank was committed to lowering inflation and a recession could happen.

August 3 -

The proposal may be less feasible for certain types of trades, market participants said, especially larger trades.

August 3 -

Federal Reserve officials said they want strong evidence that the hottest inflation in four decades is on a sustainable downward path before declaring victory in their fight against it.

August 2 -

The day after the Federal Open Market Committee's next meeting we will analyze the increase and the signals about what rate hikes may be coming.

-

The large primary was led by two $700-plus million of revenue bonds from the Port of Seattle and the Georgia Ports Authority.

August 2