-

The U.S. Treasury kept its quarterly auction of long-term debt, planned for next week, at a record size to help fund the government’s continuing wave of stimulus spending.

May 5 -

The lineup of exclusively short-duration fixed-income products, taxable and municipal, still managed an overall gain.

April 21 -

The U.S. Treasury expanded its plans for the issuance of longer-term debt in coming months, after depending mainly on shorter-dated bills to fund the federal government’s record spending surge to address the COVID-19 crisis.

August 5 -

The rating agency affirmed the U.S. at AAA but said the outlook cut reflects ongoing deterioration in U.S. public finances.

July 31 -

The Federal Reserve has been proactive and the secondary market could be next up for assistance.

May 6 -

As COVID-19 wreaks havoc on global markets, munis try to keep pace.

March 9 -

As fear and uncertainty over COVID-19 rapidly grow, it has sent yields for both municipals and Treasuries to never before seen low levels — begging the question if we could see zero or negative yields here in the States?

March 6 -

MarketAxess Holdings will buy LiquidityEdge for $150 million.

August 13 -

Treasury Secretary Steven Mnuchin warned that the U.S. government will face a default in “late summer” unless Congress increases the debt ceiling.

May 22 -

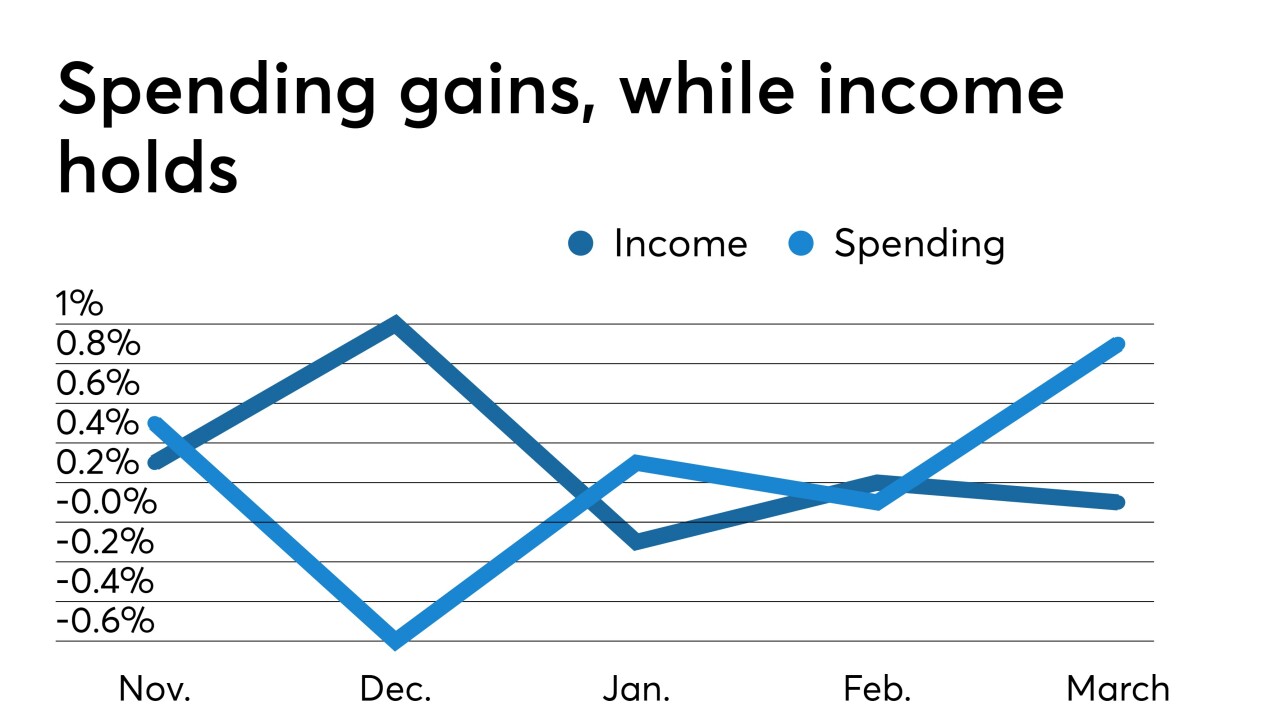

Inflation took a step back, according to the Federal Reserve’s favorite indicator, while income edged up in March, ahead of this week’s Federal Open Market Committee meeting, suggesting the Fed will be able to remain patient on rates.

