-

The MSRB announced new board leadership as well as a revision to a controversial fee structure proposal.

July 29 -

Municipals will end July with positive returns across all sectors. The Bloomberg Municipal Index shows a 2.49% return in July, moving year-to-date losses lower to 6.71%.

July 29 -

Total July volume was $25.598 billion in 520 deals versus $37.573 billion in 1,013 issues a year earlier, according to Refinitiv data.

July 29 -

Former Treasury Secretary Lawrence Summers said he was concerned the Federal Reserve is still engaging in “wishful thinking” about how much it will take to bring inflation down from four-decade highs.

July 29 -

A group of 20 muni bond investment firms have asked U.S. cities to disclose their environmental-related needs and risks, including infrastructure projects, to CDP, a global disclosure firm.

July 29 -

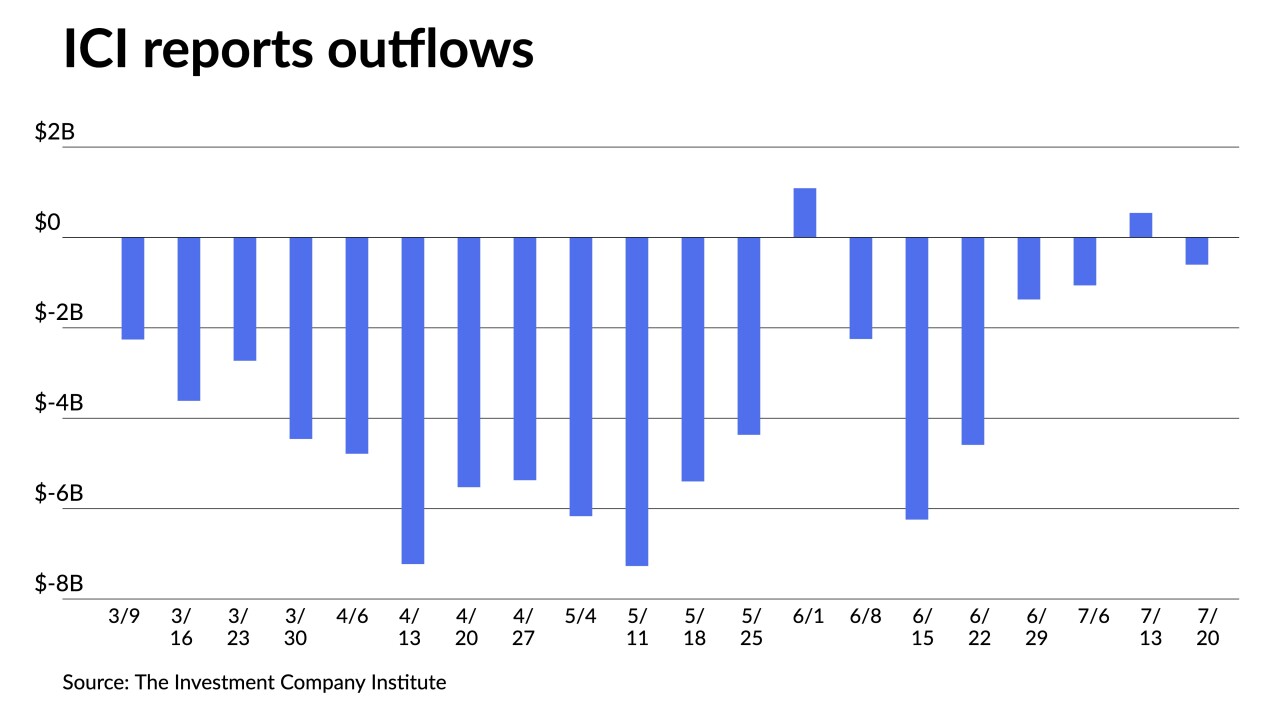

Investors added $236.491 million to municipal bond mutual funds, per Refinitiv Lipper data, versus the $698.782 million of outflows the week prior. High-yield saw inflows hit nearly $550 million.

July 28 -

Sens. Manchin and Schumer's long-elusive deal on a energy, climate and tax bill includes no muni-friendly items or SALT reform.

July 28 -

Municipals are poised to end July in the black. Demand for muni product has been strong this summer, with analysts expecting supportive market technicals through August with a likely continuation of positive performance.

July 27 -

With the Fed committed to fighting inflation with aggressive rate hikes, fewer issuers want to take the risk with taxable advance refundings.

July 27 -

The SEC’s Public Finance Abuse Unit has brought four enforcement cases against municipal issuers this year, which signals a shift from the usual focus on underwriters and municipal advisors.

July 27