-

Recent court decisions have the potential to up the ante in lawsuits accusing major banks of manipulating the variable-rate market.

September 30 -

John Hallacy talks with Chip Barnett about how fiscal and monetary policy is affecting the municipal bond market. He discusses recent data releases, supply forecasts and the midterm elections and the future of ESG in public finance. (20 minutes)

September 27 -

The inclusion of swaps has the potential to increase claimed damages in the New York State lawsuit, though banks view swap materials as providing a potential defense.

August 17 -

The federal lawsuit brought by Philadelphia, San Diego and Baltimore on behalf of thousands of issuers is similar to a series of closely watched state whistleblower cases that claim banks manipulated interest rates on variable-rate bonds.

June 29 -

The office of Rob Bonta filed its objection to the dismissal with a California appellate court in San Francisco May 19.

May 20 -

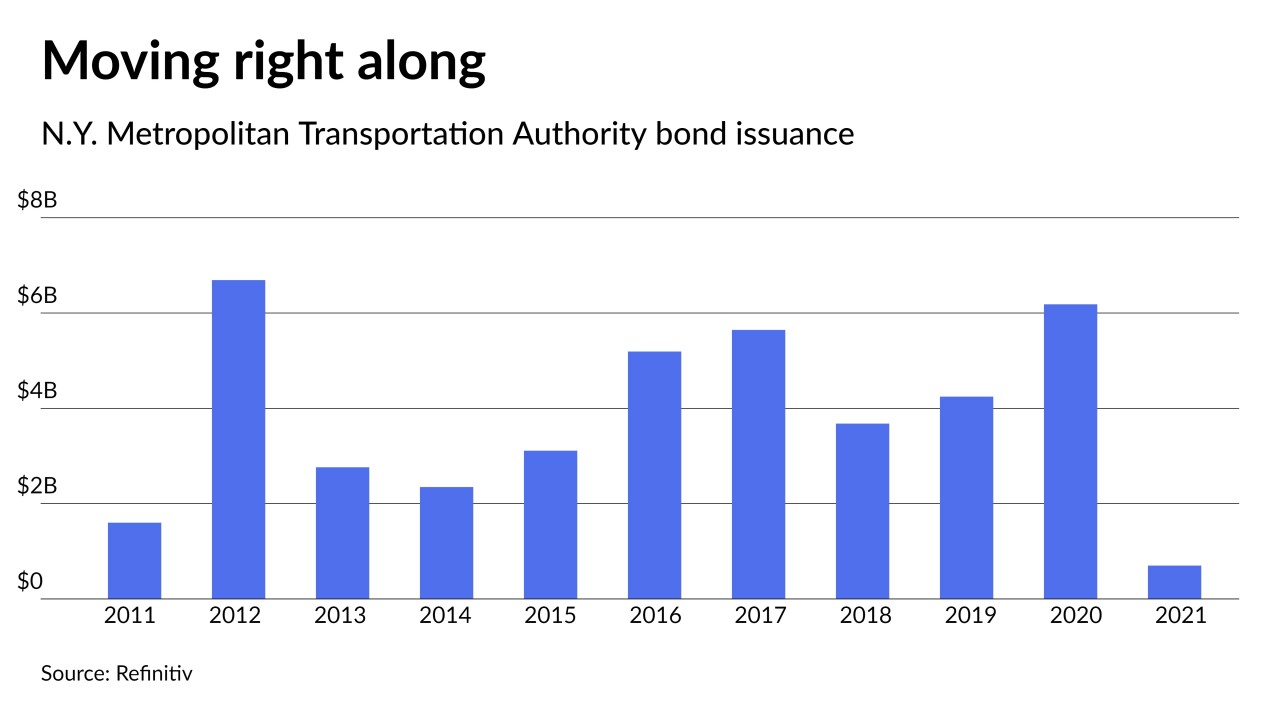

As the MTA works toward a post-pandemic future, Kevin Willens, formerly co-head of public finance at Goldman Sachs, becomes its chief financial officer.

January 28 -

Avoiding even the appearance of representing conflicting interests is important for attorneys and municipal advisors alike.

November 22 -

A proposal from the Ohio Treasury would provide a new enhancement for state-purchased public university debt and offer a backstop for hospitals' VRDOs.

October 13 -

A superior court judge has granted the relator a small victory in a long fought case of alleged false claims, fraud and collusion.

September 21 -

Issuers should recognize their ability to prepay debt is an extremely important term, and they should consult with their MAs to achieve the most liberal prepayment term consistent with the type of financing they are doing.

July 19 McNees Wallace & Nurick

McNees Wallace & Nurick -

The $187 million deal is the largest yet to be hosted on the Clarity platform, which is approaching the half billion mark of resets every week.

January 25 -

A judge said that the lawsuit filed on behalf of California accusing major banks of colluding to inflate VRDO interest rates did not allege the means of the conspiracy.

January 8 -

Tuesday's decision keeps the trial process rolling along, progress the accused banks were hoping to halt with their appeal.

December 29 -

A federal judge largely rejected the arguments offered by Wall Street banks seeking to dismiss the lawsuit, which alleges a conspiracy to fix rates in the VRDO market.

November 3 -

The Louisiana State Bond Commission will refinance $424 million of variable-rate bonds; the deal isn't expected to include the termination of underwater swaps.

October 15 -

Missing minimum denomination and interest rate information for VRDOs affected about 57 CUSIPs, FINRA found.

October 9 -

VRDO reset rates in California consistently were too high to be justified, a new filing contends.

July 20 -

New York Federal Reserve President John Williams said the transition away from Libor “continues to be of paramount importance.”

July 15 -

The office of Illinois Attorney General Kwame Raoul informed a Cook County court it will not allow the Edelweiss lawsuit to be dismissed on public disclosure grounds.

April 13 -

GASB will release on April 16 a list of delays to various initiatives because of the coronavirus pandemic.

April 3