April 29 -

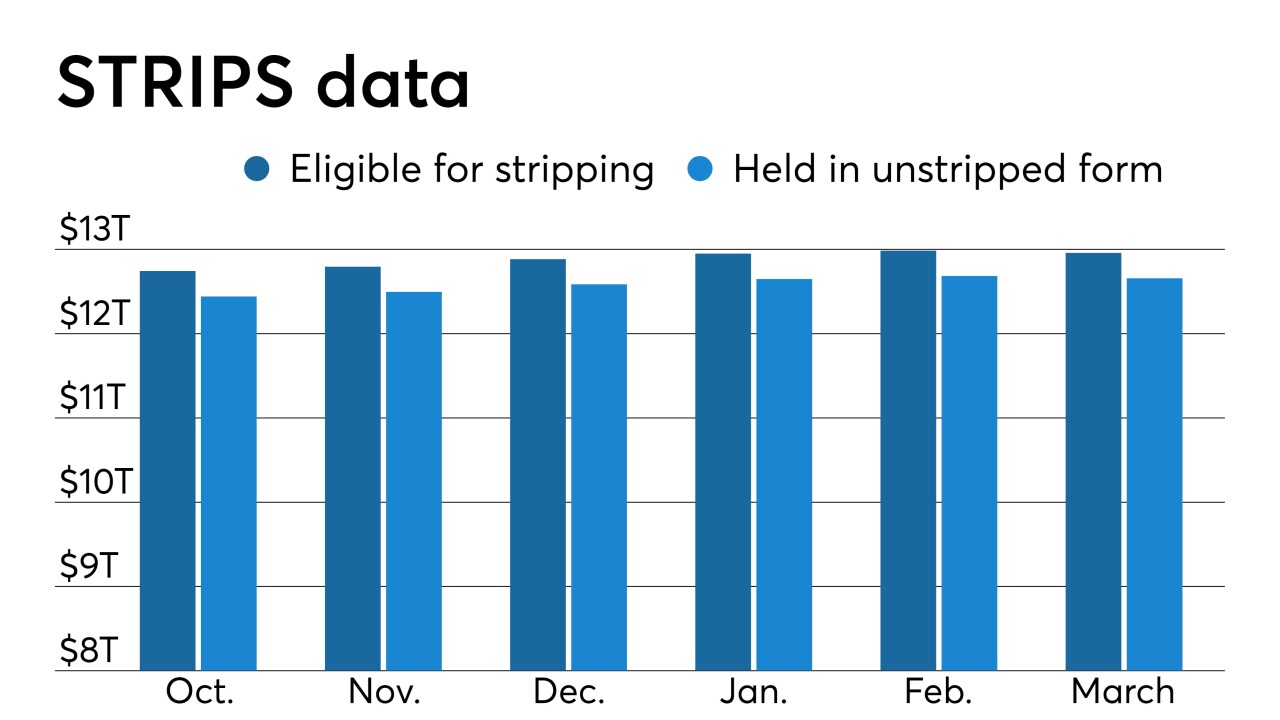

Newly issued Treasury securities held in stripped form increased about $1.155 billion in March to a total of $301.140 billion.

April 4 -

Eagle Asset Management PM Manager uses barbell approach to find value for clients when short-term munis are expensive relative to Treasurys.

March 13 -

A gauge of U.S. economic health closely watched by the Federal Reserve is flashing warning signs for the second time this year.

March 8 -

Newly issued Treasury securities held in stripped form decreased about $1.197 billion in February.

March 6 -

The federal government ran an $8.7 billion surplus in January, the Treasury Department reported Tuesday.

March 5 -

The Treasury Department said it will auction $23 billion 41-day cash management bills on Feb. 28.

February 28 -

The federal government ran a $13.5 billion deficit in December, the Treasury Department reported Wednesday.

February 13 -

Newly issued Treasury securities held in stripped form increased about $2.97 billion in January to a total of $301.182 billion.

February 6 -

The Treasury Department's February quarterly refunding of $84.0 billion will raise $29.9 billion new cash.

January 30 -

The U.S. Treasury Monday estimated it will borrow $365 billion of net marketable debt in the first quarter of 2019, assuming a $320 billion cash balance on March 31.

January 28